Why Palantir Is Right to Buy Gold Now

Amanda Heckman|August 21, 2021

This week, gold “celebrated” an infamous anniversary… It was 50 years ago that then-President Nixon cut all ties between the dollar and gold. Without that link, gold took a back seat to the “almighty” dollar.

As analysts, historians and economists dissect that crucial decision from many years ago, one Manward reader wrote in to ask…

I still feel gold is good… Am I wrong?

Not at all.

Golden Armor

Our Modern Asset Portfolio calls for a 10% stake in physical gold. While we expect gold’s value to rise and don’t want to hold anything that will cost us wealth, we hold gold not for today… but for tomorrow. It’s a store of value and safety for when things head south.

It’s our protection from inflation and a declining dollar.

Gold is the ultimate insurance policy in case something goes horribly wrong.

And with negative real rates… we stand to get paid by the shiny metal’s appreciation in value as we wait for fate to play out.

The data-mining and analytics giant Palantir Technologies agrees. Its newly disclosed position echoes Manward’s strategy for owning gold…

This week, we learned that the company spent $50.7 million on 100-ounce gold bars as part of a strategy to prepare for a future that will include a rising number of black swan events… devastating crises that no one sees coming – like the pandemic.

Now, some folks will be quick to say that Bitcoin is better than gold. Jim Cramer, for one. And last week, as Bitcoin surged, Mike McGlone, a Bloomberg analyst, agreed. They see Bitcoin replacing gold as protection against inflation and a declining dollar.

But here’s why they’re wrong…

Opposites Attract

Bitcoin and gold are completely different assets.

They should not be looked at as competitors for space in your portfolio. They are on opposite ends of the risk spectrum.

While the future may be different, right now, Bitcoin and other cryptos should play an important role in building your wealth. Gold’s role, on the other hand, is to protect it.

Again, gold’s your insurance policy for when things go to hell.

It would be foolish to cash of that policy just because crypto has helped your portfolio look better than ever.

It’d be like selling gold because you own a breakout penny stock.

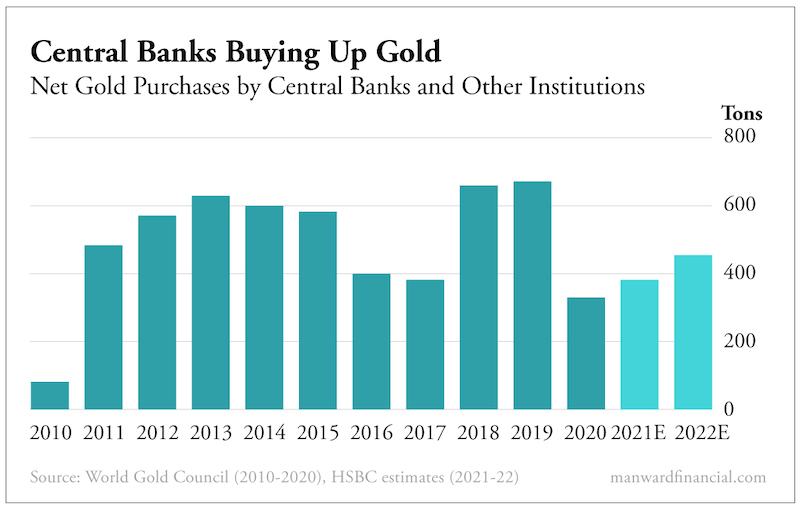

And consider this… In 2021, the coronavirus and inflation threats have central banks increasing their own gold reserves, and those purchases are expected to continue into 2022.

That’s led Goldman Sachs analysts, including Sabine Schels and Daniel Sharp, to forecast that gold prices will hit $2,000 toward the end of the year.

So now – just like yesterday and tomorrow – is a good time to add some golden insurance to your portfolio.

And you don’t have to stock up on gold bars like Palantir did. There’s a new way to own gold that you may not know about. It’s an ingenious way to actually use gold to buy everyday items. All the details are here.

Amanda Heckman

Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years – give or take a few sabbaticals – sharpening Andy’s already razorlike wit. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus and – lucky for us – the fine folks at Manward Press.