The Biden Surprise: The Best Stock in the S&P

Andy Snyder|April 4, 2022

There’s still hope for America… maybe.

We had dinner with our state senator the other night. She’s one of the good ones.

We talked about cutting regulations… fighting irresponsible spending… and, dare we say it, saving today’s surplus for tomorrow.

“What’s crazy,” she said, “is we got rid of so many regulations during the pandemic and now they want to bring them back. Things have worked fine for two years without them. It’s obvious we don’t need them.”

Like we said, there’s hope. There’s a good chance we dined with the future governor.

You know we don’t get political in these pages, but we’ve long said the biggest threat to today’s investor isn’t off-the-wall valuations, a recession or any natural market force.

The biggest threat… is those elected folks who are convinced they are our saviors.

Just look at the news.

Good Money After Bad

Right on cue, the insane folks who run the asylum in Chicago are printing up 50,000 pre-loaded gas cards to hand to lucky citizens. They’re each worth $150 and will be divvied out via a lottery system.

We’re not sure… but we reckon the more times a fella voted in the last election, the more lottery entries he’ll get.

If you want hyperinflation, this is the kind of thing that will bring it about.

Spending more money to patch over the problems created by previous spending is the sort of move that precedes every inflationary disaster.

For investors, there’s opportunity in the “idiocracy.”

Occidental Petroleum (OXY) has been the best-performing stock in the S&P 500 so far this year.

Shares started 2022 priced at just $31 each. They recently hit highs of $63 each – a jump of more than 100%.

Government-loving Halliburton (HAL) has been the second-best performer – up 70%.

Of course, investors sitting on these highs would be wise to consider cashing in some of their gains.

Washington is closing in.

Profits Are Unfair

Rich with cash from surging oil prices, Occidental announced a whopping $3 billion share buyback program. But the president doesn’t like such things. He just proposed a plan that would slow some of the most aggressive buybacks.

More acute, of course, is Washington’s meddling in the crude market.

Putin, they say (overlooking the $5 trillion in freshly printed money), has raised our gas prices.

We must do something.

Elections are coming.

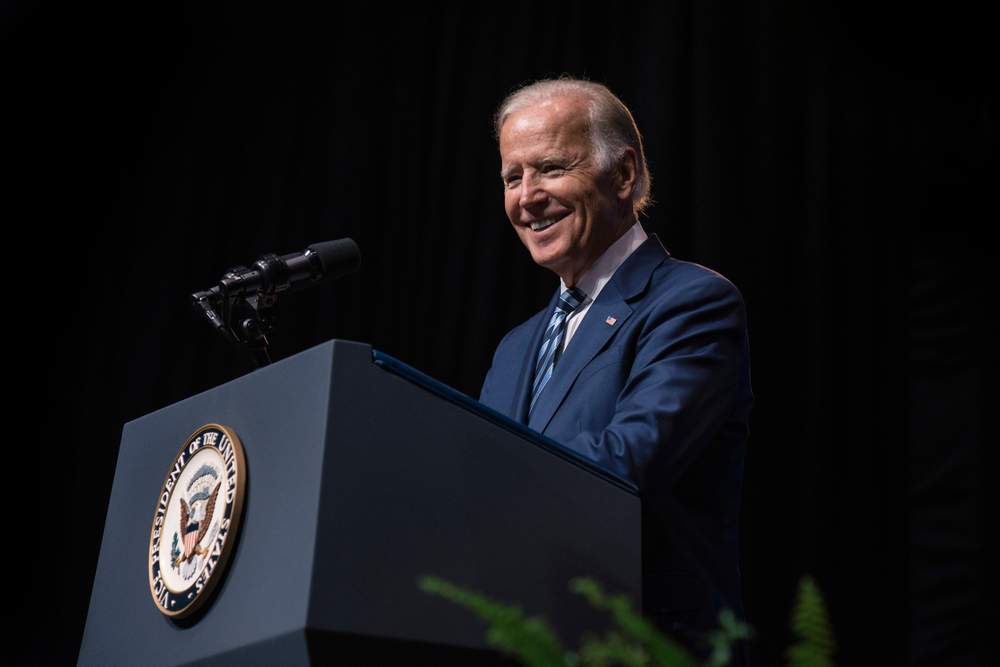

Chicago, of course, has resorted to bribes. But Biden is a big thinker. He’s got to keep an entire nation of voters reaching into his pockets.

“Companies have an obligation that goes beyond just the shareholders – to their customers, their communities and their country,” the president said last week. “No American company should take advantage of a pandemic or Vladimir Putin to enrich themselves at the expense of American families.”

We didn’t hear those lines uttered in person… but we’re told he said them with a straight face. But the folks from Pfizer, Merck & Co., and Lockheed Martin looked at their feet and bit their lips.

The latter has had quite a good start to the year thanks to Putin.

Opening the Spigot

Biden, of course, said those words just as he put his hand on the nation’s massive strategic oil reserves.

“Let ‘er loose, boys,” he implied as he gave the nod to send a million barrels rushing into the market each day.

In a petrodollar world, it’s the equivalent of firing up the printing press. It’s not cash we’re flooding the market with… it’s artificially cheap oil.

Once again, the free market has the dusty prints of a big boot on its neck.

Just as demand was starting to slow due to natural forces… and inflationary pressures were starting to let up on their own… Washington quietly broke its promise to do what’s best for the people it represents.

Polls and elections are more important.

And so it goes.

It’s more proof that it pays just as much to know what’s happening in Washington as what’s happening on Wall Street.

It’s not supposed to be this way. The government should merely be a shadow lurking in the background.

There’s hope it will change.

But until it does, more folks must see it for what it truly is.

It’s not the economy so many of the folks in government are concerned about… it’s the next election.

And elections are expensive.

Note: As we’re sure you’ve heard, we went live with one of the world’s most famous political commentators last week. What we revealed has nothing to do with politics… and everything to do with an incredible new market opportunity. Watch the interview and get my free pick here.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.