Search Results for:

Monday Takeaways: Ride the Tiger, but Mind the Claws

The markets simply want to go up. Money is flowing into the markets… and earnings are beating estimates. Ride the tiger, my friends. But don’t forget that tigers have sharp claws.

The Q4 Rally Is Just Getting Started

Will the fourth quarter’s red-hot start continue? These three factors say yes. Get ready for a year-end rally.

Dealmaker’s Diary: A 60% Profit Gusher

This $4.7 billion parts supplier shows the potential for a 60% profit in less than a year!

Buy This, Not That: Should You Bank On JPM or BAC?

JPMorgan (JPM) and Bank of America (BAC) just kicked off earnings season. But which big bank stock should investors bank on?

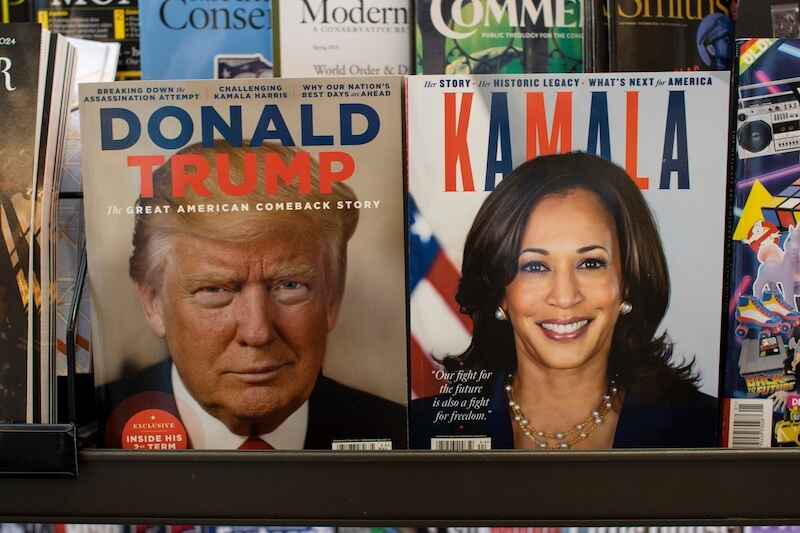

The BEST News About the 2024 Presidential Election

Candidates are spending like it’s going out of style. But no matter who wins in November… this one truth should put your mind – and portfolio – at ease.

Monday Takeaways: Stay Long, My Friends

Stay long, my friends. That’s the message from the markets right now. Will anything change their minds?

Just 24 Days to Go…

In 24 days, we’ll have another contentious election cycle behind us. And regardless what new regime we get, the markets can move forward with knowns rather than uncertainty.

The Biggest Driver of the Market

There’s a self-fulfilling narrative driving the markets higher… and it’s easy to trade on.

Dealmaker’s Diary: This Cosmetics Giant Paints a Pretty Picture

This cosmetics giant has a strong retail and online presence around the world… and a head-turning 71% profit margin. This just might be the perfect foundation for a beautiful investment.

AI’s Biggest Winners

There’s been much ado about whether AI hype is overblown. But the truth is… the AI fervor is still heating up. Especially for these three AI stocks…