Robert Ross's Archive

Robert Ross

Robert Ross’s unique style of clear and direct stock research helped him build a massive following in the investment research industry, starting his career at investment research company Mauldin Economics and quickly rising through the ranks to become one of the youngest chief analysts in the industry. Today, over a million investors turn to Ross every month for his take on investing, economics, and personal finance. Between his social media followers on TikTok, Instagram, and Patreon and profiles in Time, Business Insider, MarketWatch, and Daily Mail (London), Ross uses his platform to promote fundamentally sound investing habits for people of all ages. And now, he shares his unique insights in Total Wealth and Manward Money Report. Ross has a degree in economics from Loyola University New Orleans.

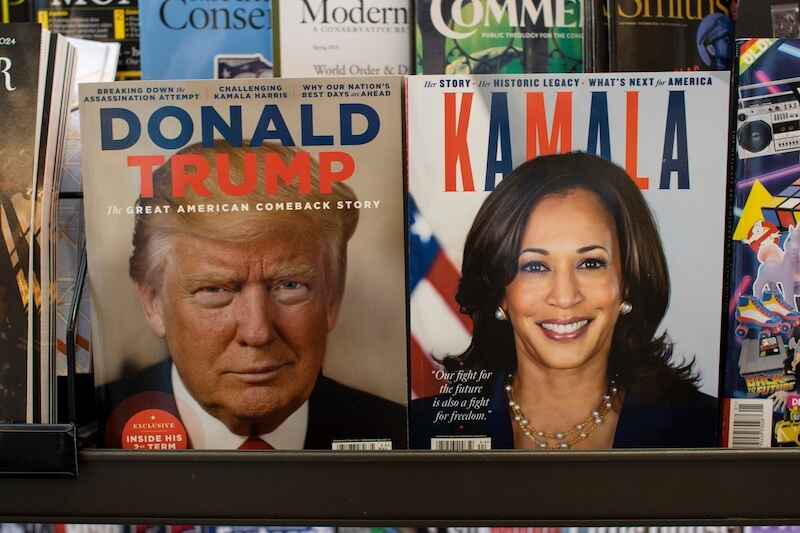

The BEST News About the 2024 Presidential Election

Candidates are spending like it’s going out of style. But no matter who wins in November… this one truth should put your mind – and portfolio – at ease.

This “Clock” Says It’s a Good Time to Invest

The economy, by design, is complex and chaotic. No one has all the answers, but what we do have are systems that improve the odds…

Sometimes a Rate Cut Is Just a Rate Cut

A 50-basis-point rate cut has historically meant a recession is coming… so why is this time different?

The World’s Most Powerful Banker Is Wrong About the Economy

JPMorgan CEO Jamie Dimon is a smart guy… but he has cried wolf so many times. So why should we listen now?

Unlock Your Election Investing Edge

The markets are following this pattern to a T. That’s why Robert is convinced more gains are to come. See how…

Don’t Be Afraid of the September Sell-off

When the leaves start turning and the weather begins to cool… it’s time to put our pessimist caps for a few months. Here’s why…

The Biggest Winner of the Fed’s Coming Rate Cut

Rate cuts in absence of a broader economic crisis are good for risk assets. They create a more favorable environment for stocks, particularly small cap stocks.

From Panic to Profits: Why a 10% Gain Is Just the Start

Stocks are back in the driver’s seat. And history shows the trend is likely still “up.”

This Is the Absolute Best Time to Buy Stocks

While everyone was panicking, the market just gave us one of its strongest historic “Buy” signals…