The Golden Hour: The Perfect Time to Trade Every Day

Manward Financial Research

Smart investors are always looking for an edge. Here’s one…

The time of day you trade stocks can matter just as much as which stocks you buy.

In fact, there are two sets of rules about when to buy stocks that every investor should follow.

And which set you follow depends on whether you’re investing for the short haul or buying to hold.

The Magic Hour for SHORT-TERM Traders: 10:00am

If you’re a short-term trader, make your moves before 10:00 each day – the earlier, the better.

The rationale is simple.

Volatility is almost always at its peak in the morning.

It makes sense. There’s a large gap between when the market closes at 4:00 in the afternoon and when it reopens at 9:30. A host of things can happen during that time.

Companies can report big news – like earnings or a merger. Or major news events can happen around the world.

Remember, when Wall Street closes for the day, there’s another 17.5 hours until it reopens.

That’s a long time in today’s news cycle.

When the opening bell rings, there’s often a flood of orders – for a host of reasons – waiting to be processed.

It’s why the direction stocks take first thing in the morning is often the direction they head for the rest of the day.

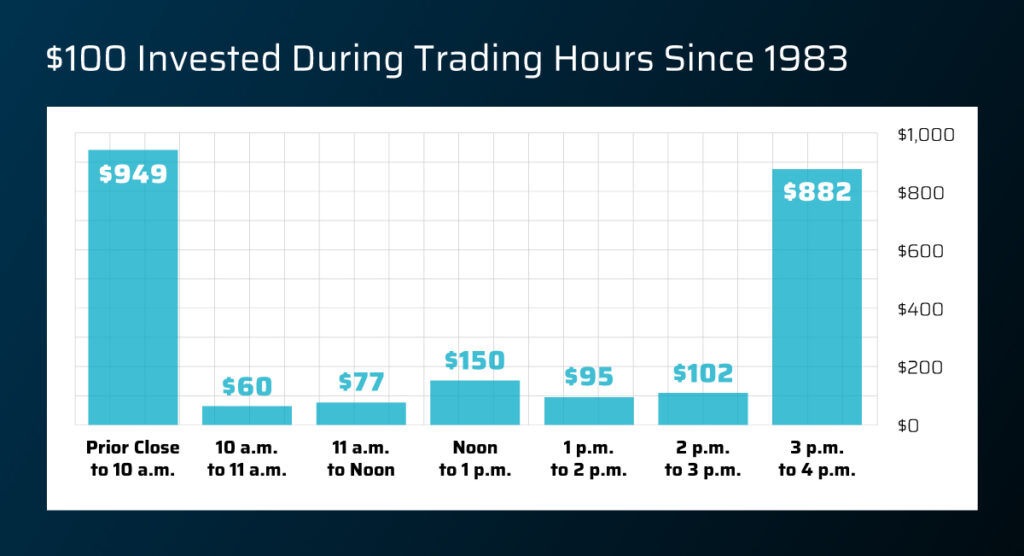

Meanwhile, the folks who bought and sold during the hour that followed – between 10:00 and 11:00 – actually lost money.

According to data from Bespoke Investment Group, every $10,000 invested became $6,000.

Ouch.

Of course, few investors can buy and sell every day.

And even fewer have the analytic prowess and data to reliably make winning short-term trades.

That’s why longer-term investors should find something else to do in the morning.

They shouldn’t invest before 10:00.

The Magic Hour for BUY-AND-HOLD Investors: 12:00pm

For buy-and-hold investors, there’s a much smarter – much less volatile – time to buy.

History shows these folks should buy between noon and 2:00, when volume is typically at its lowest for the day (mainly due to a lack of news flow) and the dust has settled from the often hectic early morning session.

This is when long-term investors can get their limit orders filled.

If you’re looking to buy a stock and hold it for months or, better, years, there’s no need to rush. Enter your positions later in the day.

As volume wanes, you have a better shot at getting your shares at a discount.

For example, if shares of XYZ have been trading at $12.50 all morning, you may be able to put in a bid capped at $12.45. With few other midday buyers in the market, your chances of getting filled are higher.

By waiting just a few hours to make your move, you can enter a long-term play at a discount.

It’s all because you’re buying when the competition is at its lowest.

Use these two tricks to get the most out of every trade.