A Powerful Lesson on Big Gain Hunting

Alpesh Patel|August 27, 2021

“Elephants don’t gallop.”

That phrase is used to describe the sluggish price growth of large companies.

There’s a lot of truth to it. For instance…

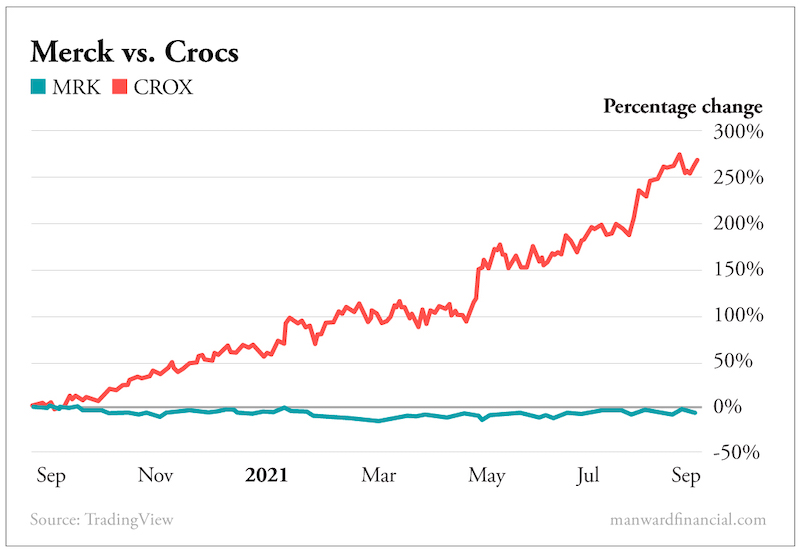

A large company like Merck & Co. (MRK) would need to add $200 billion to its market value in order to double in size.

Compare that with a smaller company like Crocs (CROX), which would need to add only 4.5% to its market value to do the same.

Unsurprisingly, Merck’s value has barely changed in the past year. Crocs, on the other hand, has soared.

And yet, individual investors are strongly advised to hunt “elephants”… to stay away from smaller companies and buy only megacap stocks instead.

That’s what the big-name private investors are focused on, their brokers tell them.

If you follow that advice… it could cost you money.

Overlooked Opportunities

Small cap growth stocks have shot up 16.5% over the past year, beating the “elephants” in the S&P 500.

Additionally, small cap value stocks have risen 30.6%… and the S&P SmallCap 600 Index has grown by 23.6%, outpacing even midcap stocks, as measured by the S&P MidCap 400 (up 17.6% year to date).

So why don’t more investors buy smaller cap stocks?

According to research examining 700,000 individual investors’ accounts, private investors are more likely to buy attention-grabbing large caps (i.e., stocks in the news). And, remarkably, this holds true even after earnings warnings.

Electronic Arts (EA), Kraft Heinz (KHC), Intel (INTC) and JD.com (JD) are all more attention-grabbing than Northeast Bank (NBN), Danaos (DAC), Ferroglobe (GSM) or Euroseas (ESEA). Yet the latter, smaller companies are up 81%, 1,200%, 1,000% and 750%, respectively, in the past year… far outstripping their large cap peers.

But that’s not the only reason that investors tend to overlook smaller companies.

Busting a Market Myth

Investors also avoid smaller cap stocks out of fear.

They’re afraid that greater growth brings greater risk. But they’re mistaken. True, the worst-performing smaller caps give a poorer showing than the worst-performing large caps. But many smaller companies are less volatile – and thus less risky – than so-called elephants.

(Note: I have a unique risk-reduction strategy – for stocks of all sizes – that I’ll share in a future essay.)

Believe it or not, a smaller cap company can offer a better return than a large one… with the same level of risk.

For instance, surprising to many, the smaller company A10 Networks (ATEN) has historically been less risky than blue chip Boeing (BA), according to their respective volatilities (17% for A10 versus 26% for Boeing). It should come as no surprise then that over the past year, little A10 has outperformed Boeing by a factor of two (60% versus 30%).

And small caps don’t move in lockstep with large caps. That means when you add small caps to your portfolio, they can reduce the likelihood of all of your stocks going down at once – while also maintaining your potential rewards.

So don’t waste your days hunting elephants. There is smaller, more lucrative game in the stock market jungle.

And with proper diversification, you can ensure you don’t get trampled.

Alpesh Patel

Alpesh Patel is an award-winning hedge fund and private equity fund manager, international best-selling author, entrepreneur and Dealmaker. He is the Founder and CEO of Praefinium Partners and is a Financial Times Top FTSE 100 forecaster. As a senior-most Dealmaker in the U.K.’s Department for International Trade, he is part of a team that has helped deliver $1 billion of investment to the U.K. since 2005 . He’s also a former Council Member of the 100-year-old Chatham House, the foreign affairs think-tank, whose patron is Queen Elizabeth. For his services to the U.K. economy, Alpesh received the Order of the British Empire (OBE) from the Queen in 2020. As a recognized authority on fintech, online trading and venture capital, his past and current client list includes American Express, Merrill Lynch HSBC, Charles Schwab, Goldman Sachs, Barclays, TD Bank, NYSE Life… and more.