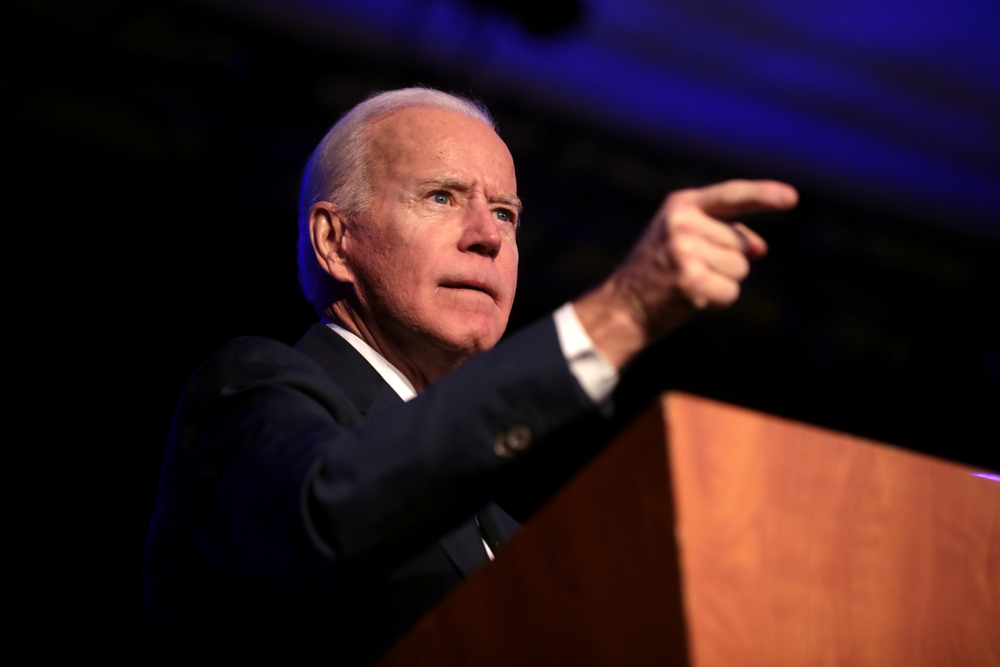

The Sinister Detail in Biden’s Tax Plan

Andy Snyder|May 6, 2021

Oh, Janet… our old love.

Ms. Yellen has gotten herself into a bit of a mess once again. Ever eager to do the right thing and raise interest rates, her mere half-cocked mention of the idea on Tuesday sent markets into a tizzy.

She said we might have to raise rates if the president dumps another $4 trillion into the economy.

The markets heard it differently, though. They heard rates are on the rise.

Stocks sold off.

Within hours of going off the script, the old Fed chief was dragged back onto the stage to read from a new one.

“I don’t think there’s going to be an inflationary problem, but if there is, the Fed can be counted on to address it,” she said in a mea culpa.

Whew…

Just like that, the standing world disorder was back in place.

Devastating News

But there’s something else Ms. Yellen, now the Treasury Secretary, is spouting these days. It has much more to do with her current role – one she hasn’t quite seemed to be able to define yet.

She’s talking about taxes… and how they desperately need to rise.

Not enough folks are paying their fair share, she said this week.

A “shocking” $7 trillion worth of taxes are going uncollected.

It’s a huge figure. But there’s more to the story… much more. By our take on things, the headline has all the believability of Chinese propaganda.

To start, that $7 trillion isn’t really $7 trillion.

No. In typical Washington fashion, it multiplies its disheartening numbers by many years in order to make a “shocking” sound bite. In this case, the tax gap Yellen is gumming about is over the span of a decade. It’s more like $700 billion each year.

That’s a lot, to be sure. But it’s a mere 18% of the fed’s estimated total tax take in 2021.

But 18% isn’t the “shock and awe” figure the government needs to pass massive tax reform. It’s not nearly big enough for the watchers of The View to put down their Diet Cokes and care about what happens next.

If they knew the government was about to take massive steps to eliminate privacy in order to plug an 18% gap, they might get a bit concerned. They might even get a bit angry.

But $7 trillion? Well, that’s an emergency. That’s enough to put little Jimmy and his pals through school. If Uncle Sam had that much money, we could all cash in our college funds and go on a cruise.

With the nod of Whoopi, Meghan and Joy… the nation would be okay with what Yellen and her crew want to do next.

And so the headline writers push and prod the facts and figures. They multiply by 10 and bury the lead.

Let’s get that $7 trillion, the nation chants. Rip it from their greedy, rich hands.

Privacy Destroyed

But then some middle-aged bald fella comes and kicks some sleepy shins. Wake up, he says, it’s all a ruse.

You probably didn’t catch it – the media was too busy touting all the freebies the president pitched – but the American Families Plan that Biden announced last week had a very sinister aspect to it.

Privacy wonks should freak.

It’s why Yellen is out in front of the news this week, acting as if she’s just now learning that millions of Americans take advantage of the thousands of loopholes buried in the tax code.

If she really is “shocked” by the news, perhaps she’s not the right person for the job.

But we know a well-orchestrated act when we see one. And this is one of the best.

It should be. What’s been proposed will have ramifications for generations.

Get this… the president and his troops want to force banks to report “aggregate account outflows and inflows.”

It’s a way to ensure we’re all paying what we’re supposed to be paying.

That’s huge.

It means your bank won’t send the IRS just a 1099 detailing the interest you earned in a year. Oh no… it will send details on everything that goes in and out of your account.

Uncle Sam will know what is in your account, how much you spent and how much you transferred here and there.

If Uncle Sam doesn’t like what he sees, the suits will come knocking.

Give a graduation gift to your grandson… you’d better hope you reported it the right way.

Help a child out with a down payment on a home? Sure, it’s your money… but you’re allowed to gift only so much of it in a lifetime.

Deposit cash from the sale of an old boat… you’d better hope the numbers match up.

It’s no wonder Biden wants to “invest” $80 billion into the IRS and its audit army. He knows that for every buck he puts into the tax machine, it will pull $10 into the government’s coffers.

It’s the next best thing to printing money.

The future is clear.

Washington is broke. It has gotten itself into a pickle. It can’t slow spending. It won’t cut back. And it’s going to have a heck of a time passing any of the recently proposed tax hikes.

But it will find a way to get its money.

Whether it does it by slashing your privacy or taking the cash right out of your paycheck… taxes are on the rise.

Don’t worry, though… most folks will likely never even hear about any of it.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.