Paying Up Makes Sense: The Case for High P/E Multiples in a Predictable Bull Market

Shah Gilani|August 22, 2025

Wall Street’s old guard still clings to one sacred valuation metric as the arbiter of what’s hot and what’s not: the price-to-earnings (P/E) ratio. And you know what? They’re not wrong – just incomplete.

The multiple you’re willing to pay for a dollar of earnings matters. But if you’re not accounting for the context – the economy, interest rates, investor psychology, and especially paradigm-shifting growth catalysts like artificial intelligence – you’re only seeing half the chessboard.

Right now, the S&P 500 trades at 22.8x forward earnings, well above its 5-year average of 19.9x and the 10-year norm of 18.5x. That’s a 23% premium. Old school analysts might call that frothy, or worse. But what they’re missing is that this market isn’t driven by old-school fundamentals – it’s driven by certainty.

And certainty is what investors are paying a premium for.

It’s Not Just the “E” in P/E – It’s the “Confidence” Behind It

Valuations don’t stretch just because people expect growth – they stretch when investors believe that future earnings growth is predictable. That’s the difference between a 15x and a 23x market.

And today, three core valuation pillars – corporate earnings, long-term earnings growth, and interest rates – are all aligned with unusually low perceived risk…

Corporate earnings are stable and outpacing GDP. In the first half of 2025 U.S. GDP grew just 1.2%. But S&P 500 earnings surged 11.2%. That kind of earnings power in a slow-growth economy is a green light for multiple expansion. It means corporate America is productive and growth is scalable. That’s especially true for mega-cap tech, where marginal revenue growth drops straight to the bottom line.

Interest rate directionality and volatility are subdued. Fed Funds Futures imply an 81% chance of a 50bps cut by year-end and a 79% chance of a full point cut by the end of the first quarter of 2026. Meanwhile, the MOVE Index, the bond market’s VIX, is as quiet as it was in 2021 as stocks soared. That’s a textbook condition for multiple expansion.

Long-term growth is being rewritten by AI. Every analyst and algorithm worth their server time agrees: Generative AI is the next decade’s profit engine. And that expectation isn’t just hype – it’s being built into earnings models today.

The likes of Microsoft, Meta, Nvidia, Amazon, and Google aren’t speculative upside stories. They’re fundamentally reengineering cost structures and opening entirely new TAMs (Total Addressable Markets).

That means more future cash flow, more predictability, greater earnings, and justifiably higher multiples.

But What About the “Overvaluation” Argument?

Yes, 22.8x is rich compared to long-term averages. But history shows that valuation regimes are contextual, not static. Over the past decade, the S&P’s forward P/E multiple has ranged between 14x and 22x. That’s a 50% swing – the difference between 4,100 and 6,400 on the S&P 500.

So what would justify a move to 24x or 26x, as a few bullish strategists, like me, project?

How about continued earnings strength from Big Tech, which – despite only 10 names – commands 35% of the S&P index weighting. Low volatility in rates, both front-end and long-end. And growing AI-driven productivity and monetization, not just in tech but across industrials, healthcare, and financials.

If these factors hold – and they’re showing every sign of doing just that – then higher multiples are not only possible, they’re rational.

The Real Takeaway: P/E Is a Sentiment Tool Disguised as a Valuation Metric

If you’re reading P/E multiples like an accountant, you’re missing the forest for the trees. P/E is a mirror held up to investor confidence, not just a calculator of cost.

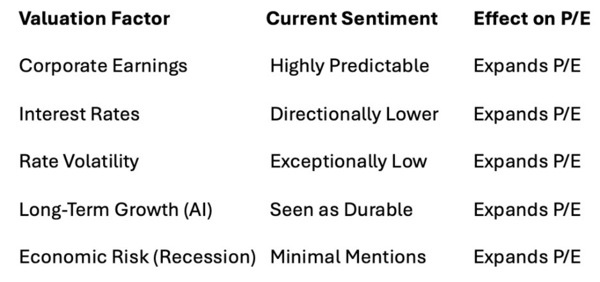

Here’s how I break it down, analyst-style:

Now stack that against the earnings growth leadership of companies like Microsoft, Nvidia, Meta, and Amazon – our “Fab Four” megacaps. They’re still cheap if you believe in their 5-10 year growth trajectories, because those trajectories are no longer hypothetical – they’re visible in operating income, CapEx plans, and margin leverage today.

Yes, P/E matters. But what matters more is what’s inside that multiple: conviction, clarity, and a collective market psychology that says, we see the future, and we like what we see.

This market isn’t soaring because investors are crazy. It’s soaring because they’re certain. And when investors are this sure about earnings, rates, and growth? The premium they’re paying isn’t irrational – it’s inevitable.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.