Three Ways to Play the TikTok Theft

Andy Snyder|September 21, 2020

The corporate thievery continues.

China had something America wanted… so Washington stepped in to rip it out of its hands.

The proceeds will go to the biggest donor, er, uh, the highest bidder.

Clearly, we don’t like the story that surrounds the TikTok deal. Regardless of our not-so-swell ties with China, the move reeks of manipulation and political favoritism.

It’s China’s assets the government’s deeming “unsafe” today… but could it be your assets tomorrow?

Data Wars

As we mentioned last week, this deal has nothing to do with the hip, new platform that’s drawing in all the kids. We bet most of the folks fighting for a stake in TikTok – companies like Microsoft, Oracle and even Walmart – have never been on the platform.

We certainly haven’t.

Nope. These companies want to be the home of all that data the app collects… and they want to reap the many rewards of hosting it.

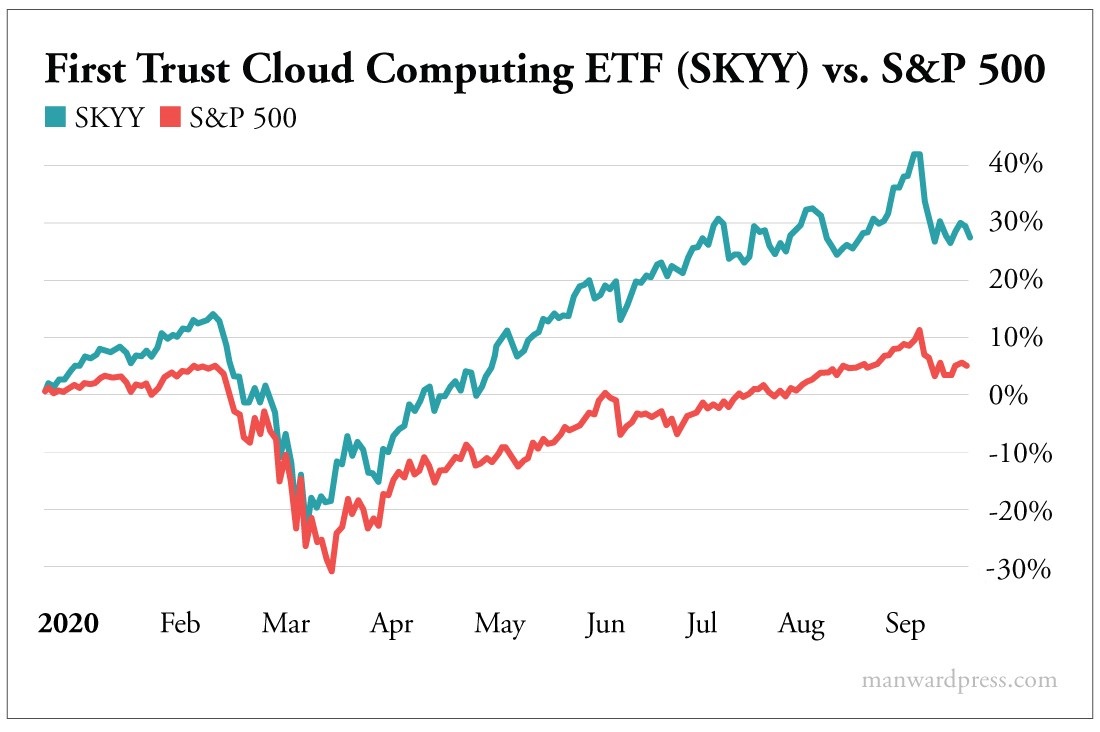

Check out this chart…

It shows the year-to-date action of the S&P 500 versus the First Trust Cloud Computing ETF (SKYY). It’s the fund that pools together the ticker symbols of the biggest data fortresses on the planet.

It shows the year-to-date action of the S&P 500 versus the First Trust Cloud Computing ETF (SKYY). It’s the fund that pools together the ticker symbols of the biggest data fortresses on the planet.

These are the companies dealing with the most valuable commodity of the 21st century.

Data.

As easy as it is to be negative on the notion of Big Data, it’s vital to understand that what these companies are up to is a lot more than just tracking where you go and what you buy.

Much of this trend is about data storage and organization.

Many companies now have no physical assets. Everything they’ve got is stored in the “cloud.” Software, hospital records, financial data… It’s all stored and managed by a company that’s likely in that ETF.

It contains names like Amazon (AMZN), Oracle (ORCL) and Microsoft (MSFT).

It also gives investors a stake in lesser-known cloud plays like Fastly (FSLY), MongoDB (MDB) and SalesForce (CRM) – all companies that have flat-out crushed the market this year.

With gains like these companies are seeing – Fastly is up more than 300% in 2020 – it’s not hard to see why a company like Oracle would want some help from powerful friends

After all, shares of the company were trailing the performance of the S&P 500 for the year… until Trump got involved this month.

The Smart Play

As we said last week, if you’re looking to play the opportunity that’s erupting in the cloud space, the big names aren’t the way to do it. And you certainly don’t want to get involved in any of the shenanigans sponsored by Washington.

For conservative investors, the ETF mentioned above is a fine place to start.

If you’re looking for a bit more of a wild ride, you can invest alongside Mr. Buffett with his fresh stake in newly IPO’d Snowflake (SNOW). It’s a leader in cloud data and getting a lot of attention from Wall Street.

But if you’re looking for a bit of an off-centered play, check out FireEye (FEYE) for just $12 per share. It’s the lesser-loved company many of the big boys turn to in order to keep their cloud data secured.

Its second quarter results crushed Wall Street’s expectations, sending shares surging. The same thing could happen on November 3, when the company opens its books once again.

When Washington starts to meddle, it means big money is on the line.

We agree.

Just stay out of the China mess.

P.S. In the latest issue of Manward Letter, we revealed a high-tech data provider for the nation’s banking sector. We bet you’ve never heard its name… but you use its products every day. To learn how it fits in what could be the biggest economic story of our lives, click here.

Has your portfolio ridden the tech boom this year? Tell us about it at mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.