Three Stocks That Will Power the EV Revolution

The electric vehicle (EV) industry is one of the largest and fastest-growing emerging industries in the world.

Electric vehicles are the next stage in automobile technology, and many of the world’s largest car manufacturers are making the transition to electric. These companies have been heavily investing in their futures with electric vehicles.

To give just a few examples, GM announced it will aim to have an all-electric model lineup by 2035, Ford promised to build its biggest factory ever along with two battery plants, and Toyota is building a $1.3 billion battery plant in North Carolina.

With lots of investment going into this technology, it’s difficult to ignore the industry-wide shift from gas to electric.

The Inflation Reduction Act, which was signed into law in August 2022, contains a host of tax credits aimed at reducing the cost of new and used EVs for consumers. These include a $7,500 tax credit for new EV purchases and a $4,000 credit for used EVs, providing more incentives for consumers to transition to electric.

In the sustainable-development scenario from the International Energy Agency, electric vehicles will make up an estimated 34% of new vehicle sales in 2030, compared with 4% of such sales in 2020.

When major innovations like electric vehicles are introduced, there is a period of early adoption when sales growth is limited by early-stage technology.

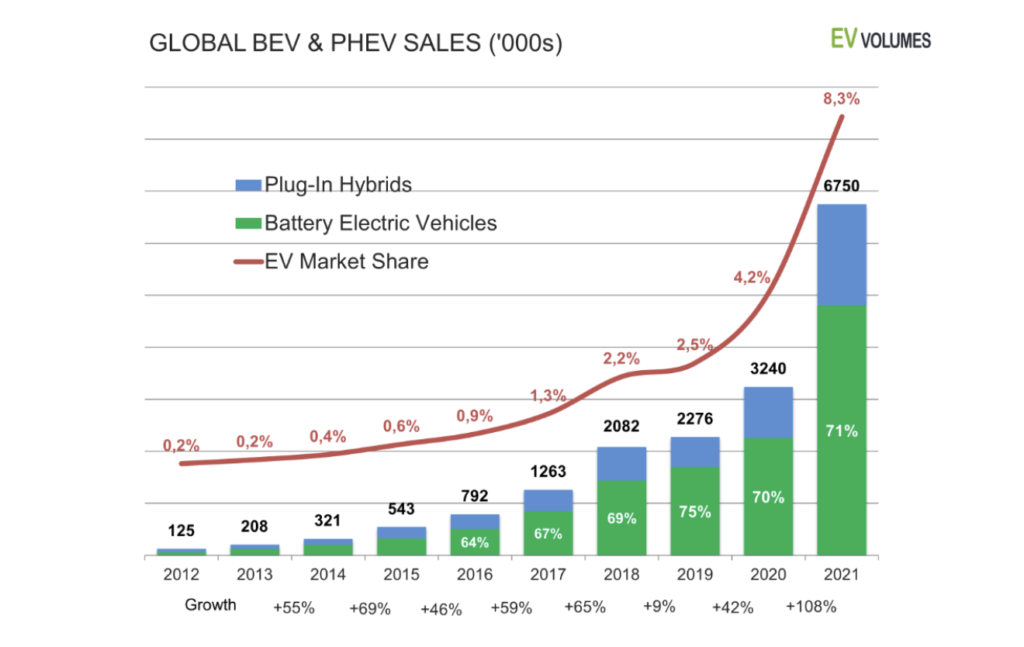

The massive growth in global sales of hybrid and battery-electric vehicles over the last few years – which you can see in the chart below – indicates a higher level of adoption and marks a shift to exponential growth for the EV industry.

The main limitation to this industry’s growth is consumer sentiment. Electric vehicles are a new technology and come with uncertainty and higher average costs, which most consumers avoid when making a purchase.

For adoption to accelerate, the concerns around EV technology must be eliminated. The top three barriers to EV adoption are lack of charging infrastructure, lack of appropriate EV type and cost.

The EV industry has shown steady growth over the last few years, and with the main concerns being addressed, it is likely that growth will accelerate to higher levels and that EVs will soon emerge as the new global standard.

For the EV industry to reach its full potential, the vehicles must evolve. The next major upgrade will be to battery technology. Upgraded batteries are the key to unlocking longer ranges and faster charging, and the companies focusing on EV batteries will be among the biggest beneficiaries of the growing EV industry.

Let’s look at three sectors relevant to the development of batteries: raw materials, EV battery technology and global charging infrastructure.

Charging Infrastructure

Charging infrastructure is essential to the adoption of electric vehicles. One of the main reasons people aren’t willing to buy EVs today is the concern that they will run out of charge while on the road.

To eliminate this concern, countries are deploying EV chargers at a rapid rate, and one of the tailwinds driving charging station growth is supportive government policy.

In 2021, the United States passed a large infrastructure bill, setting $7.5 billion aside for U.S. EV charging programs, with a target of 500,000 public stations by 2030. Over the next several years, this will provide a major boost to the companies deploying the charging stations.

Although the United States is making progress, it’s still far behind Europe and China in EV charging.

China has the largest charging network in the world, with more than 1.8 million public EV charging stations. In Europe, there are more than 375,000 charging stations, while the United States has only slightly more than 160,000.

Supportive government policy has helped fuel growth in Europe and China.

Here is a forecast of global charging infrastructure over the next decade:

With global policy favoring adoption of EVs, charging infrastructure will continue expanding to meet the needs of the growing EV fleet.

If the sustainable-development scenario from above is accurate and electric vehicles make up more than a third of 2030 new vehicle sales, the EV charging industry will see extreme growth over the next decade.

Let’s look at Blink Charging (Nasdaq: BLNK), one of the fastest-growing EV charging companies, which is actively expanding its network and developing advanced charging technology.

So far, Blink has deployed 58,000 individual charging ports across 25 countries. In the last few years, it has increased its total charger count by 80%.

To manage the expansion of its charging network, it has developed cloud-based software to maintain charging ports as the numbers grow.

The Blink Network enables Blink to remotely operate and maintain charging stations while simultaneously collecting charging data. This will reduce future maintenance costs and provide valuable data for improving Blink’s technology.

In terms of the company’s actual charging ability, Blink’s “IQ 200” chargers are the fastest Level 2 alternating current charging stations available and can charge any battery-electric or plug-in hybrid vehicle. This charger provides up to 19.2 kilowatts (kW) of power output. Tesla’s Level 2 charger, for comparison, provides only 17.2 kW.

In 2022, Blink launched a new charging port design that includes large screens for advertising that will enable each charger to generate an additional stream of revenue.

Blink has signed a series of deals to deploy its chargers, with many more on the way.

In January 2023, it signed a national supplier agreement with Vizient for deployment of EV charging stations and services. Vizient is the largest member-owned health services company in the U.S.

Also in January, Blink announced an exclusive agreement to become the EV charging infrastructure provider for Mitsubishi’s national dealer network.

Blink recently completed the acquisition of SemaConnect, adding 12,800 chargers and 150,000 users to its network.

And Blink continues to expand upon its agreement with SG Blocks.

SGB Development, a subsidiary of SG Blocks, repurposes cargo shipping containers with the goal of promoting safe, eco-friendly construction. These affordable, multifamily developments can be combined and arranged in any configuration to create any amount of space needed. Strategies include workforce housing, residential developments, mixed-use communities and townhomes.

Under the agreement, SGB will install Blink chargers in all current and future development sites, enabling each resident to reduce their carbon footprint. This deal will provide Blink with a steady stream of revenue for years to come.

Deals like these will continue to emerge and will contribute to Blink’s growing network as companies and corporations rush to install EV chargers to accommodate the rising number of electric cars on the road.

Typical of smaller, growth-oriented technology companies, Blink operates at a loss. It is important to focus on revenue growth when evaluating unprofitable companies, and Blink generated $17.2 million in revenue in the most recent quarter, a 169% increase from the year prior. Year over year, gross profit soared 436% and the number of contracted charging stations jumped 160%.

As the number of EVs on the road continues to grow, so too must the number of chargers that power them. If Blink can sustain its recent growth, it won’t be long until it’s profitable and controls a significant chunk of the available market share.

The 2021 Infrastructure Investment and Jobs Act and the Inflation Reduction Act of 2022 allocate billions of dollars to EV-related projects. These new laws will serve as strong catalysts for growth in years to come.

The company currently has a market cap of less than $800 million and is emerging as one of the fastest-growing, highest-quality EV charging companies in the world.

Another approach to propelling the EV revolution is through improved battery technology. The next generation of batteries is currently in development and will result in a huge boost for EVs.

EV Battery Technology

The battery is the most important and most costly component of electric vehicles. The battery determines charging efficiency and driving capabilities like range.

Lithium-ion batteries are currently used to power electric vehicles, but there are limitations with this outdated battery technology.

The lithium-ion batteries used in EVs are not as efficient as traditional internal combustion engines (ICEs) and come with a few other issues, including…

- Freezing or catching on fire

- Charging improperly, which can lead to short-circuiting

- Being rather expensive and requiring rare materials.

The high price of EV batteries is the main reason electric cars are more expensive than cars with traditional ICEs. As batteries become cheaper to produce, EV prices will decrease and more people will buy them.

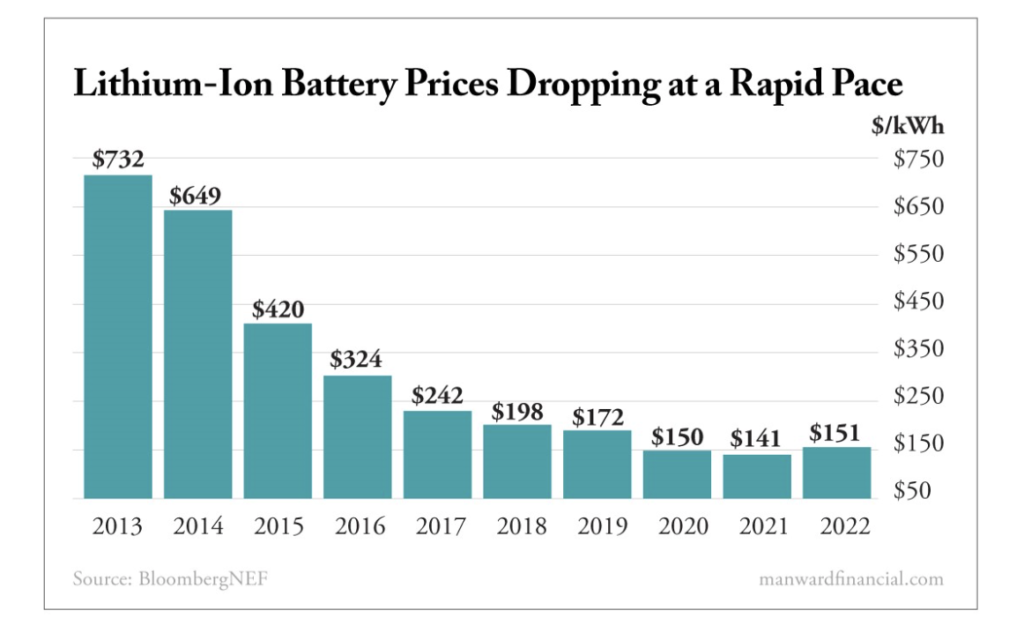

With their technology advancing at a rapid pace, batteries’ prices have been declining in recent years:

Batteries cost less than a quarter of what they did eight years ago, and EV battery technology continues to become cheaper and more efficient every year.

By 2025, the average price per kilowatt-hour (kWh) is expected to be slightly more than $100, and it is expected to fall to $60 per kWh by 2030.

However, to achieve this price target, a major technology upgrade is needed… and it’s currently in development.

The EV battery industry has recently shifted its focus to developing solid-state batteries in order to replace the lithium-ion design in cars.

This technology is not ready for commercial production, but solid-state batteries are expected to cost less than half as much as lithium-ion batteries when produced at scale.

In addition to the cost benefit, solid-state batteries come with significant improvements: They have higher energy density, they’ll increase range and they’ll enable more efficient charging. Plus, they virtually eliminate the risk of fires.

Prototypes in development are delivering up to 400 watt-hours per kilogram (Wh/kg), double the amount of a typical lithium-ion battery used in EVs today.

When available, solid-state batteries will enable EVs to travel distances of more than 500 miles on a single charge and will provide a major boost to charging efficiency. And it’s only a matter of time until they are the new EV standard.

QuantumScape (NYSE: QS) is a $4.5 billion company that is backed by Bill Gates and is developing industry-leading solid-state batteries. It has positioned itself to be a leader in terms of both technology and production when the manufacturing process is completed.

QuantumScape is currently building out its QS-0 pilot production line in order to deliver more than 200,000 cells annually for use in testing vehicles, with more capacity on the way.

The company has formed a deep partnership with Volkswagen, and Volkswagen has tested multiple generations of QS cells and publicly validated their performance at automotive power levels.

In a recent expansion agreement with Volkswagen, QuantumScape established plans for a new production facility. Following positive third-party test results on its solid-state technology, Volkswagen announced it would invest an additional $100 million into QuantumScape’s production capabilities.

The pilot-line facility will initially be a 1-gigawatt-hour (GWh) battery cell production plant. There are plans to expand capacity by an additional 20 GWh at the same location.

When complete, QuantumScape’s pilot-line capacity will establish it as a leader in EV battery production.

The partnership with Volkswagen is essential to unlocking the commercial production of solid-state batteries. Volkswagen has the funds and facilities – plus the commercial manufacturing expertise – to support this venture.

As investors, we must remember that developing new technologies is a costly process. QuantumScape is currently burning through cash, and it has not yet earned a profit. For this reason, it should be viewed as a longer-term, hypergrowth investment opportunity.

When commercial production is established, these batteries will be standard in most electric vehicles, and QuantumScape could reach this production goal as soon as 2024.

Volkswagen has first priority to QS cells, but the deal is nonexclusive. QuantumScape has contracts with six additional automotive companies for QS cells.

Other companies are developing solid-state technology, but QuantumScape has more than 300 patents and patent applications on the most efficient design. And its batteries have the highest density and operate at lower temperatures than other solid-state prototypes.

QuantumScape solid-state batteries will be capable of providing a greater than 300-mile driving range, a less than 15-minute charging time and an estimated 12-year/150,000-mile battery life.

Before we know it, QuantumScape will establish commercial production, and it will emerge as THE battery leader in the rapidly growing EV industry.

Frank Blome, head of Volkswagen’s Center of Excellence for Battery Cells, keeps it short and sweet when discussing the new technology: “Solid-state is the end game for lithium-ion battery cells.”

Whether it’s QuantumScape’s solid-state batteries or the current lithium-ion batteries, the EV industry will continue to heavily rely on lithium. And there are some major developments within the lithium mining industry that will impact the EV battery market.

Raw Materials

Demand for batteries – and their main component, lithium – has been growing every year.

In 2022, global lithium production rose by 21%, from 107,000 metric tons to approximately 130,000 metric tons. Lithium has become one of the most in-demand commodities in the world, and the industry is projected to expand at a 34% compound annual growth rate over the next nine years.

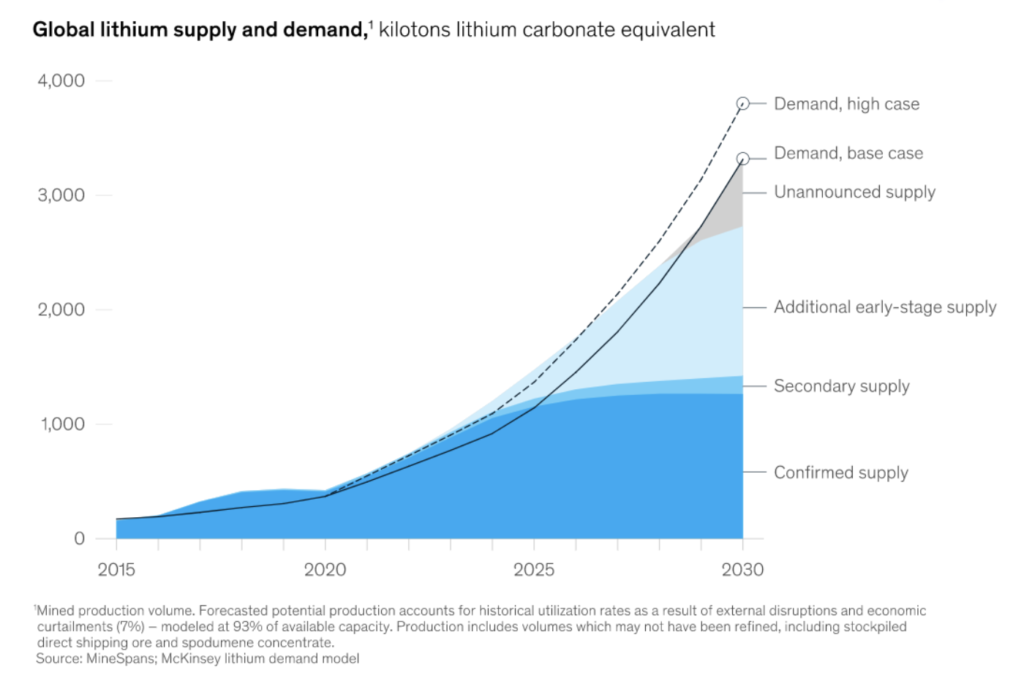

Although it has been increasing, the current global production capacity is not enough to meet the forecast demand:

The supply deficit forecast here is largely a result of unmet battery demand, which will likely remain an issue.

Even with the 100% production increase during the last five years, there are not enough mining operations to meet demand. This is a positive sign for lithium miners and means there will be a large inflow of new business over the next few years as the EV revolution accelerates.

Lithium miners have taken notice and started to explore and develop new mining projects. New developments in Nevada, the Czech Republic, Austria, Spain and several other regions will drive lithium production levels to all-time highs.

A major cause for the forecast supply deficit is the introduction of battery megafactories. There are 200 battery megafactory projects in development, and more than 120 of them are currently operational.

Once complete and operating at full capacity, the 200 megafactories will demand a total of 3 million metric tons of lithium. This is 30 times the amount produced in 2021, showing just how serious the need for more mining operations is.

The lithium mining industry is preparing for a long-term boom, and mining companies are developing new projects and expanding existing projects to combat the growing supply deficit.

Lithium Americas (NYSE: LAC) is the best-positioned miner to meet the growing demand. It recently made a series of strategic moves intended to increase its market share and production capacity.

It is currently developing two advanced-stage lithium projects – one in Argentina and one in the USA.

A huge catalyst for Lithium Americas is its January 2023 announcement that it has entered into a purchase agreement with General Motors (NYSE: GM).

Under the agreement, GM will – in two stages – make a $650 million equity investment in Lithium Americas. This represents the largest-ever investment by an automaker in battery raw materials. The stock purchase makes GM the largest shareholder of Lithium Americas.

The company will use part of the GM investment to accelerate development of its Thacker Pass resource in northern Nevada – the largest known lithium resource in the United States.

In return, Lithium Americas has signed a binding supply agreement with GM for 100% of its Thacker Pass lithium production for 10 years.

Significantly, the Inflation Reduction Act requires, by the end of this year, that 40% of EV battery minerals be recycled in North America or extracted or processed in the U.S. (or a country the U.S. has a free trade agreement with). The requirement will increase to 80% by 2026.

In Argentina, Lithium Americas entered into an agreement with Ganfeng Lithium, Tesla’s lithium supplier, to construct the largest new lithium operation in more than 20 years.

The Cauchari-Olaroz brine deposit is the third-largest in the world, construction is 90% complete and lithium production is expected to start in mid-2023. Upon completion, this project will produce 40,000 metric tons of lithium per year.

In another recent deal, Lithium Americas outbid the world’s largest EV battery maker, Contemporary Amperex Technology, to acquire Millennial Lithium, which has two existing lithium operations located next to the new Cauchari-Olaroz project.

While it will be the Cauchari-Olaroz deposit that will go into production first and start generating revenue later this year… the big story here is the Thacker Pass project.

The company recently completed the construction of the Lithium Technical Development Center in Reno to display the production capacity of Thacker Pass.

The project is expected to break ground in the second half of 2023 and, upon completion, will have a mine life of 46 years and an expected annual production capacity of 80,000 metric tons.

The company has obtained all the permits necessary to commence construction. This will be Lithium Americas’ largest operation and will provide a stream of consistent long-term revenue.

Aside from meeting global lithium demand, this project is important to the United States in terms of its ability to build out the North American EV supply chain.

While it is currently developing major lithium projects, Lithium Americas is not yet producing lithium. This is a point of concern for investors, but the company is preparing for the EV boom. And with two large projects in development, Lithium Americas will grow into a global leader in lithium production.

The EV Revolution Is Underway

The EV industry is on the brink of exponential growth…

It’s important to understand why that’s happening and where this growth is coming from.

The solid-state battery design is the next major development for EVs. The improvements to EV battery technology will unlock longer driving ranges and contribute to consumer adoption.

These batteries will require tons of lithium to produce, and as adoption of EVs accelerates, more and more batteries will be needed.

As more EVs hit the road, an expansive network of chargers will be essential to keep them running.

By focusing on the production components rather than on the EVs themselves, you can reduce risk and invest in the overall industry instead of a single EV brand.