The Art of the Free Ride: The Simple Strategy That Turns Volatile Winners Into Stress-Free Wealth

Robert Ross|September 22, 2025

One of the most common questions I get is: When do you sell a stock?

It’s an important question. Because as much as we all like to talk about buying, the truth is your selling discipline is what makes or breaks your portfolio.

If you sell too early, you cut yourself off from potential life-changing gains. If you never sell, you run the risk of watching a big winner turn into dead money – or worse, a loser.

Over the years, I’ve developed a strategy that helps me solve this problem. I call it taking a “free ride.”

It’s a simple but powerful way to manage risk in speculative positions like small caps and crypto. And it’s a tactic that has allowed me to keep riding big winners while still protecting my downside.

Let me show you how it works with a real-world example.

Our Latest Triple-Digit Winner

We recently used this strategy on one of our winners in the Breakout Fortunes portfolio.

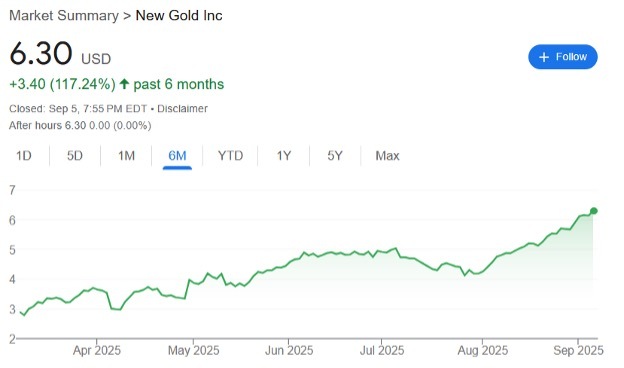

The stock is New Gold (NGD). The company has been a direct beneficiary of the “stimulus wave” liquidity surge we’ve discussed since April.

Here’s how the “free ride” worked…

Let’s say you bought 1,000 shares at $3.24 for a total investment of $3,240.

Fast forward to today: New Gold trades around $6.28. Your position is worth $6,280.

Here’s the move… To take a free ride, you sell enough shares to get back your original $3,240. At current prices, that’s about 515 shares.

You’ve now recouped every dollar you originally put in. The rest of the position – 485 shares – is entirely profit-funded. That means whatever happens from here, you’re playing with house money.

Why This Approach Works

The beauty of this strategy is that it gives you the best of both worlds.

- You’ve locked in a win by taking your initial capital off the table.

- You still have upside exposure if the stock keeps running.

- And psychologically, it’s much easier to sit through volatility knowing you’ve already secured your principal.

That’s key with speculative names like small caps and miners. The volatility can be brutal, and if you don’t have a framework for managing it, you’ll get shaken out before the big payoff.

Small caps are where the outsized returns come from. But they’re also where you’ll see the most gut-wrenching swings. A 50% drawdown isn’t unusual. Without a risk management tool like the free ride, most investors either sell too early or hold too long.

This is how you avoid both mistakes… especially in a ripping bull market like we’re in right now.

Taking free rides forces discipline, protects your downside, and lets your winners run.

A Word of Caution

The free ride only makes sense once you’ve banked a substantial move. If you try to take one after a 15% or 20% gain, you’ll stunt your upside. My rule of thumb is to look for doubles or more before peeling back to your cost basis.

And remember: this is just one piece of risk management. If a stock breaks down before it ever doubles, you still follow your stop loss and move on.

The most successful investors I know stay in the game long enough for their winners to pay off.

Taking a free ride is how I do that. It’s how I turned a volatile small cap like New Gold into a long-term position without worrying about losing my shirt.

So the next time you see one of your speculative plays double or more, don’t agonize about whether to sell it all or hold everything. Sell enough to get your original investment back.

Then sit back and let the rest ride. Because nothing feels better than compounding wealth with house money.