Monday Takeaways: Pivotal Fed Week Tests Central Bank vs. Presidential Power

Shah Gilani|September 15, 2025

Wednesday’s Fed decision is a done deal – but Trump wants more than markets expect…

Fed fund futures are pricing in 100% odds of a 25 basis point cut Wednesday. But over the weekend, Trump called for a “big beautiful cut” – meaning 50 basis points.

But Trump is bound to be disappointed…

Meanwhile, the S&P 500 continues traveling along the bottom of its uptrend channel. Nervous buyers keep chasing performance from April’s “tariff tantrum” bottom, even as they worry about a breakdown.

Add in this week’s potential Trump-Xi call about TikTok, and you’ve got a week that could determine whether this rally extends or finally tests lower support levels.

I’ll explain why 25 basis points is the smart bet, what the labor data really means, and how the TikTok situation could provide unexpected market upside.

Click on the image below to see how this Fed week unfolds.

Transcript

Hey, everybody. Shah Gilani here with your Monday Takeaways. It’s about 30 minutes before the market opens. Futures are higher, and why not?

Last week was another good week for stocks. Yes, markets were up again. So let’s look at some charts as I’m talking to you today about what to take away from what happened last week and over the weekend.

First up, there’s the S&P 500.

Now here’s this long trending up channel that we broke out of, and we know this was the April selloff here – that tariff tantrum, as I call it – and then we made our way back up. Everybody hated this all the way back up. And even when we got above these highs right over here, even when we got above this back, we’re still just at the bottom of this uptrending channel.

People got nervous and said, “No, no. I don’t trust it.” Well, the market’s gone higher, higher, higher.

We’re nicely traveling along the bottom of this channel, this uptrend. Now that worries a lot of people because they think, “Well, we could easily break down, head back down, and go somewhere” – maybe check some support at 6,200. Maybe we go all the way down and test 5,900. So there’s still nervousness out there, which is helping performance chasing because everyone who’s missed – institutions who have missed – have been chasing this, and they continue to chase.

And they’re chasing this morning. Again, futures are up this morning.

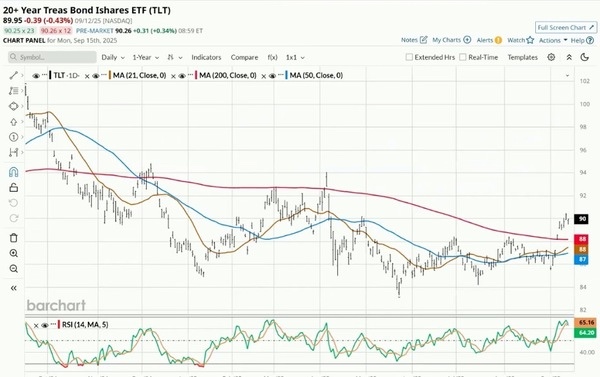

Now some of the other news that was very helpful for the market: we have the Fed meeting this week. And here’s a look at TLT, the 20-year-plus Treasury bond ETF.

Again, look at this action here. Here’s like, “What’s the Fed? What’s the Fed? What’s the Fed?”

Oh, we know what the Fed’s going to do now. It’s going to cut. So prices of bonds will rise. Yields will fall.

That’s the expectation. TLT certainly showing up. Fed fund futures showing close to a 100% bet that the Fed will cut 25 basis points. Now the president is coming out today – and over the weekend, he’s asking for a big beautiful cut.

In other words, he wants 50 basis points. Now markets don’t think he’s going to get 50 basis points. I can’t imagine the Fed’s going to kowtow to the president by giving him 50.

We’re going to have to have some pretty ugly numbers between now and the Wednesday announcement of what’s going to happen. So good luck with the 50 basis point cut because they have a late October meeting. They could cut again 25 or maybe 50 if they need to cut there. Don’t forget, people – inflation, inflation.

Last week, we were still running close to 3%, just shy of 3%. The Fed’s target is 2%, so we’re considerably above that. How about 50% higher than the Fed would like to see it? So this is what the bonds are saying – that there is a rate cut coming, and that’s because of softening labor markets.

We got more on softening labor markets last week. The takeaway from that was the Fed’s definitely going to cut. It would be a shock, in my opinion, if the Fed doesn’t cut this week. That’s because the labor market seems to be softening.

We have a few million fewer jobs created than had been expected, and now unemployment claims seem to be rising somewhat precipitously and faster than anyone expected. So the labor market, which we know the Fed watches, is signaling yes – time for a cut. So a 25 basis point cut looks to be in the offing. Let’s see how markets manage that.

Last thing I want to talk about: the president is going to meet, hopefully, or talk to President Xi of China later this week. Will they talk about a TikTok deal? Does Trump have some of his buddies and cronies lined up to buy TikTok? That’s going to be interesting and positive for the market if the deal is made.

That means that the Chinese are willing to work with the U.S. If TikTok ends up in U.S. hands with all its algorithms intact and everything intact, and the impossibility, hopefully, of China tracking anybody’s data, anybody’s information, and TikTok becomes a U.S. asset, if you will, in terms of the company being domiciled in the U.S. and controlled by U.S. entities – maybe even the government getting a piece of it. Going to be an interesting week on that.

Will Oracle be a part of that group? My guess is yes, it will. Anyway, that’s where I’m looking toward the end of the week for this supposed call between China and the U.S.

The two presidents maybe go tête-à-tête, and maybe things will go well. Maybe they won’t. And last but not least, I wanted to say hats off to Elon Musk. Once again, if you get Tesla’s valuation to some ridiculous level, like $8 trillion, you deserve $1 trillion.

So in order to prove that he’s on the path to do that, he buys $1 billion worth of stock on Friday. And Tesla stock – for those of you who occasionally fade Elon Musk as I do once in a while – it’s always a tough bet to bet against Elon Musk because what happened again, as has happened again and again and again, the master ringleader has managed to move the stock up. First, with the rhetoric about a trillion-dollar payday, and then, of course, now we know that he’s been buying some stock – a lot of stock. And here’s Tesla.

You know what? Hats off to you, Elon. You’re a cool dude. I’ll catch you guys next week.

Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.