Before They Were Giants: How to Spot the Next Infrastructure Breakouts

Robert Ross|September 8, 2025

One hundred and fifty years ago, railroads were everything.

They didn’t just move people and goods… they transformed the economy.

They were the arteries of commerce, the backbone of industry, and the connective tissue of the entire nation.

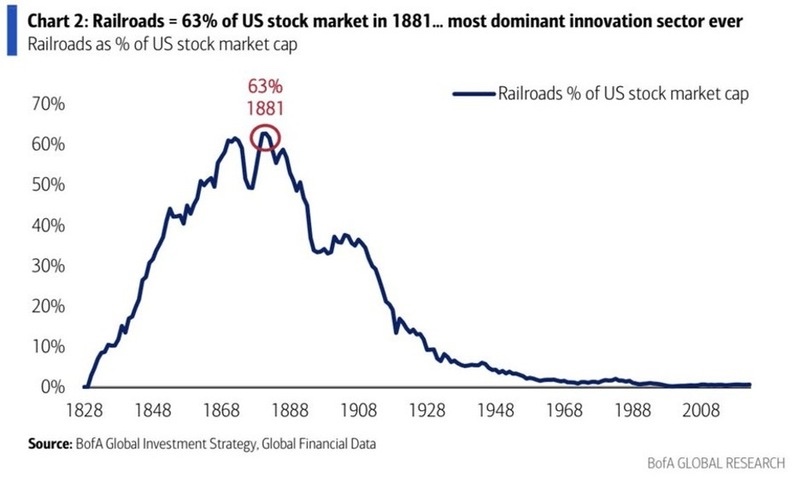

At their peak in 1881, railroads made up 63% of the entire U.S. stock market.

Let that sink in for a moment.

Nearly two-thirds of all U.S. equity value was tied to one industry.

Investors back then didn’t talk about “railroad stocks.” They just talked about the market.

Because railroads were the market.

But eventually, the railroads matured. They became stable, dividend-paying companies – utilities, not growth engines. The next wave of innovation – oil, automobiles, electricity – took the baton.

And that’s how innovation always works.

One technology dominates. Then it gets commoditized. And something new comes along to capture the world’s imagination – and capital.

The Railroads of Today

Fast-forward to 2025, and the new “railroads” are here.

They don’t lay down steel tracks or run locomotives. Instead, they build the digital and financial infrastructure powering the modern economy:

- AI infrastructure: chips, data centers, and software platforms processing the explosion of artificial intelligence applications.

- Semiconductors: the “picks and shovels” of every tech boom, powering everything from iPhones to self-driving cars and ChatGPT.

- Blockchain rails: the decentralized networks enabling digital payments, stablecoins, decentralized finance, and tokenized real-world assets.

Just like railroads in the 1800s, these technologies aren’t the flashy consumer apps people see on their phones. They’re the foundational layers. The backbone. The things everything else gets built on top of.

The Small Cap Opportunity

Here’s where things get interesting for us as investors…

Many of the companies building these new “rails” are still small caps.

They’re not the Nvidias (NVDA) or Microsofts (MSFT) of the world (though we like those too). They’re the next generation of growth companies quietly laying the tracks for the future economy.

Some will fail. That’s the nature of innovation.

But others? They will compound for decades… just like the railroads, oil giants, and early internet companies did.

And because they’re small caps, the upside can be extraordinary if you get in before Wall Street wakes up.

Why Now Is the Time

Two reasons I’m pounding the table on this theme right now…

First, we have the stimulus wave. We’ve talked about this for months: tax cuts, rate cuts, Treasury buybacks, and regulatory easing are creating a tailwind for risk assets we haven’t seen in years.

When liquidity floods the system, growth stocks tend to rip higher – and small caps even more so.

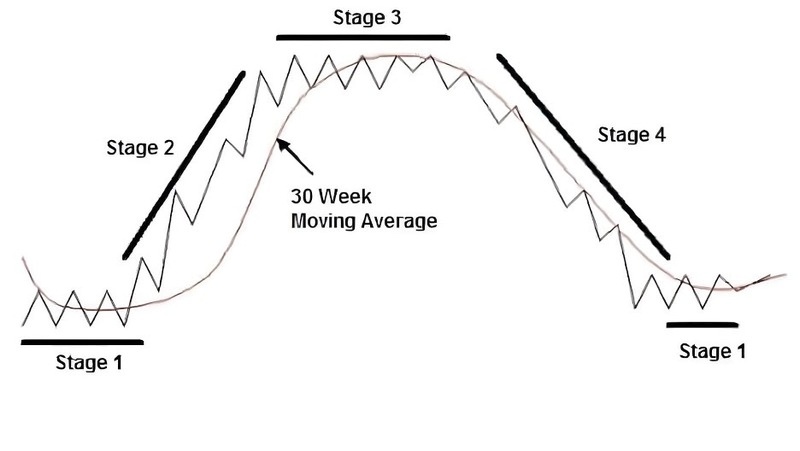

Second, we have the “profitability inflection” or as I call it, “the breakout.” This is the point when companies flip from unprofitable to profitable.

History shows this is when institutions pile in, valuations go higher, and multiyear uptrends begin.

Here’s How to Play It

I’m looking for names in AI infrastructure, semiconductors, and blockchain rails that fit our criteria…

- Stage 2 technical uptrends

- Positive earnings momentum

- Reasonable valuations (for growth stocks)

- Exposure to these “railroad” themes.

These are the kinds of companies that could go from obscure tickers to household names over the next decade.

The railroad investors of the 1800s weren’t thinking about quarterly earnings or short-term interest rates. They were betting on a generational technology shift that reshaped the economy.

Today, we have the chance to do the same with AI, semiconductors, and blockchain.

The tracks are being laid right now. The trains haven’t even left the station.

And I plan to ride this new “train” to massive profits.