Monday Takeaways: Going Nuclear

Shah Gilani|September 30, 2024

Nuclear’s back, baby.

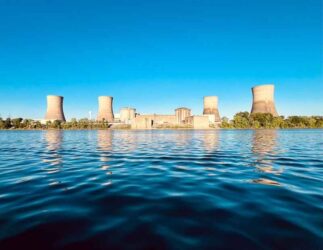

News that Microsoft (MSFT) is planning to buy up all the output from the soon-to-be resurrected Three Mile Island nuclear plant in Middletown, Pennsylvania, says it all.

Microsoft is going all in to power its AI demands… which follows a move by Amazon to purchase a data center site right next to another nuclear plant in Pennsylvania.

Watch uranium prices… and get ready to buy.

But that’s not the only takeaway for the week…

Big news from China has sent certain stocks and sectors soaring. I explain what’s going on… and where you should look to put your dollars… in today’s video.

Click on the thumbnail below to watch.

Transcript

Hey, everybody. Shah Gilani here with your Monday Takeaways.

First takeaway is what we take away from what happened last week. S&P 500… new record high. Dow Jones Industrial Average… new record high.

But they were bested.

Having risen 0.6% on the week, those two indexes were bested by the Nasdaq Composite, which was up 1% on the week. Not a new high yet, but bull market territory.

So what really happened? What caused all that great stuff?

Well, we know that the Fed cut half a point. We know that the ECB is cutting. We know now that China is going to do an awful lot to stimulate its economy. And so we got more money flowing to the system, and investors are aggressively buying stocks.

Here’s the takeaway from one thing that happened last week.

Microsoft is going to buy all the output from Three Mile Island once Constellation Energy gets it back up and running, which is going to take billions of dollars.

The takeaway from that, people, is nuclear is back. So start looking for nuclear plays in the market because nuclear is back. And we know that solar and wind are not going to quite cut it soon enough to help the green movement.

So we’re going back to nuclear.

Resurrecting Three Mile Island, that says it all.

Takeaway from there? Yes. Go look at nuclear stocks, nuclear options. So, yes, great week last week.

But despite new highs for the Dow and the S&P and the Nasdaq Composite going being up 1% on the week, the big gainer on the week was the materials sector. XLB, the SPDR XLB materials ETF, was up 3% on the week. That was the big winner domestically, more so than technology, more so than consumer discretion.

By far, it was materials. Why? Again, China. Because what are they doing? They are, first of all, cutting mortgage rates by half of a percent.

They cut their short-term interbank lending rate by point two percentage points, and they are telling institutions to buy stocks to support the stock market.

So who is the real big winner last week?

FXI.

Chinese stocks. The FXI, the large cap ETF, was 21% last week.

The takeaway from there is, yeah, go look for bargains in the Chinese market, but it’s going to be tough to not have to chase such tremendous outperformance.

Twenty-one percent in a week on a large cap index.

Wow. I’m loathe to chase that, but at some point, you’re going to want to get back into Chinese stocks, but you have to do it diligently.

So I like the material sector. I like the mining sector, and that’s maybe a way to play Chinese stocks. But, yeah, I think there are some plays out there worth playing in China as far as whether it’s a Baidu or Alibaba, or JD, but use stops, people, because as crazy as the move was last week, things could come back down and perhaps quickly because that’s an awful big tanker, meaning the Chinese economy, to try and turn around on a dime. Good luck with that. But there’s a central government telling institutions to buy stocks.

That’s why you had the tremendous rally in Chinese stocks. Says it all right there. So, yeah, that’s a little front loading.

But listen….

You have to go where the opportunities are. So next up, what’s happening this week? Well, we got BLS numbers on Tuesday. We got jobs reports. We also have unemployment.

We got all kinds of stuff that is really important because it’s about the labor market if you’re paying attention to what the Federal Reserve is saying.

So Tuesday, we got BLS, Bureau of Labor Statistics. We got job openings numbers and labor turnover survey.

Okay? The expectation is for there to be 7.7 million job openings. So keep an eye on that number. If there are fewer job openings on that, that’s bullish for the economy that it’s doing better than expected, and there’s a lot of hiring going on.

If there are a lot more job openings, then that’s going to push Fed fund futures to expect a further cut, perhaps a 50 basis point cut at the next meeting. So depending on those numbers and, again, these numbers are all more important now because the Fed’s dual mandate is in focus.

These are all the takeaways from two weeks ago, but that’s what’s important now. Labor market.

Also on Tuesday, we get ISM. We get the ISM manufacturing index. The expectation there is for 47.7. That will be about a half a point or so better than August. We’ll see where the number comes in and how the market reacts.

On Thursday, we get ISM services. That number is supposed to be unchanged September from July, coming in at 51.5.

Now keep an eye, I say, even more so on services because that’s where inflation has been stickiest. If services numbers are a blowout higher, that means that there’s more upward pressure on wages and stickiness in terms of services, and that’s not a good thing for the Fed to want to have to cut in the face of higher prices in the service sector.

So, again, a lot of stuff to look at this week. Plenty of important stuff.

Friday is probably the biggest day because that’s the jobs report for September. The forecast is for a gain of 145,000 workers. The unemployment rate is supposed to remain the same at 4.2%.

So keep an eye on those numbers. Will the market be bullish or bearish? This is like game theory. It’s trying to figure out what the market’s going to do based on whether the numbers are good or bad. Are they going to react to bad numbers in a good way? They’re going to react to good numbers in a bad way. This gets a bit fun, but we’ve been here before.

Here’s last thing I want to say about the labor market, the Fed, and interest rates. The Fed is looking for signs that the labor market is weakening. It doesn’t seem that way if we get 145,000 new jobs created and payrolls increase by 145,000 jobs on Friday. That sounds pretty good, but the average monthly gain in employment, the number of jobs gained for the first five months of 2024, was 225,000 per month.

For the last three months, that average has dropped to 116,333. That’s a big dropoff. So 145k is above the last three month average of 116k.

The Fed’s going to be watching that, and you should be too.

Those are your takeaways for this week. Be careful out there.

Go take a look at some Chinese stocks. Don’t chase them. Definitely take a look at some materials, some of the miners, and you want to go look for some cheap Chinese stocks if you can find any.

Catch you guys next week. Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.