Dealmaker’s Diary: A MedTech Leader With a Healthy Outlook

Alpesh Patel|March 7, 2024

The best companies don’t miss a beat. They soldier on… staying consistent… and finding new ways to strengthen or improve their businesses.

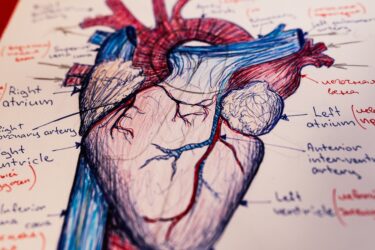

And the company that came up on my proprietary GVI system this week doesn’t miss a beat… a heartbeat, that is.

This medtech is a leading producer of medical devices and equipment for heart patients.

Its sales are projected to grow to $6.6 billion. Profits are also growing at a steady 15% per year… and the company makes a decent return on the capital it invests.

And the stock’s momentum has started to pick up. Based on my projections… there’s a shot at 40% gains here in a year.

I’ll take it.

Get all the details on the company – including the ticker – in my latest video.

Click on the image below to check it out.

And if you have a stock you’d like me to run through my GVI system, send the ticker to mailbag@manwardpress.com.

Transcript

Alpesh Has Done It Again! See What The Fuss Is All About Here

Hi, friends. Almost a very personal video, isn’t it? There’s balloons behind me as it was my son’s birthday. But, it’s not connected, I’m afraid, to the Stock of the Week, which is a company called Edwards Lifesciences(EW).

I wish there was a nice connection, but there isn’t.

Edwards is a life sciences design company which manufactures and markets a range of medical devices and equipment for advanced stages of structural heart disease.

Well, maybe there is a connection to my son’s birthday. We’re living longer. And, God willing, given that he’s 6 now, he may well live to a hundred years old.

However, since we are living older, these medical companies are doing rather well, and this is one of them which I anticipate will continue to do well.

It’s a company which for 2024 is expecting sales growth of 8% to 10%, reaching up to $6.6 billion in sales. Yep.

Profits have been growing significantly as well, as you’d expect. On my proprietary Growth-Value-Income rating – which, remember, is my proprietary algorithm that looks at the valuation of a company, the revenue growth, the dividend yields – this is a 7 out of 10. Which means it meets my minimum criteria.

Now, the forecast P/E is 31. It’s a bit expensive. In other words, you’re paying $31 to buy a share in the company for every expected dollar in profits. You’re paying $31 for every expected future dollar in profits. You might think that’s awfully expensive. It is expensive, but I’m going to put this in the medtech sector. So half tech, half medicine. I would expect P/E to be a bit high.

Cash return on capital invested – remember that’s the Goldman Sachs formula, click here to see that in more detail – that’s 8.1%, a little bit lower than I would have expected, but still a strong number.

As well, volatility is not too high at 14%. The Sortino, again, I would have liked it to have been a bit higher. That’s the average return versus the downside risk of missing it. But it’s acceptable, over there.

As you know, with GVI Investor, I’m a lot stricter with all these criteria. Really, what drew me to the company is, of course, for years, it had this nice upward trend, then it had a couple of bad years. What I’m expecting with momentum is for it to resume that same rate of growth. Which time and again, it sort of promised, failed, but I think the third time’s the charm. We should expect it to be going in that direction upward.

Let me just draw the direction for you. This is what I’m expecting with momentum, and therefore this past historic return is what I’m anticipating into the future for this one. That’s the thesis based on all those criteria.

Now, on a discount cash flow basis it is a little bit overvalued.

So like I said, not everything absolutely ideal as much as I’d like it for a stock for my GVI Investor subscribers, but I think for us, for the Dealmaker’s Diary and the Stock of the Week, no issues there. It’s solid.

Thank you.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.