Janet Yellen Calls for a Financial Crisis

Andy Snyder|July 5, 2021

Don’t think the government is the No. 1 threat to the markets?

Pay attention…

July could be a wild month.

“Failing to increase the debt limit would have absolutely catastrophic economic consequences,” Janet Yellen said last week. “I believe it would precipitate a financial crisis.”

There’s no doubt she’s right.

For a country like ours – with its economic and political might – to shirk its obligations would be a world-changing event.

It’s not likely to happen. We all know that.

But…

What is likely to happen is yet another drawn-out, nasty political battle. The kind that stirs markets, induces fear and doubt, and turns every savings-minded American citizen into collateral damage – innocent bystanders in a war we never should have started.

Rinse… Repeat

You may recall the headlines from this time two years ago.

After an on-again, off-again battle with the debt ceiling, Congress finally picked up the grenade it had been kicking and tossed it well into the future.

But that future is now.

In July 2019, Congress suspended the debt ceiling for 24 months. It opened the door for some of the most audacious spending in the nation’s history.

Within weeks of the limit getting stuffed into a congressional back closet, the Treasury borrowed more than $160 billion. The bond market – as it has done during so many previous fights – turned grumpy.

A sudden slug of debt sent bond prices lower and rates higher… the equivalent of putting a muzzle on a roaring bull.

The battle over the next four weeks is likely to be one of the most contentious yet.

It’s now quite clear America can’t afford her debt. Uncle Sam is not only scrounging under couch cushions for every penny he can get… but also taking his beggar’s bucket overseas.

He’s using his sad song to get many of the world’s nations to promise a minimum tax rate.

But our nation’s mood is divided. Boy, is it.

So is the mood of Congress.

One half says debt doesn’t matter and government spending is the only way forward.

It’s the new America.

The other half liked the old America better. It says such madness will kill us all.

You know where we stand.

We just hope wood prices fall enough that we can afford a nice coffin.

Battle Plans

Here’s the scoop and how everything is likely to unfold.

Yellen has looked at the balance due, measured the stack of bills and crunched the numbers.

“It’s possible that we could reach that point while Congress is out in August,” she said. “I would really urge prompt action on raising the limit or suspending it.”

That’s it…

Either raise the limit… or just get rid of the darn thing.

There’s no mention of cutting back or making do with what we have.

Instead, she’s pushing for Congress to put another stack of blank checks in front of her before Capitol Hill closes for its summer recess at the end of this month.

It’s the catalyst for a late-July showdown.

Again, we all know what will happen. Congress will pick up that grenade once again and toss it at our children’s feet.

But there will be a fight.

The Democrats saw it coming in March. They pondered boosting the debt limit in their pandemic package this year, but they ultimately decided to skip the arguing.

Now it’s here.

With Capitol Hill evenly divided, it could get ugly.

That means volatility will soar. Stocks will fall. And interest rates will rise.

As much as it will hurt, though, we must have the fight. We must not embrace this nation’s move toward a system that views debt only as a measure of what it’s accomplished.

Debt must be viewed as a burden… not as an artificial stimulant for the economy.

How to Win This War

For investors, the plan is simple.

Know what’s coming. It’ll be a temporary blip that ultimately fuels an inflationary run to Dow 100K.

Buy on the dips. Trade assets that rise when stocks fall. When the headlines heat up, buy puts… bearish ETFs… and the many other “contra trades” that are available.

Just don’t panic when the pressure is on in a few weeks.

The worst thing to do right now is to sit on the sidelines and wait for things to get better.

We’ve been here before… many times.

The headlines will get hellish. But the bulls will be back in due time…

And they’ll be roaring with another hit of artificial stimulant.

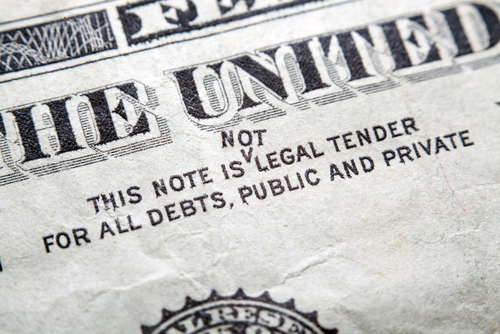

Funny money does funny things.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.