A Rate Retreat Means Big Trouble

Amanda Heckman|March 25, 2023

Talk about timing.

Just as we were hopping on a call with our VIP subscribers on Wednesday, Jay Powell was doing his darndest not to spook the markets.

As you know, the Fed raised interest rates by a mere 25 basis points.

Just enough to show it still means business…. but barely enough to stem the bleeding from inflation’s deep wound.

Subscribers got Andy’s reaction as the events unfolded in real time… but that wasn’t all we talked about during the call.

Given the mess in the banking sector last week, it was hardly surprising that Powell took a dovish tone… in a reversal from his comments earlier this month.

Just weeks ago, he said rates would need to go higher than policymakers had expected thanks to persistent inflation and strong labor numbers.

This week… he said rate hikes are likely nearing an end.

That may have made the markets happy (the S&P jumped 30 points on the news)…

But it’s only going to cause more pain.

Not Over Yet

The reality, as Andy showed viewers on our call, is that we still have strong inflation.

Food prices are still rising. In February, they were up 0.4% month over month and 9.5% year over year. And grocery costs were up 0.3% month over month and 10.2% year over year.

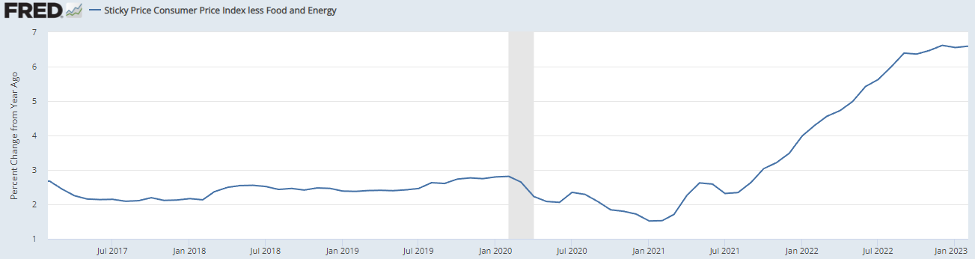

Core CPI – that’s without food and energy – is still well above 6%, a far cry from the 2%-3% range of the past decade.

Here’s the chart Andy shared on the call…

Over in the auto sector, sure, prices have dipped… but they are still way above average.

According to Kelley Blue Book, the average new-vehicle transaction price is $48,763. Before the pandemic, the average new vehicle sold for $37,876.

I took my car-loving sons to an auto show recently… and I couldn’t stop shaking my head at the prices proudly displayed. $50,000… $60,000… And I’m talking Everyman cars like Fords and Toyotas… not luxury rides from BMW or Lexus.

We still have a long way to go before the inflation damage is contained, let alone cleaned up.

But now… with the problems in the banking sector, Powell is, in a word, screwed.

Interest rates were the only way for the Fed to control red-hot inflation. And the rate hikes were helping… until banks started dropping like flies.

But if Powell makes good on his musings about lowering rates… it’ll send us right back into inflation’s arms.

Lower rates mean lower mortgages and car loans… which would reinflate the housing and auto sectors.

And lower rates mean cheap money… which would reinflate growth that’s built on debt.

Make no mistake: If the Fed backs off… inflation WILL get hotter.

There’s a way off this roller coaster, though. As Andy told our VIP subscribers, big things are happening in the security token space. For as little as $5, you could get in on the ground floor of the next generation of the markets. Andy explains it all in easy-to-understand details right here. Trillions of dollars could be at stake. Don’t miss out.

Amanda Heckman

Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years – give or take a few sabbaticals – sharpening Andy’s already razorlike wit. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus and – lucky for us – the fine folks at Manward Press.