Dealmaker’s Diary: Why This $200B Company Will Become the “Oracle” of AI

Alpesh Patel|September 25, 2025

I’ve been crisscrossing Europe for our fund launch – Zurich, Geneva, private banks, family offices.

One name keeps surfacing in every conversation. Not the flashy AI darling dominating headlines, but the company doing the essential work nobody sees.

While investors chase AI chipmakers and chatbot companies, this $200 billion enterprise powerhouse is building the actual backbone that makes AI work in real businesses.

Here’s what clicked for me: This is going to be another Oracle. The company doing the nuts and bolts of the AI revolution while everyone else fights for attention.

The proof is in the numbers:

- 30% cash return on invested capital (top quartile globally)

- $1.66 billion in current net income

- Positioned for 10x growth as AI adoption explodes

Think about it. Every AI implementation needs workflow automation. Every smart business decision requires intelligent data processing. Every enterprise AI deployment demands rock-solid security and compliance.

That’s exactly what this company provides. Not the sexy stuff that gets media coverage, but the mission-critical infrastructure that actually makes money.

Goldman Sachs research confirms companies in the top quartile for cash returns deliver exceptional stock performance. This one checks that box and more.

My projection? $200 billion market cap today, trillion-dollar company within five years.

Click on the image below for the name and ticker.

Transcript

Hi, friends, and welcome to another Dealmaker’s Diary and the Stock of the Week.

Now, I get a lot of data crossing my desk – as you can imagine since I’m a hedge fund manager – but I’ve also been out in Europe for a fund launch out of Zurich and Geneva.

So I’m meeting a lot of private offices, private banks.

![]()

And there’s a name which comes up now and again. It’s one which has been on my radar for a long time. It’s one which I’ve wanted to talk about for a long time, but there’s only so many hours in the day… ServiceNow (NOW).

Now I’ll tell you what I like about this company, and I’ve liked for a long time. It’s not just that it’s cutting edge and at the edge of AI. I think it’s going to be another Oracle. It’s going to be one of those where it’s doing the nuts and bolts of the AI revolution.

It has net income in the past month of only $1.66 billion. I think that’s going to go up tenfold in less than the next decade.

It’s got a market cap of $200 billion. This is going to be a trillion-dollar company probably in five years.

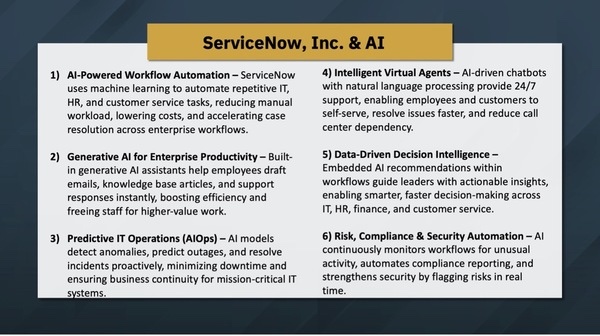

So let’s break that down, where it’s coming from. Now in terms of what it’s doing in AI, as you know each week, I like to give you that invaluable education, not just the stock pick, the stock idea.

AI-powered workflow automation – I cannot tell you how critically important this is for people from asset management companies like myself in terms of ensuring that we’re more efficient. We’re saving time so that management can focus on decision making and not on ridiculous tasks.

Generative AI for enterprise productivity – again, that goes right across productivity from making employees more efficient to making the company more profitable.

Intelligent virtual agents – you’ve heard about it. It goes without saying. Data-driven decision intelligence and metadata recommendations within workflows, actionable insights, smarter decision making – all of these things are important.

Risk compliance and security automation as well.

Seven on my value growth income criteria. Now anything which is seven, eight, nine, or 10 meets my criteria. This meets my criteria. Forecast P/E ratio – you’re paying $57 for every future dollar of profit. It’s expensive because it is expected to grow sharply.

Cash return on capital invested: 30.4%. Pretty much anything above 10%, but you’re in the top 25% of all companies. And Goldman Sachs Wealth Management Research shows that companies in the top quartile are going to be exceptionally good performers in terms of stock price returns.

Sortino – average return versus downside volatility – incredibly high, 0.69, which is very good for a stock. Volatility low, well below 20%.

So it’s got everything going for it.

I’ve done a projection based on recent trends.

I’m sticking by momentum downward pressure for the moment. You can see that over here. Despite that, it will pick up.

That’s the direction. Now could it drop to hit? Yes. Of course it could. We’ve seen drawdowns in the past, but we’ve seen rebounds up.

It is the kind of company you feel comfortable buying the dip. On a discount cash flow, well valued – that happens with high-growth, high-return companies.

Hope you like that.

Thank you very much.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.