Dealmaker’s Diary: The Rare Disease Fighter Trading at Bargain Prices

Alpesh Patel|March 27, 2025

Remember when gene therapy was the hot topic?

How did we forget that we could literally edit human DNA?

Well, their loss is our gain.

The stock I want to show you today isn’t your average biotech. It’s a $5 billion powerhouse tackling rare diseases.

Unlike most biotech companies, it generates positive cash flow.

And the best part – it’s incredibly cheap.

You’re paying just $25 for every $1 in future profits for a biotech company that leverages AI.

Get all the details on the company – including the ticker – in today’s Dealmaker’s Diary.

Click on the image below to watch.

Transcript

Hi, friends.

There’s a bigger version of me and a wonderful background.

I’m not in my living room, sadly.

But, I’ve got a fantastic stock of the week for Dealmaker’s Diary.

I seem to say that all the time.

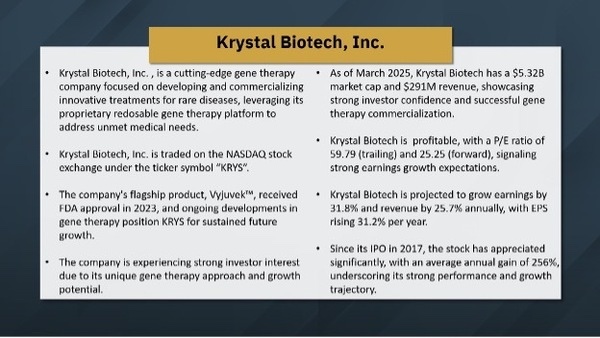

So, let me tell you what I like about this one – Krystal (KRYS).

It’s phenomenal because it’s on the cutting edge of gene therapy.

Now, we seem to have forgotten about this amidst all the fuss over tariffs and trade, and the rest.

There are a lot of humans on the planet with a lot of diseases, and they all seem to be getting older.

This one helps with combating rare diseases. That’s important.

Rare diseases don’t seem to be as rare as they used to be.

Gene therapy became one of those buzzwords that vanished. Yet people forget its importance.

You can see with some of the numbers – this has a $5 billion market cap. That is not small.

When you look at its P/E ratio of 60x or the forward P/E of 25x, you’re paying $25 for every $1 of expected future profits.

That is relatively cheap for a tech company, and this is a cutting edge tech company. Think of it like AI, but for gene therapy.

First, I want to cover some of the AI aspects of the company.

They use AI in R&D for drug discovery.

They also do Personalized Medicines.

Now, this was a big thing a few years ago.

It was personalized vitamins, and then personalized medicines.

AI can play an increasing role in that. A lot of these things don’t get the news coverage after the initial hoopla.

They have optimized manufacturing where you can improve production.

Data analytics – there is a hell of a lot of data in this kind of area.

There is automation, of course, in terms of delivery as well.

I guess I’m less concerned about regulatory support. But, there are a lot of AI benefits in this area.

So, on my proprietary GVI score, it’s a 7/10.

Anything above or at a seven meets my minimum criteria of growth, value, and income.

Forecasted P/E is around 25x. You’re paying $25 for every future dollar in profits. I think that’s cheap.

CROCI (Cash Return on Capital Invested) is at 13.7.

That’s unusual for biotech companies because they typically burn cash.

They tend not to generate a lot of cash on the capital they invest.

Anything above ten is really good. That’s from Goldman Sachs Wealth Management.

The Sortino ratio is really high at 0.75.

The return, in terms of volatility, is above twenty. That concerns me a little bit. So, watch out for that.

There’s a slight negative trend in the chart, similar to many companies recently, where the longer-term MACD has started falling while the shorter-term MACD is beginning to rise.

Now, if we do indeed have a base here at $130, then my best case projection is about 65% upside.

Could it fall more? Of course.

It could fall below $130, but I’d be surprised if it did.

And I’d probably be willing to hold it lower, though not buy more lower, given the 65% upside.

Okay.

It’s 74% undervalued according to discounted cash flow measures. So, it’s attractive there as well.

It’s got a lot going for it.

It’s one of those areas of biotech that crosses over with AI that’s been overlooked.

Hope you enjoyed it, my friends.

Thank you all very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.