Dealmaker’s Diary: Policy Panic Creates a 61% Value Play in This $87B Healthcare Giant

Alpesh Patel|July 24, 2025

The more Washington talks about healthcare reform, the cheaper this stock gets.

Which is exactly what makes it interesting.

While politicians debate policy, this $87 billion healthcare leader keeps doing what it does best – operating the largest network of hospitals in America and generating $65 billion in annual revenue.

The market is pricing in catastrophe. The reality is much different:

- Healthcare demand is inelastic – people don’t stop needing medical care.

- This company has survived every policy storm for decades.

- AI integration is driving operational efficiency to new levels.

- The stock trades at a 61% discount to fair value on discounted cash flow analysis.

Smart money knows that the best opportunities come when fear overrides fundamentals. When a defensive giant with 11.8% CROCI trades at 14.2 forward P/E because of political noise, contrarian investors take notice.

Click on the image below to see why Washington’s healthcare fears could make you wealthy.

Transcript

Hi, friends. Welcome to another Dealmaker’s Diary stock of the week: HCA Healthcare. Healthcare has been very much in the news because of policy changes and concerns over spending cost implications for healthcare companies.

But the financials, which of course are backward-looking, continue to look strong. So the issue is: Are short-term dips a good reason to buy into what are otherwise good, strong, healthy companies? Or is there such a strategic long-term shift that the devaluation of those companies is going to continue for a long time? I’m in the former camp, and I’ll explain why.

Let’s look at HCA Healthcare to see why. Obviously, a name you’re all familiar with. They’re big in the U.S. and, by the way, in the United Kingdom as well.

$65 billion in revenue.

$65 billion. Market cap of about $87 billion. We’re going to look at some of these numbers in a second. Before we do that, one of the things that you know I like to do every week is dive deeper into how they’re using AI.

Why? Because AI is important, but also we want to make sure the company is cutting-edge. So generative clinical documentation – tools to transcribe and summarize physician-patient interactions. That’s going to improve productivity and save time. I know it certainly does for me when I have interactions with clients. It saves a lot of time. But more importantly, it ensures clients are happier.

They understand what’s going on. So client retention. Nursing handoff automation – fine. Understood.

AI-based staffing and labor forecasting. Operational efficiency – you’d expect it to be using it. Claims processing, revenue cycle management – that’s where it could get interesting. I like the fact that they’re able to use it in the core elements of the business, not just in cost-cutting or making things a bit more efficient, but in the core element of the business on claims processing as well.

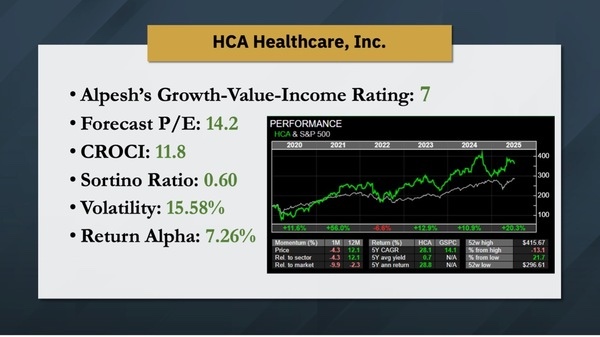

And of course, innovation hubs as well to look at how they can use AI more effectively going forward. So where does that leave us with the company? Well, I love the fact that it meets my criteria: value-growth-income rating. It’s at least a 7.

That’s my proprietary algorithm, which looks at the growth of a company, the valuation of a company and the revenue the company is generating as well. It has a forecast price-earnings of 14.2, which means you’re paying $14.2 for every future dollar in profits. Not particularly expensive, and you’ll see that on the discounted cash flow valuation in just a second. CROCI above 10%, which is good – cash return on capital invested, 11.8%.

Remember, companies in the top quartile – top 25% – according to Goldman Sachs Wealth Management perform exceptionally well over the long term. So that’s good. Sortino, 0.6 – nice and healthy. When you get a Sortino of 0.6, ideally you want it to be above 1.

Sortino measures reward versus risk. But when you get a Sortino of 0.6 in a portfolio and you add it to a group of other companies with, say, around 0.6 as well, the portfolio as a whole ends up getting a better reward-to-risk ratio – possibly well, usually well above 1 on the Sortino. So that’s a good number to be working with. And you might think, “Wait a minute.

“How come a load of stuff at 0.6 doesn’t average out at 0.6?” Portfolios don’t work like that.

What happens is volatility to the downside cancels out among the others, so they have a dampening effect. The volatility doesn’t average or accentuate. It dampens across noncorrelated assets, and that means that the average returns stay the average returns, of course, but the dampening effect of the volatility is what is otherwise known as diversification. So that’s a good number to stick into a portfolio.

Volatility below 20% – good. I like that. Strong alpha – in other words, ability to outperform the market – ticking all those boxes.

By the way, nice upward trend. Lovely, as you can see here.

Now, were I to put a modest projection on this, you can see where I’ve drawn it, and that’s the angle that I’m looking at.

Does that mean it couldn’t continue falling?

Of course, it could continue. There are a lot of shocks going on to the system. Could it reach a recent low of January 2025? Of course, it could.

But I think it’s the kind of company that – despite that, and you’ve seen it in the past where it’s a lovely upward trend that all of a sudden dips down – it recovers. It’s got that resilience. I know it’s annoying when it has these drawdowns. You see those drawdowns, and the duration of them can be a year at least for the recovery.

But you generally know – give it a year – it tends to recover. Worst case. And drawdowns happen.

I can’t magic-wand them away.

Look at that. Discounted cash flow – 61% undervalued.

Not necessarily the most reliable of measurements for evaluation, but nice to have if you can get it.

So I hope you found that interesting and informative as well.

Thank you all very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.