Archive

Monday Takeaways: Panic Sellers Just Gifted You AI’s Leader at Fire Sale Prices

This recent rollover has spooked the market, but at 8% of the S&P, any dip toward $150 is a gift. Here’s why the pullback sets up the next leg higher.

A Powerful Asset Class Bigger Than the Stock Market

U.S. exchanges now host more ETFs than individual stocks, creating market mechanics that work beautifully – until they don’t. When “authorized participants” step back, the “passive bid” becomes a passive bleed.

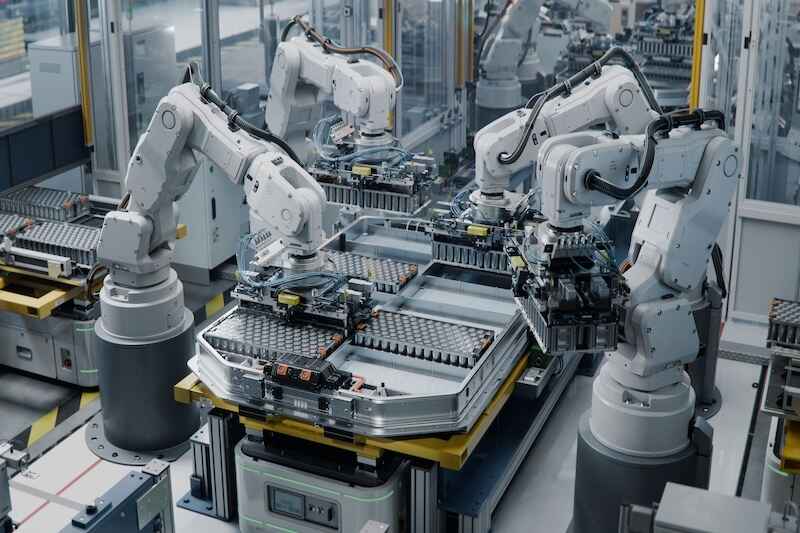

Dealmaker’s Diary: This $82 Billion Comeback Creates Rare Value Opportunity

This company died, got reborn, and emerged as an AI infrastructure giant. With $107 billion in revenue and trading 27% below fair value, this comeback story is just getting started.

Buy This, Not That: The “Better” Way to Own Gold at All-Time Highs

Gold just made a new all-time high. But if you want to own it, there are two popular ETFs to choose from. Only one gives you the better deal…

The Death of Free-Market Capitalism: How Washington Turned the U.S. Into China

From Intel’s $11 billion government investment to MP Materials’ Defense Department partnership, America is adopting China’s playbook of state-controlled capitalism – and taxpayers are footing the bill.

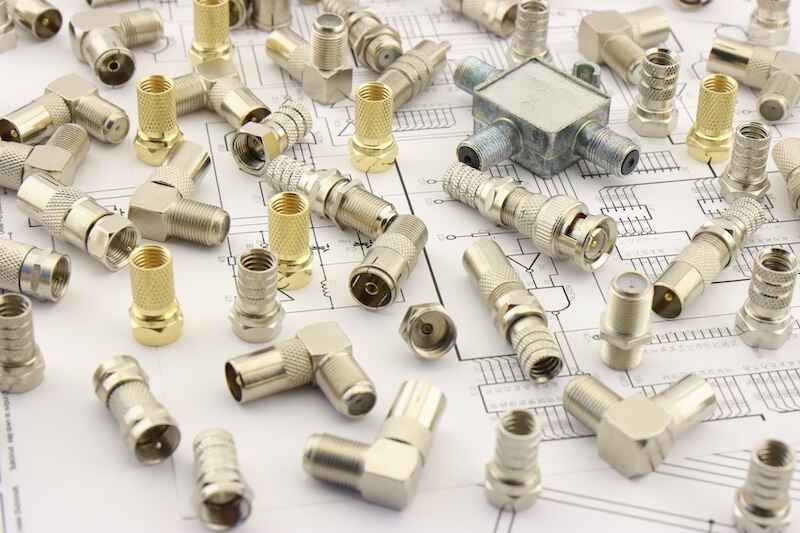

Dealmaker’s Diary: This Connector King Could Deliver 50% Returns With Low Volatility

While tech stocks swing wildly, this $135 billion infrastructure play proves that boring businesses can deliver exceptional returns with minimal drama.

Buy This, Not That: This Durable Goods Winner Could Fill a 15% Earnings Gap

Durable goods orders just posted their worst reading since April 2020. But one sector is rising while another crashes 9.7%. Here’s which stock could bounce back 15%…

Beyond Digital Gold: Why Ethereum Just Became Crypto’s Cash Cow

Ethereum has tripled off April lows with a 200% rally. Unlike Bitcoin’s store-of-value story, Ethereum is betting on utility – and the world is just starting to build on top of it.

Monday Takeaways: Jackson Hole’s Short Covering Frenzy Hides Inflation Reality

Powell’s dovish surprise triggered massive short covering Friday, but with Walmart and Target warning about tariff price impacts every week, this September rate cut narrative faces a harsh reality check.

Paying Up Makes Sense: The Case for High P/E Multiples in a Predictable Bull Market

The S&P 500 trades at 22.8x forward earnings – a 23% premium to historical averages. Old-school analysts call it frothy, but they’re missing the real story: investors are paying for certainty, not just growth.