What to Buy in the Wake of a Bittersweet Fed Announcement

Alex Moschina|June 17, 2023

Ahhh, summer.

The skies are blue. The air in New York City is back to its usual semi-breathable state. And, according to the latest CPI data, the price of eggs just dropped 13.8%.

Things have been starting to look up.

Our good pal Jerome Powell even took to the airwaves on Wednesday to tell us that, after 15 months of hiking interest rates, the Federal Reserve would be taking a breather.

It was exactly the news Wall Street had been expecting.

But Mr. Powell wasn’t finished…

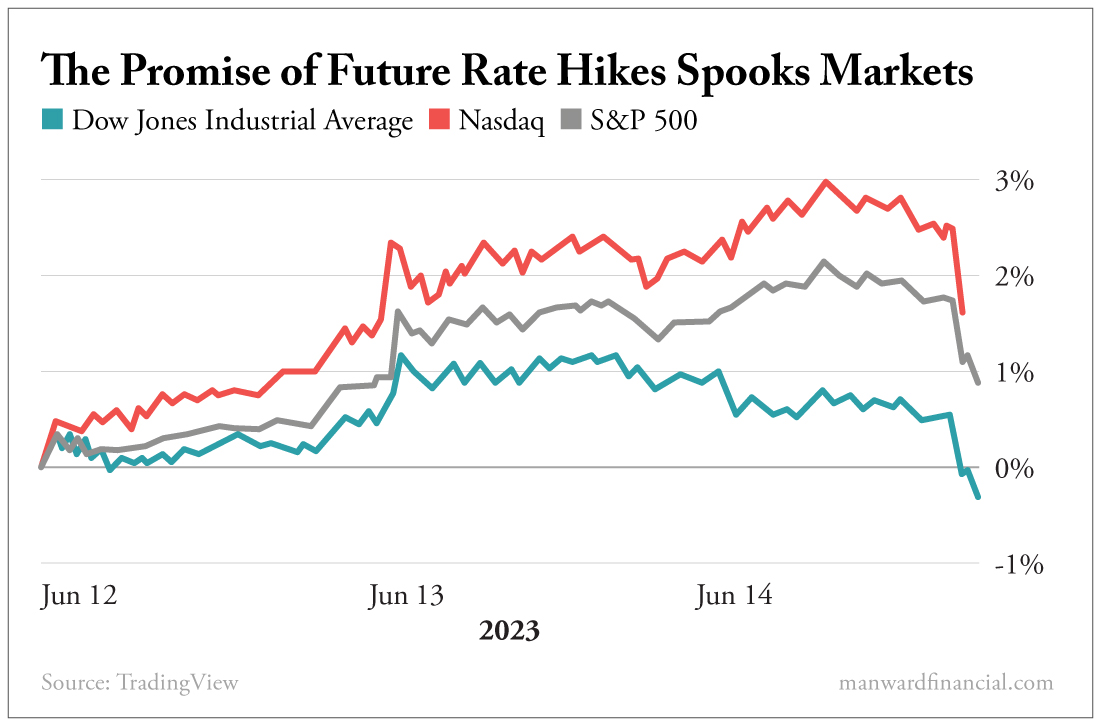

“Looking ahead,” he continued, “nearly all committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to 2% over time.”

The markets took an immediate tumble before recovering late Wednesday afternoon.

Darn it, Jerome!

Of course, the Fed is only doing the painful work that needs to be done with inflation still hovering above 4%… a figure more than double what the central bank wants to see.

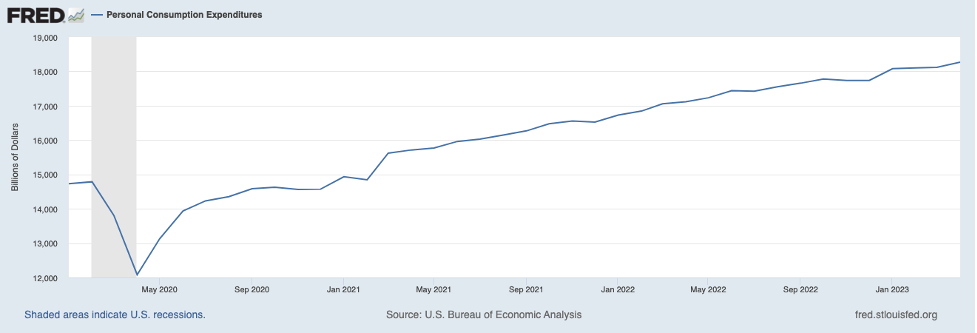

It seems not even a whopping 10 rate hikes have been enough to properly quell Americans’ spending. We’re shelling out billions upon billions of dollars more today than we were pre-COVID.

One of the most obvious signs that all is not right is auto prices.

Andy had the scoop for us on Monday.

“The average price of a new car in America,” he wrote, “now sits just below $50,000 – a record-smashing high.”

Soaring consumer demand is playing a big part. But there’s another major contributing factor here: all the new (and pricey) tech that goes into modern vehicles.

Heck, for all I know, your car may be reading you these words right now.

It’s all adding up to create a difficult situation that has the average consumer driving off the lot with roughly $40,000 in new debt.

And as if that weren’t bad enough… it turns out “going green” will drive you even further into the red…

The average price of a new electric vehicle hovers around $64,000. And they are still flying off the lots.

It’s good news for lithium investors, at least.

Or is it?

Andy had this to say in his essay on Thursday…

The nascent lithium market will continue to get crushed by a deadly combination of fresh supply, market manipulation and herd buying.

There’s a much better metal to own… one that has been economically and monetarily critical for thousands of years.

And that metal is – drumroll, please – silver.

That’s right. Forget lithium. The Age of Silver is nigh.

Aren’t you excited?

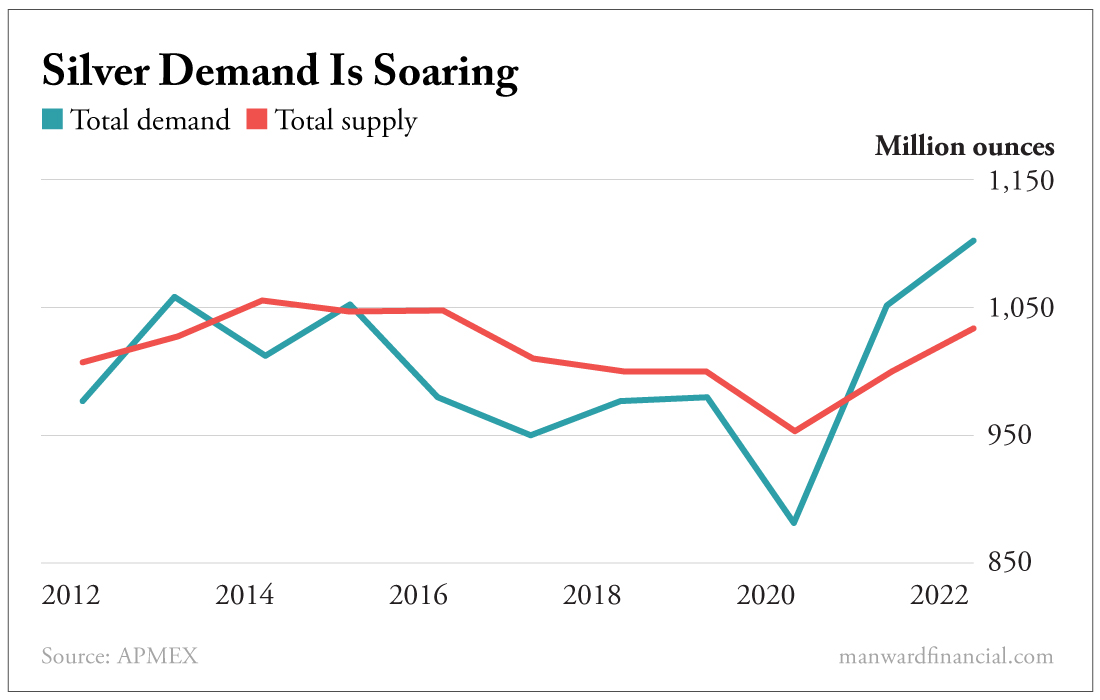

Many investors tend to think of silver as a “boring” safe haven investment… something you hold in rocky economic times. In reality, the metal has a ton of utility.

It’s a crucial component in everything from EVs and handhold electronics to solar panels.

Demand has been on the rise since 2020. It outpaced new mining capacity by more than 50 million ounces over the last year.

Click here for the full rundown from Andy.

Alex Moschina

Alex Moschina is the associate publisher of Manward Press. A gifted writer, editor and financial researcher, Alex’s career in publishing began more than a decade ago when he worked at one of the world’s leading providers of academic research and reference materials. Alex first cut his teeth in the realm of investing when he joined the team at White Cap Research in 2010. There he was charged with covering emerging market trends and investment opportunities. A stint as senior managing editor and editorial director at the prestigious Oxford Club followed. A frequent speaker at conferences and events, Alex has led educational workshops across the U.S. and Canada.