Three Top Income Stocks for 2020

vraju|September 6, 2019

The three income-generating stocks below have something very unique in common.

I beg you to pay attention to it. This idea could rewrite your financial fate.

It’s not just that these cheap stocks pay huge dividends.

It’s not just that they offer you a shot of a lifetime worth of paychecks that’s as easy to collect as going to your mailbox.

No… it’s something much bigger. And it’s much more lucrative than you may think.

You see, few folks know it yet, but the rules of investing have changed.

We’ve all heard about the great powers of interest. Save now, we’re told, and watch that money grow… and then grow some more… all thanks to interest.

I’ve seen it.

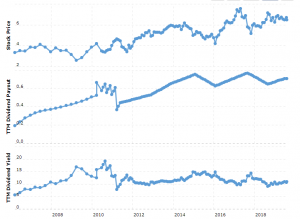

Interest rates have died.

Take a look at this chart. It’s fascinating.

It shows the death in real time.

You likely remember the 1980s. That’s when banks actually paid decent interest rates.

It’s also when a lot of the economic theory that we take as gospel today was written and discussed.

Think Differently… Think the Manward Way

Thirty years ago, the notion of retirement was just becoming a reality for many Americans. Prior to that, shorter lifespans made the notion of many “golden years” a dream most folks never realized.

The average life expectancy was just 71 years in 1980. That means there wasn’t much need to spend a lifetime saving for retirement.

In fact, retirement was short… if it ever happened.

That’s why most Americans needed some sort of incentive to put their money away. Their natural inclination was to spend it today… not save it for a retirement that would, at best, last just a few years.

Mr. Market found a way around this conundrum.

As any good banker will tell you, money goes to where it’s treated best.

And if a banker wants us to deposit our cash in his bank, he had to create an incentive that keeps us from spending it.

That’s where interest rates come in.

The banker simply pays us to save.

It’s the simple phenomenon that modern economic theory is based on.

But the money minds of yesteryear missed something important. They never bothered to add increasing lifespans to their prized equation.

Read closely.

See that volume spike? Somebody just decided to buy a LOT of gold.

See that volume spike? Somebody just decided to buy a LOT of gold.T-R-O-U-B-L-E

In other words, as more and more folks live well into their 80s and 90s, they have a strong natural inclination to save. They know they won’t be able to work at those ripe ages. So they must save and they must invest.

Once again, money goes where money is treated best.

With so many folks dumping money into stocks, bonds and savings accounts, the market (with the help of the Federal Reserve and its friends in Washington) has been forced to incentivize folks not to stash their money away.

After all, if we don’t spend our money… the economy slows.

It’s why the Federal Reserve is in a trap. Each time it raises rates and incentivizes Americans to save, the economy throws a fit.

That’s why it’s not surprising – at least to the Manward readers I’ve been detailing all this to – that interest rates and life expectancy have moved almost perfectly in the opposite direction over the last 40 years.

It proves that current financial theories are wrong. They were devised decades ago and have not kept up with real-world trends.

We can no longer assume that consumers need an incentive like interest rates to save. These days they do it simply so they’re not broke in retirement.

The idea highlights the country’s conservative fiscal culture and its long-time penchant for saving for tomorrow.

It’s no surprise that the Germans — who put away about 10% of their disposable income — save twice as much as the average EU citizen and the average American.

Given that fact… it’s no surprise, Germany is leading the continent’s dive into negative interest rates. In fact, in early August, the country’s benchmark 30-year bond slid into negative territory for the first time ever.

Imagine that… loaning the country money from now until 2048 and getting less cash back than you initially “invested.”

Obviously this trend could play hell on the average investor’s portfolio.

As the deflationary forces of falling interest rates take hold, it will make saving for a long and rich retirement quite tough.

The Oh-So-Simple Solution

Just as you’d expect, the already rich won’t have much of a problem with all of this. Most of them made their money by starting or running companies that kick out healthy streams of profits.

They don’t need interest from a bank or a bond to grow their accounts. They simply get a share of the profits from their business.

But here’s the thing… it’s what many Americans overlook.

You, too, can own those same companies.

What’s important – and what many of today’s financial scholars miss – is that these companies and the folks that run them aren’t affected by the same forces that are driving rates lower.

No. They have every incentive to increase these payouts. After all, it’s how many of the executives earn their living. And, don’t forget, they have greedy shareholders to answer to.

If payouts slip, the folks in charge will quickly be replaced.

That’s why it’s absolutely essential every investor has several healthy and lucrative dividend payers in his portfolio.

As I often tell my readers, the money from these sorts of stocks are an essential ingredient in our freedom… especially if we ever want to retire.

Three Things to Look For

Fortunately, sorting the good from the bad isn’t all that hard.

I have three criteria.

First, the company must be growing its profits.

There’s no way we can expect payouts to grow if the company’s bottom line is not growing.

Second, the company must have a strong balance sheet.

In other words, we can’t expect a big payday if the majority of profits are going towards paying off debt.

And third, the company must have a strong history of rewarding its shareholders.

There are plenty of companies that don’t pay dividends. That’s their choice. They may use that money for acquisitions, business development or other fine uses. But if you’re looking for income… that simply won’t do.

That’s why I’ve scanned the market and have detailed the three very best dividend players…

Double-Digit Payouts

The first pays a healthy 10% dividend. Try to find that figure at your local bank.

Suburban Propane (SPH) is an ideal dividend stock. Technically, as a limited partnership, it pays a “distribution” and not a dividend, but it’s fine to think of them as the same thing.

When we look at what’s leading to the death of interest rates and its effects on the American economy, we recognize what is causing the problem shun those ideas from our investments.

If not, a big payout could be here today… but gone tomorrow.

That’s what’s so appealing about Suburban Propane. The product it sells certainly isn’t going away anytime soon.

As its name implies, the company is in the business of selling and delivering propane.

It has customers spread throughout the country. Many of them are in rural America, where the company provides fuel for home heating and cooking and also a slew of agricultural and industrial needs.

While few folks would call Suburban Propane a rip-roaring growth company, that’s not what we’re looking for in a dividend stock.

We’re looking for steady growth, good cash flow and a history of rewarding shareholders with healthy payouts.

As we’d expect, this company checks all the boxes.

Sales growth, for instance, is steady. Over the last three years, the top line has grown by 28%. Meanwhile, profits have surged by over 400%.

It’s help the company pay some whopping dividends… while continuing to significantly boost its net cash flow.

And with healthy levels of cash come healthy, reliable dividends.

With the exception of a downturn in 2017, the company has reliably increased the size of its annual payout. Over the years, it’s helped the company maintain its reputation of yielding an average of 8% or more.

That’s good.

Again, you won’t find that sort of yield at your local bank.

Your New Private Equity Fund

But don’t think I’m badmouthing banks. Find the right ones – or the right companies acting like a bank – and you can earn quite a bit of money.

That’s certainly the case with Prospect Capital Corp. (PSEC).

This unique company is paying its investors more than 11%. It does it because it acts like a unique type of money lender.

But instead of taking customer deposits and lending part of the cash to borrowers, Prospect Capital uses investor money to make high-yielding loans to some of the fastest-growing companies in the country.

Think of this investment as a back-door into the sort of privately owned companies that most folks believe only the rich can take advantage of.

Take, for instance, the high-tech company Mobile Posse. As a private company, it’s closed off to most investors. You’d have to have some strong connections and the government’s blessing to get a stake at the fast-growing tech business.

But thanks to Prospect Capital, though, you can get a share of the company and its profits.

That’s because it’s a direct investor in the company… and dozens of others like it.

As a “business development company” – that’s a designation created by the Carter administration – Prospect has the ability to use its shareholders’ investments to invest directly in or loan to the companies it believes have the best profit potential.

Of course, as a shareholder, you profit when it profits.

As we’d expect, the company has a rich history of strong quarterly payouts.

If you’re looking for a reliable double-digit income yield… this one’s worth a close look.

But there’s one more you should add to your list.

Like Suburban Propane and Prospect Capital, this one is not a typical company. It doesn’t live and die by consumer whims or the latest technological trends.

It’s a chance to get paid to own some of the most-prized real estate in the country.

Become a Real Estate Mogul… for $10

Have you ever seen a property, looked at the traffic that’s driving by and said, “wow, I wish I owned that”?

Some properties are a gold mine… with no need to ever dig up a single rock.

McDonald’s (MCD) famously knows this. Many experts are quick to point out that the real cash cow for this fast food giant isn’t its burgers… it’s the company’s land. At its core, McDonald’s is a real estate giant.

That’s because it owns some of the most-valuable land on the planet… and leases it back (at lucrative rates) to its franchisees.

But with a dividend yield of just over 2%, McDonald’s is hardly a dividend juggernaut.

That’s okay… because VEREIT (VER) is.

This real estate investment trust owns nearly 4,000 properties across the country, worth more than $15 billion.

And just like McDonald’s does, it rents that real estate to franchise owners and big, national businesses who want to put their business on top of a gold mine.

If you’ve driven by a Red Lobster, a Family Dollar store, Burger King, PetSmart, Walgreens, CVS or one of more than 630 other popular brands, you’ve probably driven by a property owned by VEREIT.

It’s important to remember, the vast majority of those companies don’t own the land their stores are on. They cut rent checks each month.

And for a company like VEREIT, that has 4,000 properties but just 180 employees, those checks are very lucrative. Much of the cash it generates, gets put directly into the hands of shareholders.

For example, of the $1.3 billion of revenue generated by the company in 2018, $606 million was paid out in dividends.

Again, owning shares of VEREIT is like owning a gold mine… and you never have to get your hands dirty.

Thanks to a world-class real estate portfolio and the cash it generates, the company has paid a reliable dividend that’s growing steadily.

The result is a top-notch 6% dividend that you won’t find many other places… especially in a world where interest rates are quickly becoming a passage in the history books.

Times are changing. The global economy is going through a great revolution. And what once worked, no longer will.

If you’re looking for income, you’ve got to find a reliable source that doesn’t rely on an economic trend that’s dying.

Take a look at the three income-generating stocks above.

They represent an ideal way to make big income… that will last a lifetime.