Keep Your Biggest Winner From Turning Into Your Biggest Risk

Robert Ross|July 29, 2025

Most investors sell too early.

They get spooked by volatility, become worried that the gains will vanish, or simply don’t have a framework for holding something that goes vertical.

In truth, one of the most overlooked skills in investing isn’t buying – it’s holding.

Back in November 2017, I started accumulating a Bitcoin (BTC) position. Over the next few years, I kept buying. That includes buying 0.25 Bitcoin in January 2020 at $7,933.

Today, that position is up nearly 1,400%.

And while hindsight makes it look obvious, there were dozens of moments where it would’ve been easy – almost rational – to sell. Crashes, hacks, regulatory threats, China bans, FUD (fear, uncertainty, and doubt), volatility… you name it, Bitcoin has weathered it. And every time, investors swore the run was over.

But it wasn’t. Because the mental game is everything.

Most People Sell Too Early

A multibagger doesn’t feel like a win while it’s happening. It feels like a test.

And if you’ve ever held something that’s doubled, tripled, or gone 10X… you know what I mean. You start to feel like the gains aren’t real. You obsess over how much you’re “up.” You refresh your portfolio 20 times a day.

Eventually, you tell yourself: “It’s time to be smart. Let’s lock in some gains.”

The truth is, most investors would rather be right than be rich. Selling early feels like being smart. But it often costs more than holding through the noise.

That doesn’t mean “never sell.” It means knowing why you own something and having a plan for both upside and downside scenarios.

Trim the Size, Not the Thesis

When your 5% position becomes a 25% position, risk management matters.

But selling your entire position just because it went up is like firing your best employee for doing a good job. What makes more sense is trimming the size – not abandoning the idea.

As Peter Lynch says, “selling your winners and holding your losers is like cutting your flowers and watering your weeds.” He’s referring to a cognitive bias called the disposition effect, where investors instinctively sell winners too early and hold onto losers too long – usually in an effort to avoid regret or realize a gain.

Instead, your mindset should be: “How do I stay in this position without letting it dominate my risk profile?”

Personally, I took out my initial investment after Bitcoin doubled. But I kept the rest riding. Today, it’s still one of my largest portfolio holdings, accounting for about 22% of my combined stock and crypto portfolio. And because I’ve sized it appropriately across my broader portfolio, the volatility doesn’t keep me up at night.

If a position gets too large for your risk tolerance, reduce it. But don’t sell just because you’re scared of volatility.

Trust the Trend

I don’t spend all day glued to the charts – but I do pay attention to the primary trend.

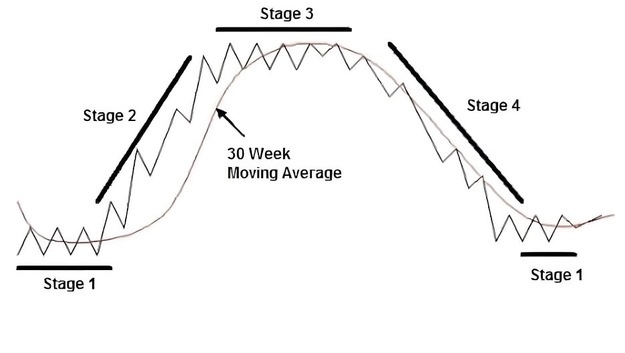

As long as Bitcoin remains in a healthy Stage 2 uptrend – defined by a rising 200-day moving average and constructive price action – I’m staying put. Strong trends bring in real capital. Institutions don’t chase chop. They pile in when the trend is clear.

What would get me to scale back? For one, if the net unrealized profit andlLoss (NUPL) rises above 75%, as that’s signaled the peak in each cycle…

Other red flags would be heavy-volume breakdowns… failed breakouts… and a clear shift in character – like a lower high after weeks of strength.

And while I’ve had a soft price target of $165,000 on Bitcoin for over two years, I still let the broader trend and market structure inform my investing decisions.

And fundamentally? Bitcoin was built for this environment. In a world where governments print and spend with abandon, a scarce digital asset with no central control becomes more than just a trade – it becomes a hedge, a statement, and a lifeboat.

There’s a reason the first chapter of my book on high-risk, high-reward investing is about Bitcoin.

Play Defense First, Offense Second

It’s tempting to focus on how much you can make when something runs. But what keeps you in the game long enough to catch those runs is risk management. Good offense comes from good defense.

Before you buy – or hold – a multibagger, ask: “How much can I lose if I’m wrong?”

If you know your risk, you’ll think more clearly during the drawdowns. And you’ll be more likely to stay in the trade long enough to let compounding do its work.

I’m still holding that original Bitcoin position. Not because I’m a “hodler,” but because the thesis, trend, and price still support it.

Multibaggers are rare. But holding onto one is even rarer.

If you want to grow real wealth in this game, learn how to hold through discomfort – not just buy the next shiny thing.