The Energy Bull Isn’t Tiring Out

Marc Lichtenfeld|March 28, 2023

A Note From Amanda: Our good friend Marc Lichtenfeld, Chief Income Strategist at The Oxford Club, is convinced we’re looking at the best time in decades to invest in oil and gas royalties.

In fact, one region in the U.S. will drive our oil production to record highs in 2023 and 2024. Marc has uncovered the #1 play in this region… a royalty stream with no debt that pays out income to investors each and every month. And you can get your share of this growth today… for just $25!

Click here to see why Marc says it’s one of the greatest income opportunities in the market today. Check it out now.

I’ve been bullish on energy since it was clear that the world was going to open again from the pandemic.

Expectations of a recession haven’t been fulfilled. Economies around the world are growing. And growing economies require more and more energy.

According to the U.S. Energy Information Administration, global liquid fuel consumption is expected to rise by 1.5 million barrels per day in 2023 and by another 1.8 million barrels per day in 2024.

Though a few countries are still buying oil from Russia, it remains a global outcast. Its former customers aren’t buying. There is less supply for those boycotting Russian oil, while demand is increasing.

And that supply crunch means big opportunity.

Brent crude oil is currently around $76 per barrel, and West Texas Intermediate crude is at $70 per barrel.

Barclays expects Brent to average $92 per barrel in 2023 and West Texas Intermediate to average $87 per barrel. The benchmarks are expected to rise in 2024 to $97 and $92, respectively.

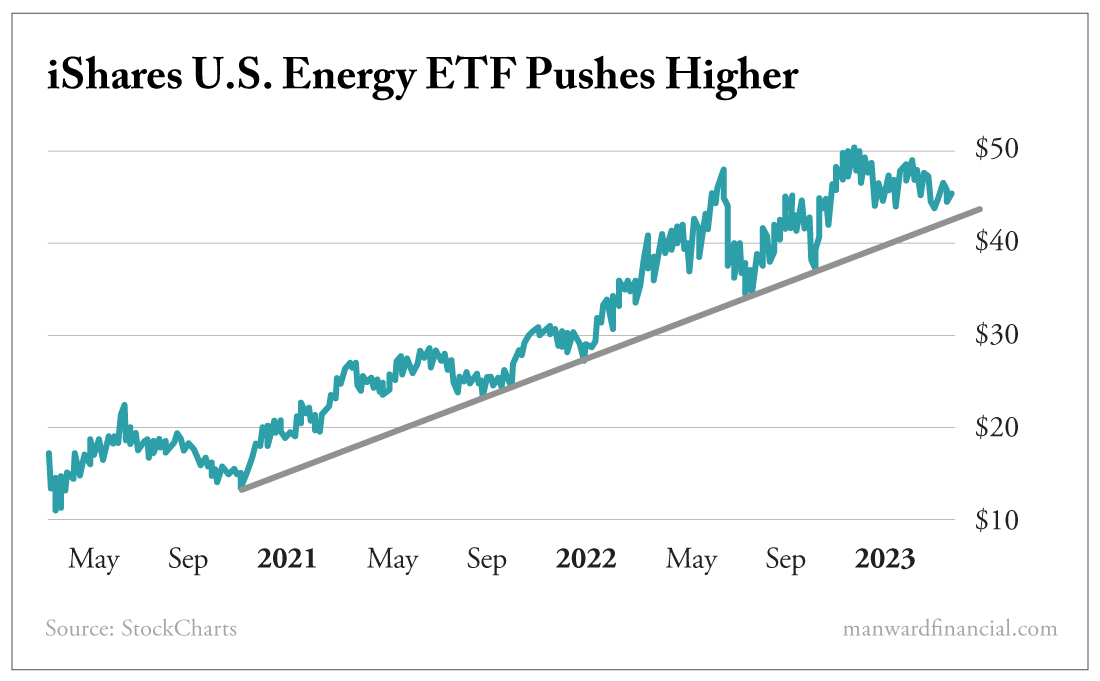

Furthermore, energy stocks are in a long-term uptrend.

The iShares U.S. Energy ETF (IYE) has been steadily climbing higher since the end of 2020. The top holdings in the exchange-traded fund are ExxonMobil (XOM), Chevron (CVX) and ConocoPhillips (COP).

With demand for energy unlikely to weaken in the future, this ETF should continue to move higher.

Lastly, energy stocks often pay big dividends. Several major oil companies, like Exxon, pay more than 3%. Pipeline companies, like Plains All American (PAA), often sport yields between 6% and 8%. And there are even energy companies whose yields reach double digits.

Despite an increase in solar, wind and other sustainable power sources, oil and gas will still be needed for a long time to meet the world’s energy needs.

If you’re looking for growth and income, energy stocks should be an important part of your portfolio.

Note: If you’re looking for a safer way to profit from the oil boom without buying regular oil and gas stocks, look no further. Today I’ll show you how to collect monthly income directly from the Permian Basin.

Bloomberg reports that the Permian is “uniquely positioned to become the world’s most important growth engine for oil production.”

While it’s the largest oil basin in the United States, only 37% of its wells have been tapped. So the lion’s share of its growth still lies ahead of it.

And you can get your share of this growth today.

For more info on my #1 oil and gas royalty for 2023, click here now.

Marc LichtenfeldChief Income Strategist, The Oxford Club

Marc Lichtenfeld is the Chief Income Strategist of The Oxford Club. After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s, and U.S. News & World Report, among others. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance. His book Get Rich with Dividends: A Proven System for Double-Digit Returns achieved bestseller status shortly after its release in 2012.

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is also the Editor of Technical Pattern Profits, Penny Options Trader and Oxford Bond Advantage.