My Top Three “Slingshot” Picks

Bryan Bottarelli|July 13, 2021

Editor’s Note: In May 2019, trading experts Bryan Bottarelli and Karim Rahemtulla launched the biggest breakthrough in investment research the world has ever seen. They created an online community of like-minded individuals and trading enthusiasts focused on one thing: winning.

They call this community The War Room.

They’ve already hit 1,000 wins. And for a limited time… they are opening their doors to new members… and guaranteeing 300 winning trades! Click here to get all the details.

And keep reading for three plays Bryan says are sure to surge in the weeks and months ahead.

Back in early May, I told my readers that the next trend in the post-COVID-19 world would be one of vanity.

I said…

You see, for the last 18 months, we’ve all been looking at our faces on Zoom and noticing every imperfection. Maybe your eyelids droop, maybe you have dark circles under your eyes, maybe you’re losing your hair or going gray, or maybe that double chin is just getting to be too unpleasant to look at.

Whatever the reason, I believe we’ll see a comeback in cosmetic plays. From an investment angle, this sector is undervalued and quite overlooked. For us, it could set up a great opportunity.

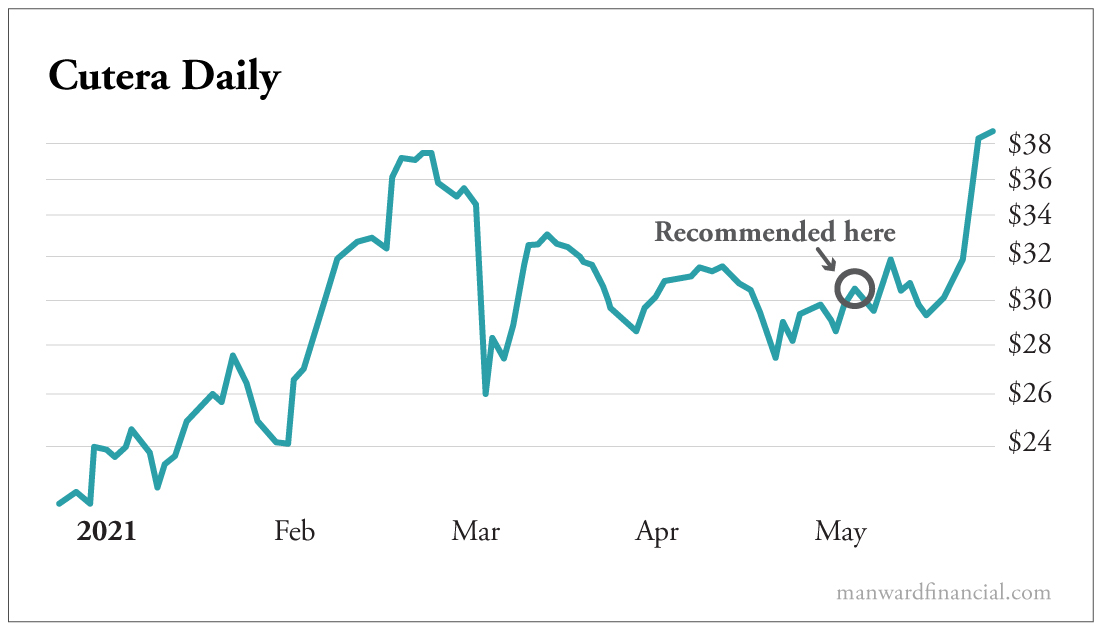

To profit off this trend, I recommended shares of cosmetic laser treatment company Cutera (Nasdaq: CUTR).

My forecast was crystal clear…

I said, “Of all these candidates, the play I like the best is Cutera… I’m forecasting a retest of the February highs at $37 and above.”

Just look at this chart…

I was right on the money!

One reader wrote to me just a few weeks later and said…

@bbottarelli – Congrats on the mention of CUTR on May 3rd, 2021 – the share price is up nearly +30%. – S.R. 5/24/2021 at 9:06 a.m.

So, naturally, after a quick win like that, readers wanted to know…

What’s my next post-COVID-19 winner?

Today, I’ll give you three plays that I’m calling “slingshot” stocks.

These are companies that will not only retest their pre-COVID-19 highs but also slingshot ABOVE those levels in the weeks and months ahead.

Here are my top three slingshot picks…

Pick No. 1: Starbucks (Nasdaq: SBUX)

Recently, I popped into a Starbucks… only to see quite a sight: a mobile order line that was backed up for 45 minutes! The lines were out the door, and the demand was insane. The store was a madhouse.

If people are starting to flood back into Starbucks stores – which now have an expanded menu that offers food – I could see sales remaining very strong. In a recent UBS survey, 66% of responders said they are not comfortable eating in restaurants – which makes Starbucks a prime slingshot stock.

And it has already started to build momentum… The stock bounced off its $110 support line at the end of June.

Pick No. 2: Live Nation Entertainment (NYSE: LYV)

After an 18-month hiatus, concerts are starting to sell out – which could make Live Nation one of the biggest slingshot stocks available today.

I think you could see its stock price shoot above $100 very soon – pent-up concert demand should remain red-hot for the next 12 to 24 months.

Pick No. 3: Planet Fitness (NYSE: PLNT)

As with Live Nation, we could see a slingshot reaction in Planet Fitness as people get comfortable going to gyms again.

Buyers have supported recent dips, which have formed daily “W” formations and could allow shares to retest their $88 support level very soon.

These three picks were LIVE trade recommendations made inside my online trading community, The War Room, which I founded with expert trader Karim Rahemtulla.

If you want to get our real-time buy and sell advice on our slingshot picks… plus our daily market analysis… and ALL of our other LIVE recommendations… we have something special to share with you today…

We have already given 1,000 winning recommendations since we started in May of 2019… and we’ve beaten the S&P by an astonishing 1,550% (enough to turn a $12,000 model portfolio into more than $101,000!)

In honor of this milestone, we are GUARANTEEING new members at least 300 winning recommendations in the next year…

Bryan BottarelliHead Trade Tactician, Monument Traders Alliance

Bryan Bottarelli started his career trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. As a so-called “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk. Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager. He now spends his days moderating one of the most elite trading research forums ever created, The War Room.