Buy This, Not That: The “Better” Way to Own Gold at All-Time Highs

Shah Gilani|September 3, 2025

Gold just broke to a new all-time high yesterday… and it’s on the move.

After trading sideways since April, the precious metal is suddenly surging.

Getting in on the action is as easy picking up shares of a gold ETF. But which gold ETF is the better buy?

Most people automatically think of GLD – the original gold ETF with over $101 billion in assets.

But there’s another option that might be smarter for your portfolio…

IAU holds the same physical gold, tracks the metal just as closely, but has one crucial advantage that could save you money over time.

I’ll show you exactly what that advantage is – and why it matters more than you might think.

Click on the thumbnail to dive in.

TRANSCRIPT

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That. Today’s subject is gold. All that glitters is gold.

Why gold? All because it’s making a new all-time high. Made a new all-time high yesterday, and it’s on the move. This is after being pretty much, I’m going to call it sideways, relatively flat since April, but all of a sudden, gold is on the move.

So I’ve gotten a lot of requests from a lot of you.

Which is better? Is it GLD, the OG of the ETFs that tracks gold, holds physical gold? That’s what I really want. I wouldn’t want necessarily futures contracts based on gold. I want an ETF that holds physical gold.

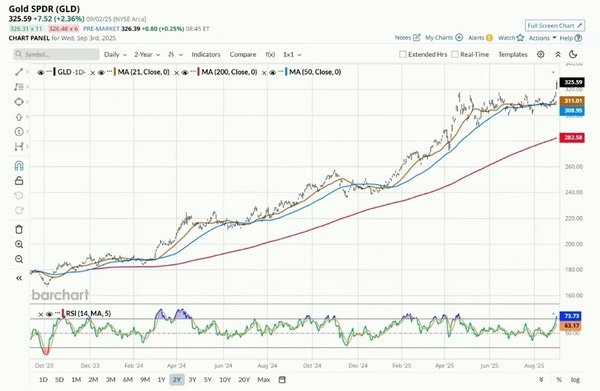

That’s GLD. That’s the symbol, and that is the Gold SPDR. The oldest of the gold ETFs.

And I’m going to compare that against the symbol IAU. Now that’s BlackRock’s iShares Gold Trust. Not quite as old in terms of being around as long as GLD.

And most people are more familiar with GLD because, well, the ticker symbol says gold. So most people right away look up GLD. But I’m going to compare the two.

Now the most important thing is IAU also holds physical gold. So they’re really very similar.

In terms of liquidity, I’m going to give a slight edge to GLD, simply because it’s larger. The assets under management for GLD are just north of $101 billion, while assets under management for IAU are about $47 billion. So IAU is less than half the size in terms of assets under management.

The gold is held in vaults in New York and London – where most are held. Again, IAU, smaller.

But I don’t think given the volume in both that there’s much difference in liquidity. Now, there is a difference in price. So let’s pull up a chart here and talk a little bit about price.

And by price, I don’t mean value. I mean share price.

So IAU, Gold Trust iShares here, as you can see, this is a two-year chart trading at $66.65 closed yesterday.

And you can see in the pre-market here, it’s Wednesday morning before the open. Looks like it’s going to be a little higher today.

I’m looking at a one-year chart for IAU.

Here’s the long sideways action that I was talking about, from April onward and then a nice pop. So here’s IAU. $66.65 a share.

Now GLD and the first thing you’ll notice about GLD when I pull it up is, you’re not able to tell the difference between IAU and GLD.

The charts look pretty much the same. Here’s a two-year.

If I were to overlay one over the other, there’d be very little difference. They track gold very closely, and they track each other very closely.

But as you can see, GLD trading at $325.59 versus $66 and change for IAU. So the difference there is that IAU has become more of a retail product on account of the cheaper price per share for IAU. So I’m going to give IAU the edge here. And, again, here’s GLD and here’s IAU.

So you can’t really tell the difference, people.

Again, if you’re six of one, half a dozen of the other, Again, what’s important to me is price.

It’s a little cheaper. I can buy more shares. That makes a lot of people feel better. They can acquire more shares with IAU.

And the other thing and the deciding factor for me and by the way, if you own GLD, don’t go you don’t need to go sell to buy IAU because it’s fine. And especially if you’ve owned it for a long time, you don’t necessarily need to or want to. It doesn’t really matter. But if you were new and you want to own this investment and you’re thinking about GLD or IAU, I’m going to say buy IAU.

I’m not saying don’t buy GLD. I’m saying buy IAU.

Why?

One reason above all others, the expense ratio. So expense ratio for GLD is 0.40%. The expense ratio for IAU is 0.25%. Okay?

Long term, that makes a little bit of a difference. And anytime you can get an ETF with a lower expense ratio, that’s the one you want to choose, all things otherwise being equal. So there you have it. As far as GLD versus IAU, if you’re going to buy it today, I would go with IAU.

That’s it for today.

Good luck holding on to gold because it looks like it’s going to go higher. A lot of reasons, maybe de-dollarization impact out there, possible inflation ahead with tariffs.

Fed’s likely going to cut in September’s a 90-plus percent chance according to Fed Fund Futures, and I think that there will be some impact on inflation if that’s the case. And if that is the case, then gold’s likely going to continue to rise. So go out there and get yourself some IAU.

Cheers, everybody.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.