20 Stocks Paying Double-Digit Dividends in 2022

Joseph Hill|June 1, 2020

by Manward Research Team

Income investors are constantly hunting for yield.

It’s one of the most common things Manward Financial Digest readers ask about.

They want our expert opinion – honed over decades spent researching and writing about stocks, bonds and options – on where they can find the highest-yielding dividend plays today.

And we can see why…

Find the right stock – with the right dividend – and compound it, and you can set yourself up with a steady flow of income for life.

But… can there be “too much of a good thing” when it comes to high-yielding stocks?

Does a bigger payout inherently come with a bigger risk?

In this special report, we’ll address those key questions. We’ll also provide a list of 20 stocks paying 20% (or higher) dividends in 2022.

They’re among the highest-yielding investments trading on a U.S. exchange, with yields ranging from 20% to more than 50%…

In a world where CDs pay 1% and savings accounts pay virtually nothing… those figures are huge.

But before you start jotting down ticker symbols, it’s important that we get a few things straight…

Starting with exactly how, dividend yields are calculated.

It’s crucial Know-How for anyone looking to generate reliable income using stocks.

A Simple Formula That Says So Much

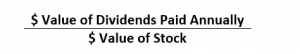

Dividends are paid out in cash, but a yield is expressed as a percentage. The formula is quite simple. It looks like this:

So if a stock is trading for $5 a share and pays a $0.05 dividend per share every quarter ($0.20/year), you’d divide 0.20 by 5, getting 0.04. The stock, therefore, pays a 4% dividend yield.

That’s all there is to it.

It’s worth noting that companies aren’t required to pay a dividend. For young and growing companies, it may not make sense to shell out profits that could be better used elsewhere. So the presence of a dividend doesn’t necessarily speak to the overall quality of a stock.

That said… a healthy and rising dividend can be a sign that things are going well for a company. If debts are low and steady cash flow is enabling handsome payouts to shareholders, then things are likely A-OK.

Though, as we’ll explore in just a moment, looks can sometimes be deceiving.

And while a sizable yield can be attractive, it shouldn’t be the only thing you consider when evaluating a potential investment.

Remember: Dividend investing isn’t about gettung a one-time payout. The goal should be steady income over a sustained period of time.

[Interesting fact: Warren Buffett’s stake in Coca-Cola (KO), the bulk of which he acquired in 1988 for $1 billion, generates more than $620 million in annual dividends. Now, mind you, that’s on top of the 2,000%-plus return Buffett’s enjoyed as a long-time Coca-Cola shareholder. It just goes to show how powerful a solid, rising dividend can be.]

In other words… if a company is paying a 4% dividend yield today, what assurance do you have that it will continue to pay that same yield (or, ideally, a higher one) in the future?

For that, we can turn to three reliable metrics…

Three Ways to Gauge Whether That High Yield Is Safe

- Dividend payout ratio (DPR). This is defined simply as total dividends divided by net income. It shows what percentage of the company’s earnings is making its way back to shareholders. If the DPR is low, it typically means the company is reinvesting in the business (not a bad thing for investors interested in growth…Tesla (TSLA) is a good example). But if the ratio is high, it could mean a few things. For example, if a company has steady and reliable income (like a government contractor or utility company), it can probably afford a higher payout ratio. However, if the company’s sales are less predictable (like a retailer or homebuilder), a high payout ratio could be unsustainable and, therefore, a red flag.

- Dividend history. We’ve all heard it before: “Past performance is no guarantee of future results.” That’s often true, but… a company’s dividend history is still a good indicator of how serious it is about rewarding shareholders. And tracking down this information couldn’t be easier. You can visit the investor relations section of the company’s website to find out…(a) Has it paid investors consistently?

(b) Has it raised its dividend on a regular basis?

(This information can also often be found, on Yahoo Finance and similar sites.) If the answer to one or both of those queries is yes, it’s a very positive sign for the stock.

- Dividend growth rate (DGR). If you prefer a more mathematical approach to gauging the safety of your dividend, this is it. The DGR is the annualized increase (or decrease) of a company’s dividend yield over a certain period of time. (five years is typically the period used.) Advanced traders use this figure, in tandem with a few other metrics, to determine whether a stock is undervalued compared with its (likely) future price. But on its own, the DGR is a helpful tool to use when sizing up multiple stocks in the same sector. If you’re looking at three energy companies, for example, and they all pay around a 3% yield, but one has a higher DGR… that would suggest it’s the better long-term bet for income.

Today’s Highest-Yielding Equity Investments

Like we said up top… income investors love a nice high yield. But not all high-yielding stocks are created equal.

You should be sure to do your own due diligence, and incorporate the tools we discussed here, before you get swept up in an investment that falls outside of your risk tolerance.

The 20 stocks listed below are some of the highest-yielding equity investments available. Some are worth your investment dollars, but others may be a bit risky for your taste.

That’s why I encourage you to keep an eye on your inbox for more ideas and commentary from Manward and its expert contributors. Follow our lead and you’ll be sorting the winners from the losers like a pro… and you’ll be well on your way to creating a strong, high-paying income portfolio.

For now, if you’d like more tips and strategies to invest smarter, profit more and risk less, be sure to check out the archives on ManwardFinancial.com.

Good investing,

The Manward Research Team

P.S. It’s a good time to be an investor. Stocks are at record highs. The economy is soaring. And many folks are getting rich. But the crazy part is… what’s happening is totally unnatural. As we explain here, the system is rigged (in our favor!). It has been since the 2008 crisis. And if you follow these five steps, the next few months could be very, very good to you.

20 Stocks Paying 20% (And Higher) Dividends in 2022

| Ticker | Name | Exchange | Yield | Cap |

| MPLX | MPLX | NYSE | 11.00% | 25.93B |

| IEP | Icahn Enterprises | Nasdaq | 14.60% | 13.49B |

| PSXP | Phillips 66 Partners | NYSE | 11.90% | 6.68B |

| SHLX | Shell Midstream Partners | NYSE | 14.47% | 4.99B |

| AM | Antero Midstream | NYSE | 14.03% | 4.12B |

| MFA | MFA Financial | NYSE | 43.53% | 1.82B |

| DKL | Delek Logistics Partners | NYSE | 10.21% | 1.53B |

| USAC | USA Compression Partners | NYSE | 14.01% | 1.45B |

| BPMP | BP Midstream Partners | NYSE | 11.12% | 1.31B |

| IVR | Invesco Mortgage Capital | NYSE | 38.60% | 904.92M |

| ORC | Orchid Island Capital | NYSE | 13.32% | 549.89M |

| SRLP | Sprague Resources | NYSE | 12.76% | 484.63M |

| HMLP | Hoegh LNG Partners | NYSE | 12.37% | 482.97M |

| TPVG | TriplePoint Venture Growth | NYSE | 11.00% | 432.66M |

| CTO | CTO Realty Growth | NYSE | 28.16% | 293.23M |

| OXSQ | Oxford Square Capital | Nasdaq | 13.20% | 225.63M |

| USDP | USD Partners | NYSE | 55.29% | 153.38M |

| GECC | Great Elm Capital | Nasdaq | 30.46% | 76.87M |

| NHTC | Natural Health Trends | Nasdaq | 12.08% | 76.65M |

| SIRR | Sierra Income | NYSE | 2133.33% | 3.08M |

*As of March 2021