Buy This, Not That: Revenue vs. Hype in Rare Earth Stocks

Shah Gilani|October 29, 2025

The rare earth sector just went through a wild ride.

Government interest sent these stocks soaring 250%… then reality hit hard.

Now they’re down 40% from their highs, and investors are asking which ones are worth buying on the dip.

Here’s the thing most people missed: One company has a $652 million market cap but zero revenue. Meanwhile, its smaller competitor actually makes money – $30.5 million in sales with 29% profit margins.

In today’s Buy This, Not That, I reveal why market cap doesn’t tell the whole story and show you which rare earth stock deserves your attention.

Click on the thumbnail below to dive in.

Transcript

Hey, everybody. Shah Gilani here with your weekly BTNT, as in Buy This, Not That.

Now, if you haven’t noticed, a lot of the high-flying rare earth companies that the government may invest in, has invested in, may not put much more money in, may take equity stakes in, or may offer debt financing to – a bunch of them have gone up.

In fact, they’ve all gone up… but they’ve all come down to0. So I’m going to single out two of them today. I’m going to tell you which one is a buy and which one isn’t.

So the two I’m going to pick – and I’m going to show you graphically which one first – we’re going to pull up NB, which is Niovorp Development.

Here’s the chart for Niocorp Development.

They probably wish they hadn’t changed it to Niocorp because back in 2013, they were known as Quantum Rare Earth Developments Corp. Frankly, I like Quantum Rare Earth Developments because I think that would draw a lot more attention.

But anyway, this stock was trading down around here, probably around $3 to $3.50 a share. Then it gets up to $10, $13, $25 up here.

The stock makes a spectacular move on the intraday high and is up 254%. And then it dives, and here we are today – which a lot of these stocks have done since those highs were around the same time. The stock is now down about 40% from its highs.

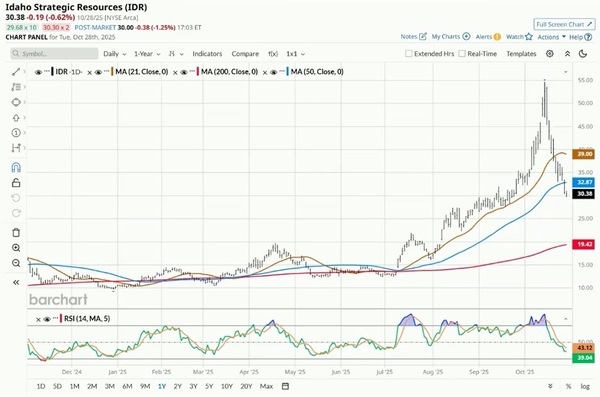

Now, I’m going to compare Niocorp to Idaho Strategic Resources Inc. (IDR). And the first thing you’re going to notice is the chart looks really similar.

IDR has a similar story – kind of doing a whole lot of nothing until all this interest in rare earths comes about. IDR was hanging around $16, just kind of floating around here, trying to find a home somewhere. Then all of a sudden, everybody catches some drift that the government’s interested, rare earths are hot, and there we go – off to the races.

This stock, similar to NB, rose 240%. NB was a little higher at 254% off of its lows. From its average $3.55 here, versus about $16 for this stock, IDR rose 240%. It’s down 44%, and NB is down 40%.

But again, look at these charts – there’s something similar. There’s something similar to all the charts, whether it’s Critical Metals (CRML), whether it’s USA Rare Earth (USAR), MP Materials (MP) – same story.

But I’m just pulling out these two: Idaho Strategic Resources and the formerly known as Quantum Rare Earth Developments, now known as Niocorp. One versus the other – which is a buy, which is not?

I’ll tell you why I think IDR is a buy.

I’m going to start with – okay, to get a little bit of a heads up – Niocorp actually has gotten some money from the government. The U.S. formally designated three of its materials as among the critical for U.S. national economic security. The U.S. Department of Defense awarded up to a $10 million contract via Title III of the Defense Production Act for one of its Elk Creek resources business to support establishing a domestic mine-to-manufacture supply chain.

But that doesn’t say a whole lot just because you get a little bit of money.

Niocorp is a $652 million market cap company. It has zero revenue – so it’s not making any money because it has no revenues. No profit margin, no nothing. Yeah, it’s got some cash in the bank – $25 million. Doesn’t have a lot of debt – $131,000. That’s a pretty good picture.

Shares outstanding – and this is where the numbers matter – shares outstanding: 112 million. Floating shares: 75 million. That’s quite a haircut off of the shares outstanding.

Now the short of float: 10.36%. Only 2.81% is held by insiders. So a lot of the stuff is in the treasury. The stock is not trading because, again, outstanding shares are 112 million. The float is 75.28 million. So yeah, not a lot going on there. And short interest is 10.36%. So when you see something like this, you see that short interest gets bought up as the shorts have to cover on good news.

IDR is a much better positioned company because it actually has revenue. IDR is similar in terms of size – a $503 million market cap versus NB’s $652 million. So we’re talking pretty much small-cap stuff here.

Revenue here: $30.5 million. Yeah, they actually have revenue. The profit margin: 29%. Yeah, they actually make money and have a positive profit margin.

And here’s what’s more interesting. Shares outstanding: only 15 million. Float: only 13 million. Tiny. Short of float: 14.36%. So that’s a pretty big short of float number, which means you’re going to get spikes like this.

So when it comes to Idaho Strategic Resources or Neo Corp, I’m going to go with Idaho Strategic Resources. It’s got a better short float position, which means it can pop more, and it actually makes some money. It actually has revenue and a profit margin.

So when it comes to Buy This, Not That, I would buy for a rebound Idaho Strategic Resources and Niocorp Development.

That’s it for today. Catch you guys next week.

Cheers.

Shah Gilani

Shah Gilani is the Chief Investment Strategist of Manward Press. Shah is a sought-after market commentator… a former hedge fund manager… and a veteran of the Chicago Board of Options Exchange. He ran the futures and options division at the largest retail bank in Britain… and called the implosion of U.S. financial markets (AND the mega bull run that followed). Now at the helm of Manward, Shah is focused tightly on one goal: To do his part to make subscribers wealthier, happier and more free.