How the Fed’s Rate-Cutting Campaign Will Send Small Caps Soaring

Great is about to get even greater.

If you’ve been following the markets, you know that small cap stocks have delivered extraordinary gains in 2024.

Sezzle Inc. (SEZL) and Dogness Corp. (DOGZ), for example, have generated returns of 803% and 567%, respectively.

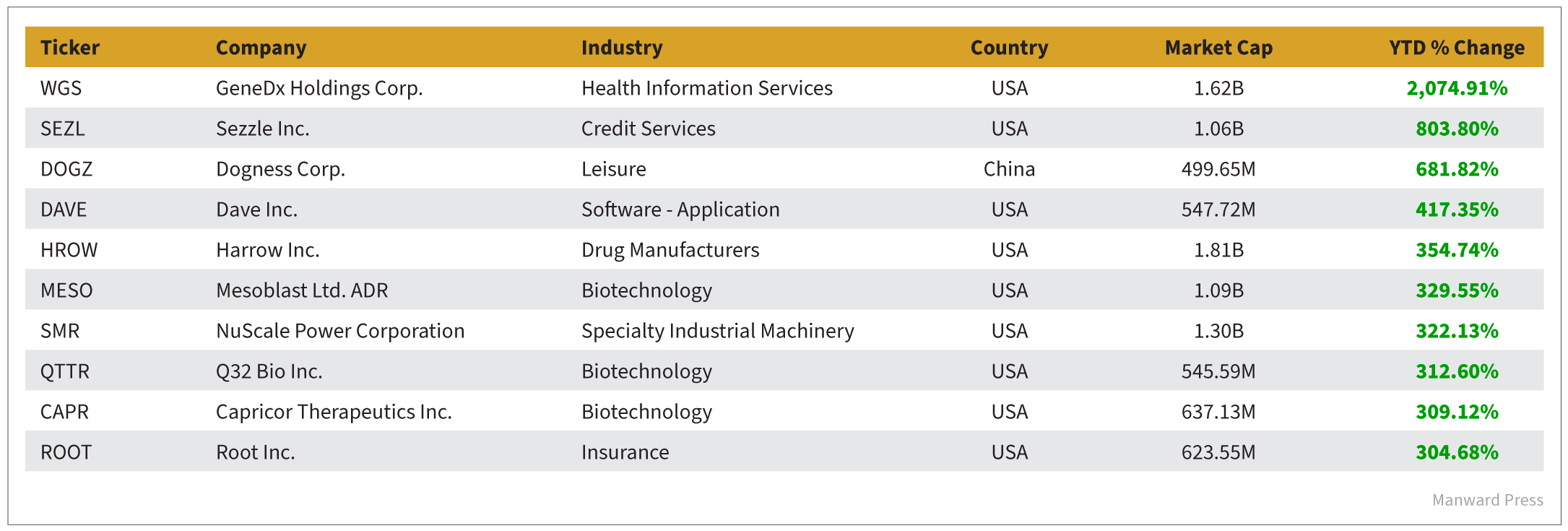

And GeneDx Holdings Corp. (WGS) has shot up more than 2,000% since January. (We’ve included a full list of the year’s top performers below.)

Small caps have become the “darlings” of Wall Street according to Reuters.

In the days leading up to that first Fed rate cut in September, the small cap-centric Russell 2000 doubled the performance of the S&P 500.

It’s no mystery why…

Investors know that when borrowing costs come down, it…

- Draws more money into the stock market

- Makes it cheaper for the market’s smallest – and most potential-packed – firms to grow.

In other words, the lower rates go, the better the conditions should be for small cap stocks and their investors.

As Manward Press’ Chief Investment Strategist, Shah Gilani, recently explained…

When rates rise, the cost of servicing debt increases. That cost squeezes the already tight margins that small caps operate within.

And when rates fall, the relief can be substantial. Profitability increases… and companies have more operational flexibility.

No question small caps have been hurt by the Fed’s aggressive tightening.

But now those days are finally coming to an end.

It’s expected to throw rocket fuel on a sector that’s already been on the rise.

Let’s look at the top-performing plays in the “small cap-renaissance” so far…

At a cursory glance, it seems like small caps in the healthcare and biotech spaces have dominated in 2024.

But really, at the heart of this list, we find the year’s other market megatrend… artificial intelligence.

You don’t have to dig deep to see that AI is central to the innovations driving these small caps higher.

- GeneDx, our top performer in the list above, offers AI-driven genomics-related diagnostic services.

- Digital banking disruptor Dave Inc. (DAVE) – which is up more than 400% this year – uses AI to provide state-of-the-art customer service. (Its custom chatbot is nicknamed “DaveGPT.”)

- NuScale Power (SMR) develops small modular reactors to help satisfy global energy demand… demand that is growing exponentially because of AI.

It’s a trend that’s more than likely to continue as we roll into 2025 and beyond. That makes now the perfect time for investors to add small cap AI plays to their portfolio.

With the tailwinds growing for small caps – and AI in general – the opportunity is clear as day.

Click here or on the image below to learn about Shah Gilani’s favorite ultra-cheap play in the AI space.