Dealmaker’s Diary: This Market Leader Stuns With an 89% CROCI

Alpesh Patel|August 7, 2025

In 30 years of analyzing stocks, I’ve never seen a cash return on capital this high.

This market leader’s 89% CROCI doesn’t just beat the market – it rewrites what’s possible when a company becomes a true cash-generating machine.

Think about it… for every $100 this company invests, it generates $89 in cash returns.

Most companies struggle to hit 10% or 15%. The Goldman Sachs top quartile averages 30%. This market leader just delivered 89%.

It’s not an accounting trick. It’s not financial engineering. It’s pure operational excellence.

The efficiency is unprecedented. The cash flow is staggering. The competitive advantage is undeniable.

Click on the image below to discover which company turned capital allocation into an art form.

Transcript

Hi everyone. It’s time for Stock of the Week for the Dealmaker’s Diary.

Why would I pick a stock you’ve all heard of? Well, because sometimes even with the best companies, there’s a degree of doubt that creeps into people’s minds, and I want to put them at ease.

But also, some of the companies that are staring you in the face can be very good ones to learn from regarding our processes and the way we do things.

It’s Nvidia (NVDA). Come on – we’ve all heard of it.

But do you really know the company? I think it’s worth a deeper dive.

There have been concerns about China being able to do everything Nvidia can do at a cheaper cost base, and all sorts of political machinations about exporting to China and whether that could impact the company.

There’s also talk about whether the revenues are really that great and if they’re being booked too early – which is a common complaint even with Apple or Microsoft.

So let’s dive deeper into Nvidia.

Obviously, it’s the company you all know, but it is now worth over $4 trillion. Who would have thought five years ago, six years ago, 10 years ago that the first company to cross $4 trillion would be Nvidia?

We wouldn’t even have thought about $1 trillion for any company back then. Now we’re getting to $4 trillion.

Which company will be the first one to hit $10 trillion?

Probably not a company that’s on anybody’s radar at the moment. We first came across Nvidia as a serious contender back in 2023 after its graphics cards were being used to mine cryptocurrencies. Now those same graphics cards are being used for AI.

But that’s not why we picked it in January 2023.

It’s because it ticked several boxes – the key boxes being value, growth, and income. It was generating lots of revenues and earnings, and the reasons why it was doing so are less relevant than the fact that it was doing it.

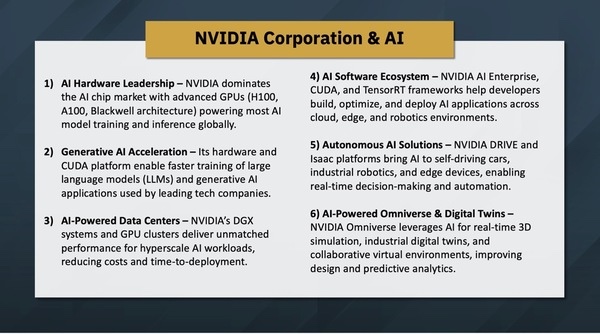

So let’s look, as I always say, at the AI aspects – a great way to learn.

This is cutting edge. This is the best of what America has to offer the world, and you can see the areas in which it’s operating. I won’t read everything out to you, and you would expect it in terms of chips – of course, it’s a global leader.

But did you know it’s also involved in all of these other areas as well? It is not a one-trick pony. And of course, it uses AI in the company itself, as well as what its chips can do for everybody else’s company.

And that’s an important point. It uses AI in data centers and as a business solution internally. In fact, you’d expect it to be one of the most advanced AI companies – not in the sense of what it produces for everybody else, but how it runs its own business. In other words, it has an innate advantage in AI adoption.

Unlike your company or mine, which might be catching up, learning what others are doing, hiring consultants, and the like, this company is inherently an artificial intelligence company both externally and internally. I think that’s an important factor when we think about corporate efficiency, profitability, and productivity – all those factors that lead to fat profit margins and ever-increasing revenues.

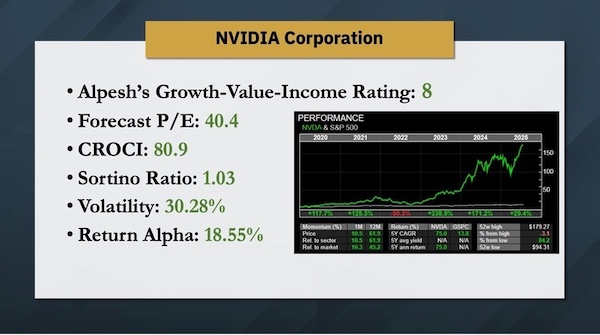

So where does it stand despite all of that growth? Year-over-year revenue growth, earnings growth – on our GVI rating, it’s an 8. Now, anything above a 7, including a 7, meets our minimum criteria, but that’s extraordinary.

It’s extraordinary for a company to have risen this much and still have outstanding valuation relative to its profitability, stock price, year-over-year revenue growth, and dividend yields as well. And then you look at forecast price-to-earnings… you’re only paying – for such a leading company – $40 for every forecasted dollar of profits.

Now that might be because people are just catching up to the thought that you could make so much profit in any company, and they just can’t keep up with the pace at which it’s doing it. Therefore, they’re not willing to pay fair value for it. They just find it incredible. Imagine a rental property where somebody says you’ll earn $1 for every $40 you pay. You might say, “Well, seems a bit pricey,” and I think that’s the sort of cap that’s being put on it. It’s just that we’ve never seen anything like this level of growth.

Cash return on capital invested – the highest I’ve ever seen. This is the record: 89%.

That’s the Goldman Sachs Wealth Management measure. 89%. I’ve never seen anything like it. The amount of cash this company is generating on the capital it invests – it literally has a money-printing press. That cash cow, that machine, churns out cash based on the capital they’ve invested in that money-making machine.

That’s what it is. That’s what all companies are – they’re factories for making money. A Sortino ratio above 1 is incredibly rare for a company to have. If you go through 10,000 stocks, I doubt there are even 100 with a Sortino ratio above one that are also billion-dollar companies. What does that mean? High average returns, low downside volatility.

Now you might say, “Hang on. The volatility overall is 30%. That is high.” But the downside volatility is low. Upside volatility is high. In other words, it tends to go up rather than down, and it smashes the market in terms of performance.

So direction – you can see the long-term trend there. You got in quite early. We first came across it in January 2023. Well, there were a lot of stocks doing what it’s doing beforehand.

Actually, the whole blockchain thing happened in 2021, before 2022, and we had to get out because of this major bear market where the MACD drops. So actually, the blockchain element was there, but the AI part was 2023 – that’s what really led it to accelerate.

Now it is overbought. Of course it is. Can it keep going? That’s really the question with the S&P 500 as well. Can this keep going upward?

It certainly looks like it, and if it can, it’ll drag the S&P 500 higher. If you invest in other companies in the S&P 500 that can’t keep up with, say, Nvidia – which is a major component of the S&P 500 – then you will underperform the index.

Most people were too scared to have a concentrated position in one stock like Nvidia. If you think about it, the S&P 500 is actually a concentrated portfolio in seven stocks. Most people would not directly have those proportions of those stocks, which is why most people underperform the S&P 500.

They think by having the index, they’re well diversified. In actual fact, they’re highly concentrated, but they just put it through a veil of ignorance, and they don’t realize it. And that’s why they underperform that index.

So where are we on a discounted cash flow? Of course, on a discounted cash flow – which is not the most reliable valuation metric – it’s overvalued. But I would say it’s been like this for years.

So that doesn’t worry me too much. Hope you found that insightful and useful regarding something we’re familiar with, but perhaps didn’t know as well as we ought to know the company. Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.