Dealmaker’s Diary: The Company Turning Data Hoards Into Treasure Troves

Alpesh Patel|November 7, 2024

As the markets get a boost from Trump’s victory… it’s crucial that we don’t get swept up in the tidal wave without a life jacket.

That’s why I’ll still be looking for quality companies with the numbers and momentum to back their prices.

Companies solving problems… and this week’s stock does exactly that.

Insurance companies are facing a perfect storm…

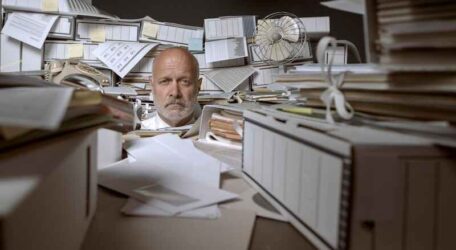

Millions of claims flooding in, decades of customer history gathering dust, complex regulations demanding precision, and customers expecting instant, personalized service.

Fortunately, there’s a company that’s turning this data tsunami into a strategic advantage for insurers.

The 25-year-old business has built AI systems that can process claims in minutes instead of weeks, predict customer needs before they arise, and spot fraud patterns human eyes might miss.

And its new Nvidia-powered AI platform just upped the game significantly.

Here’s what really caught my eye… the numbers tell a growth story that’s hard to ignore. We’re talking an 8 on my proprietary algorithm, top-notch cash returns, and a stock that’s potentially 30% undervalued.

When you combine a growing problem with a proven solution and compelling data… you get a stock that could rise another 60% from here… in less than a year.

Get all the details on the company – including its ticker – in my latest video.

This the kind of research my clients pay thousands for… but you get it for FREE as a Total Wealth subscriber.

Click on the image below to dive in.

TRANSCRIPT

Hello friends, and welcome to Stock of the Week from my Dealmaker’s Diary. And here’s the grand reveal.

![]()

ExlService Holdings (EXLS).

Twenty-five years old. Almost as old as me… I wish.

So what brought this to my attention? Well, as you know, each week in the Dealmaker’s Diary, my staff will pitch to me stocks which meet my fundamental criteria of valuation, growth, dividend yields, and momentum. And then I will narrow down, have a look at these, and look at the ones which catch my eye for your attention.

So what was it about this company? Well, as ever, it is the data, not the narrative.

I’m going to come to the data in a second… but there is a bit of a narrative which is eye-catching.

It’s a global leader in operations management and analytics. Doesn’t exactly get the blood boiling, does it?

It offers data-driven insights and digital transformation. That sounds important, interesting, and growing. You can see why I look at data because these people can’t write English.

The company operates through four segments based on products and services offered and markets served. Insurance, healthcare, emerging business, and analytics.

Multiple sectors – that’s important. I like that. Again, I’ll come to the numbers in a second.

The company launched a new AI platform built with Nvidia’s software. It will accelerate generative AI for clients.

That gighlighting its tech-driven approach.

Well, let’s get to some of that data. This was what gets me excited. Data, data, data.

On my proprietary Growth-Value-Income algorithm, this is an 8. Anything which is 7, 8, 9, or 10 ticks my box.

My algorithm measures the growth of a company such as revenue growth, the value of a company such as share price to profitability, and so on, and then weighs those and comes to an overall score. It allows me to scan through 10,000 equities to narrow down the most important.

ExlService’s forecast P/E is 25.6. That’s a little bit expensive. To put that into context, you’re probably looking at about over 30 for an Nvidia. This is no Nvidia, of course. So a little bit expensive.

In other words, you’re paying 25.6 dollars for every forecast or expected dollar of future profits.

Cash return on capital invested, tick. This CROCI measure comes from Goldman Sachs Wealth Management. The video at this link explains why CROCI is important. But this is in the top quartile or top 25% of all companies by cash return on capital invested.

The sortino 0.5. Not bad. It meets my minimum threshold.

Volatility is pretty low. I like volatility under 20% if I can get it.

So let’s look at the stock chart. You can see it’s had some phenomenal growth since 2020.

Of course, 2022, like the rest of the tech market, was a down year. I beg your pardon, 2023, unlike the rest of the tech market for whom 2022 was a down year, for this one, 2023 was the down year.

And we’ve now got a rising MACD.

Were it to continue the trend it’s had over the last six, seven months, you’d be looking at almost a 70% return in 12 months.

I’m not saying that could happen. However, the momentum and the trend direction look pretty good.

On a discount cash flow basis, the stock is 30.4% undervalued.

So you’ve got a few things really playing for you on this one. I like it.

And that’s my Dealmaker’s Diary Stock of the Week.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.