The Scariest Chart in 43 Years

Andy Snyder|June 23, 2021

Ahhh… those nearsighted headline writers.

The price of lumber has fallen 50% from its highs. Inflation is dead, they declare.

It’s safe to start spending again.

Let us count the many ways they’re wrong.

First off, yes, lumber prices have fallen dramatically. Thank goodness. Even so, they’re still up 170% from where they were before the Fed fired up its printers and flooded the world with some $4 trillion in fresh money. And even though futures are down, retail prices have barely budged.

That’s the fun in all of this… picking the reporters’ facts apart from their fiction.

A Chart Tells the Tale

The headline writers have had quite some fun learning about inflation as they’ve tried to figure this story out. It’s supply and demand, they say. The mills were shut down at the same time that demand soared.

But now prices are falling. Things must be good again.

If only it were that simple.

There’s a much bigger issue at play… one far too deep for those who print one story and move on to the next to understand.

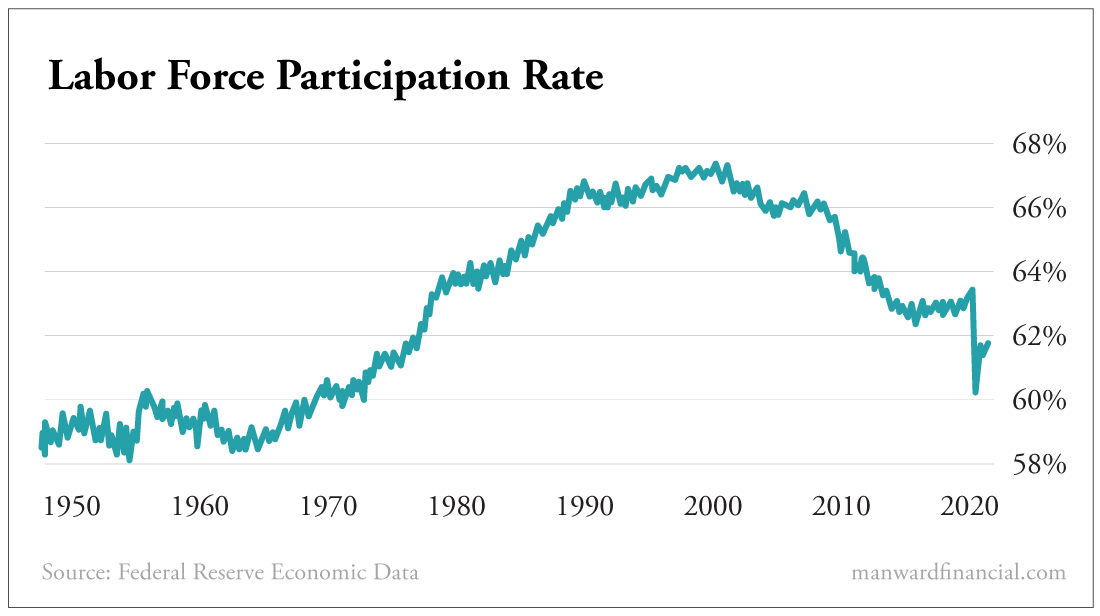

Take a look at this chart. For inflation hawks, it’s the scariest setup we’ve seen in 43 years…

You’ve likely heard about the labor force participation rate. It’s the percentage of working-age Americans who are either working or looking for work.

Mingling physics and economics, we like to think of it as potential energy.

The higher that number… the more spending power the nation has.

Change

Looking at the chart, it’s no surprise that the period from 1965 to 1980 saw some of the nation’s highest inflation. That’s when the number of folks in the workforce made one of its most abrupt changes in history.

Within the span of a generation, tens of millions more Americans not only went to work each day… but also brought home a paycheck every other Friday.

Dig a bit deeper and we see that many of the folks jumping into the workforce were women.

Study the economic history books and you’ll see this sudden behavioral shift drove the bean counters nuts. It threw off many of their calculations and was ultimately a leading cause of the inflation that ensued.

The reason it caused inflation is quite clear.

Many of those workers who jumped into the labor pool represented a family’s second income.

This led to a huge shift in the nation’s economics. Within the span of a few years, the average home went from having one paycheck to having two. Not only did that dramatically change spending habits, but it also permanently altered the economy and the behavioral decisions that dictate economic activity.

But look at that chart again…

T-R-O-U-B-L-E

Despite recent gains, labor force participation remains near its nadir. In fact, we are at the bottom of a trend that started 20 years ago.

There are many reasons that the numbers have fallen.

Women and men have left the workforce to raise children. For many, it’s cheaper not to work than to pay somebody to watch their kids. But there is also an ever-generous safety net to blame… as well as higher incarceration rates… and automation.

It’s no coincidence that the decline in labor force participation lines up with a rare period in the United States – one when there was virtually no inflation.

So what comes next? Will the current trend continue to pull rates lower, or is a turnaround inevitable?

The answer to those questions determines our rate of inflation.

A fascinating study out of the Russian Academy of Sciences looked at the correlation between inflation and the labor force in America. It found a clear and direct tie.

In fact, it was one of the most significant associations within inflation-forecasting models.

But here’s the thing. It shows a two-year lag between a change in labor force participation and inflation.

That doesn’t bode well for prices… or the headlines that declare inflation dead.

If a sudden rise in the amount of folks in the workforce (which is the most likely scenario) combines with some $4 trillion in freshly printed money and massive amounts of dirt cheap debt… it’ll be like somebody tossed a match into a sea of gasoline.

That means the Fed is right to be penciling in some changes in 2023. But if this research holds true, the scale of the Fed’s efforts may be far short of what is needed.

Inflation is not dead.

Not at all.

In fact, history tells us it hasn’t even started to pass.

It will be the topic of an “all hands” live discussion we’ll have with our paid subscribers on Thursday afternoon.

We’re inviting all members to join us on Zoom for a robust discussion of inflation and what to do about it. If you’re a subscriber to any of our paid services… look for an invitation in your email inbox.

If you’re not a subscriber… now’s a good time to become one. And just for today, you can get in on our most popular letter at our very best price. Click here for details.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.