Why Tech Stocks Are Not Yet in a Bubble

Robert Ross|October 7, 2025

Whenever markets surge, the word “bubble” isn’t far behind.

It’s an easy accusation to make. Point to a soaring chart, sprinkle in some dot-com bubble nostalgia, and the story writes itself. And with technology stocks leading the current market higher, bubble talk is everywhere.

But here’s the truth: tech stocks are not yet in a bubble. As I discussed on my latest Room to Run podcast, the current rally is rooted in fundamentals and demand in a way that looks very different from 1999.

Building for Real Demand

The late 1990s were a period of excitement, excess, and expectations that went unfulfilled.

Companies spent billions building out infrastructure for an internet revolution that never quite materialized on schedule. Demand lagged, and many of those businesses collapsed under their own weight.

Contrast that with today…

OpenAI, Meta, Google, and Microsoft aren’t building capacity for some hazy, far-off demand. They’re scrambling to keep up with demand that already exists. ChatGPT, Copilot, Gemini, Llama – these aren’t future promises. They’re products with tens of millions of users and surging adoption.

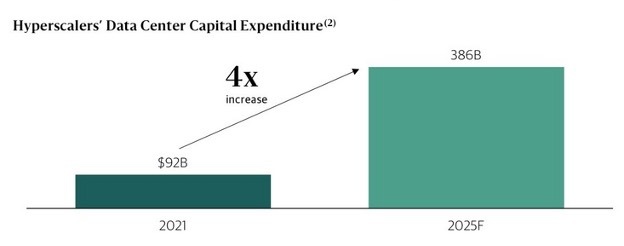

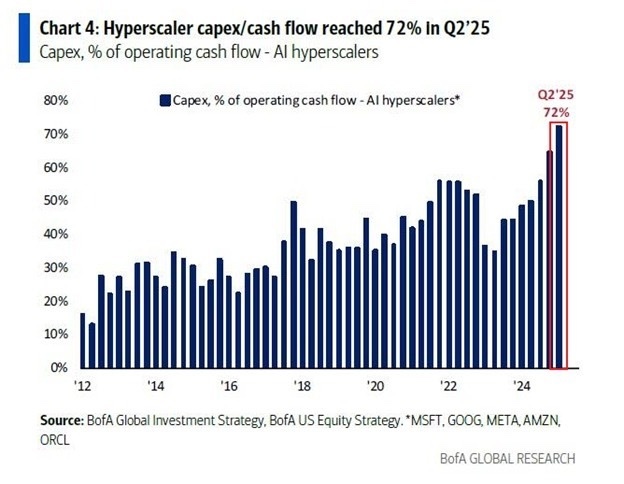

The challenge isn’t finding customers. It’s building enough data centers, servers, and chips to serve them.

That’s a critical distinction. The dot-com era was about building ahead of demand. Today’s AI revolution is about racing to keep up with it.

The Numbers Don’t Lie

The data tells the story.

Since ChatGPT launched in November 2022, AI-related stocks have accounted for 75% of the S&P 500’s total return, 80% of its earnings growth, and 90% of its capital spending growth.

Data centers – AI’s beating heart – are eclipsing office construction spending in the U.S. In the PJM power region, which covers much of the Eastern U.S., 70% of last year’s electricity cost increases were driven by data center demand. This is real economic activity – not castles in the sky.

And yet critics still throw around the “bubble” label. But bubbles aren’t built on surging earnings and rising capital expenditures.

They’re built on hope untethered from reality.

Earnings, Not Euphoria, Are Driving Stocks

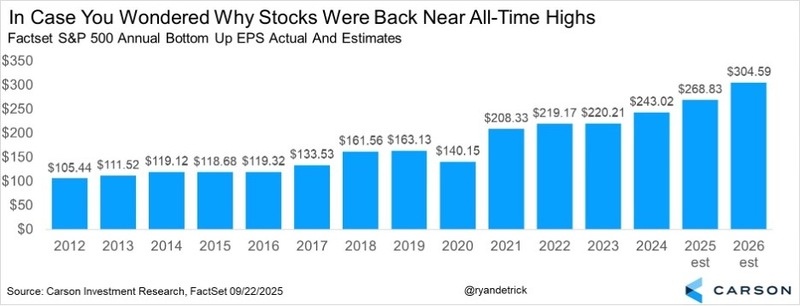

Since 2019, the S&P 500 is up 125%. At first glance, that might seem bubbly.

But dig deeper… 76% of that return has come from earnings growth and 19% from dividends.

In other words, almost the entire move has been powered by companies actually making more money. Only a small fraction of the gain is from rising valuation multiples.

That’s the opposite of a bubble.

Even more telling is profitability. In 1999, S&P 500 profit margins were 7.3%. Today, they stand at 14.3%. The average U.S. company is literally twice as profitable as it was during the dot-com era.

When companies are producing that much more earnings per dollar of sales, higher valuations make sense.

Innovation Always Looks Like a Bubble

Part of the reason investors are so quick to call this market a bubble is every transformative technology in history has looked like one. Railroads in the 1800s. The internet in the 1990s. Smartphones in the 2000s.

Each came with wild speculation, soaring valuations, and predictions of world-changing breakthroughs. Each also came with spectacular failures – railroad bankruptcies, dot-com busts, BlackBerry’s fall from grace.

But that’s not a bug in the system. That’s how markets digest revolutionary change. Capital floods in, much of it gets misallocated, weaker players die off, and the winners become household names that define entire eras.

AI is following the same script. You can be completely right about the big picture – that AI will transform the world – and still lose money if you back the wrong companies. That’s how investing works. The future gets priced in unevenly, and not every player survives the shakeout.

But does that mean we’re in a bubble? Hardly. It just means we’re in the early innings of a new technological cycle.

Yes, there are frothy pockets in the market. We’ve seen pre-revenue AI small caps like Oklo (OKLO) double in a matter of weeks.

That’s speculation. But the core of this rally – companies like Microsoft, Google, and Nvidia – is built on fundamentals. These are some of the most profitable, cash-rich companies in history, with customer bases that span the globe. Their growth isn’t hypothetical. It’s on the income statement.

That’s why comparing today’s market to 1999 misses the point. Back then, valuations rested on dreams. Today, they rest on demand, earnings, and profitability.

So, don’t let the “bubble” talk fool you. This isn’t 1999 all over again. The earnings power, the adoption rates, and the economic footprint of AI make this rally much more rational than critics admit.

The risk today isn’t that we’re in a bubble. The risk is missing the opportunity because you were too focused on fighting the last war.