The Fed Is Paving the Way for Speculation

Joe Hill|January 31, 2024

Forget Taylor Swift.

Yeah, I said it.

The world’s most famous pop star may be selling out box offices…

And performing for an average of 72,000 screaming fans each night…

All while dominating the news cycle leading up to Super Bowl LVIII…

But she doesn’t hold a candle to Jerome Powell.

In fact, Ms. Swift could learn a thing or two from the de facto leader of the Federal Reserve.

What he’s accomplished is an extraordinary feat of brand-building.

For the first time in the central bank’s 111-year history… ordinary Americans are actually paying attention to what it’s up to.

All it took was yanking interest rates up to 5.5%.

Now Jay Powell has us hanging on his every word.

Take note, wannabe stars.

Tired of Rate Hikes? Shake It Off

Of course, today saw the conclusion of the Fed’s latest meeting about monetary policy and the health of the economy.

The event was followed, as usual, by Mr. Powell’s monotone drawling about if there will or will not be rate cuts. (Spoiler alert: Maybe?)

Echoing past statements, he said that if the data justifies it, the Fed will dial back rates “at some point this year.”

Oh yeah. That’s the sort of specificity investors love to hear.

As Shah suggested might happen in his Monday Takeaways, no part of today’s announcement answered the question of whether the Fed feels it is getting close to quelling inflation.

It’s still nowhere near the Fed’s 2% target. And yet the market remains tightly focused on the idea that cuts are coming. As we move on from another Fed gathering, we’re once again left asking… When?

Consummate showman that he is, Powell has left investors on the edges of their seats.

But lest we forget…

The Federal Open Market Committee meeting wasn’t the only market-moving event Shah had his eye on this week…

Less Debt Lowers Yields

While they get far less press than the Fed’s dealings, the Treasury Department’s quarterly refunding announcements hold a similar amount of sway on Wall Street. And in a surprising development, it was announced this week that the U.S. would borrow less in Q1 than was previously expected.

$56 billion less, to be exact.

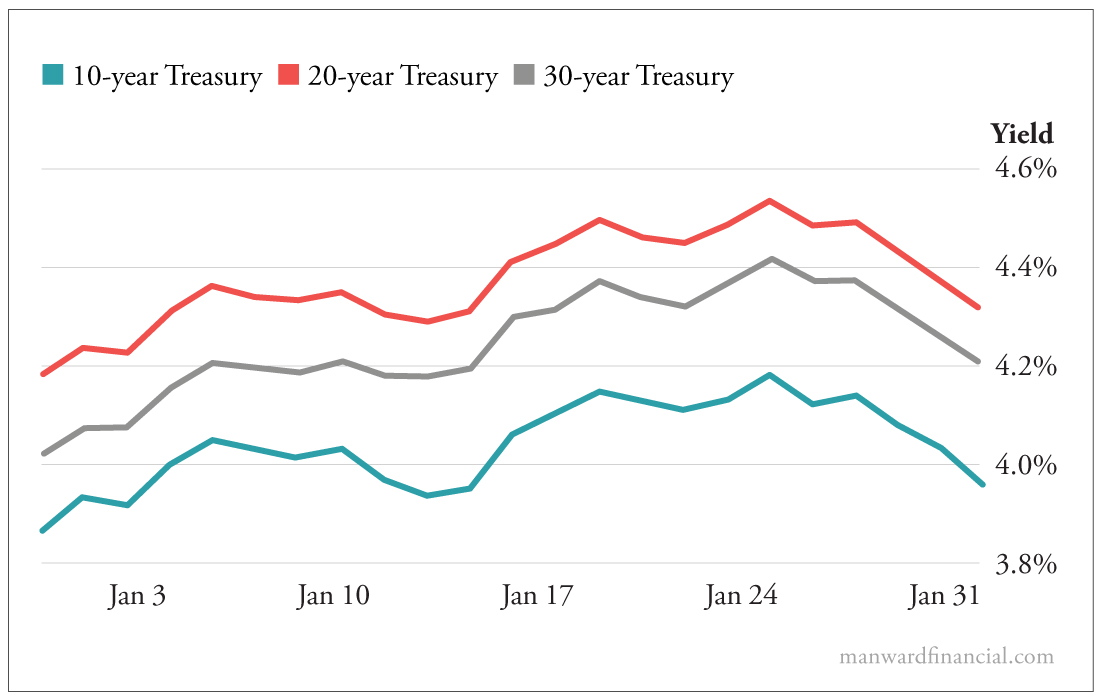

As a result, U.S. Treasury yields have dropped back down toward 4%.

The good news?

Between falling bond yields and the persistent idea that rate cuts are right around the corner, everything we’re seeing right now is lending credence to Robert Ross’ prediction that 2024 will be huge for speculative assets.

Crypto, in particular, looks to be on the verge of a major rally…

Um, Correction…

As Robert pointed out yesterday in Total Wealth – and as most seasoned crypto investors know intimately – steep corrections in digital assets are normal.

“Historically, Bitcoin has experienced significant drawdowns even amid overall bullish trends,” he wrote. “These pullbacks are normal and often healthy for the market. They shake out weak hands and set the stage for the next run-up.”

Despite that fact, many investors have been confounded by the recent pullback in Bitcoin prices – especially given that the SEC just approved those 11 long-awaited spot Bitcoin ETFs.

Robert addressed one reader’s question about what’s going on – and shared his favorite indicator for determining Bitcoin’s relative value – in his essay here.

If you’re curious about the state of cryptocurrencies, give it a read. And keep your questions coming (mailbag@manwardpress.com).

Deal With It

Lastly, I want to point you to the launch of a new series from Alpesh Patel.

In case you missed it, last Thursday we published our first edition of Dealmaker’s Diary.

Each week going forward, Alpesh will give you an inside look at how he analyzes stocks with his proprietary – and award-winning – GVI system. Plus, he’ll share the secrets to his decades of success as an investor, entrepreneur and Dealmaker to royalty.

Like Robert, Alpesh sees explosive new opportunities opening up now that speculators have returned to the market. So he spent this first video looking at a unique play on private equity. Click here or on the play button below to check it out.

There are plenty of reasons to listen to Alpesh (several of which I mentioned above). But as his GVI Investor subscribers can attest… one BIG selling point is his incredible track record.

Put simply… Alpesh is on fire right now.

In just the past week, he’s closed a leveraged play on W.R. Berkley (WRB) for 100%… another on F5 (FFIV) for 78%… and one on General Dynamics (GD) for 144%.

So be sure to check out his Dealmaker’s Diary. And if you’d like a peek at his AI-assisted strategy for picking stocks, click here.

Note: Our goal with this weekly mailing is to shine a light on some action at Manward that you may have missed. We hope you find it useful. If you have a minute, let us know how we’re doing here.