Archive

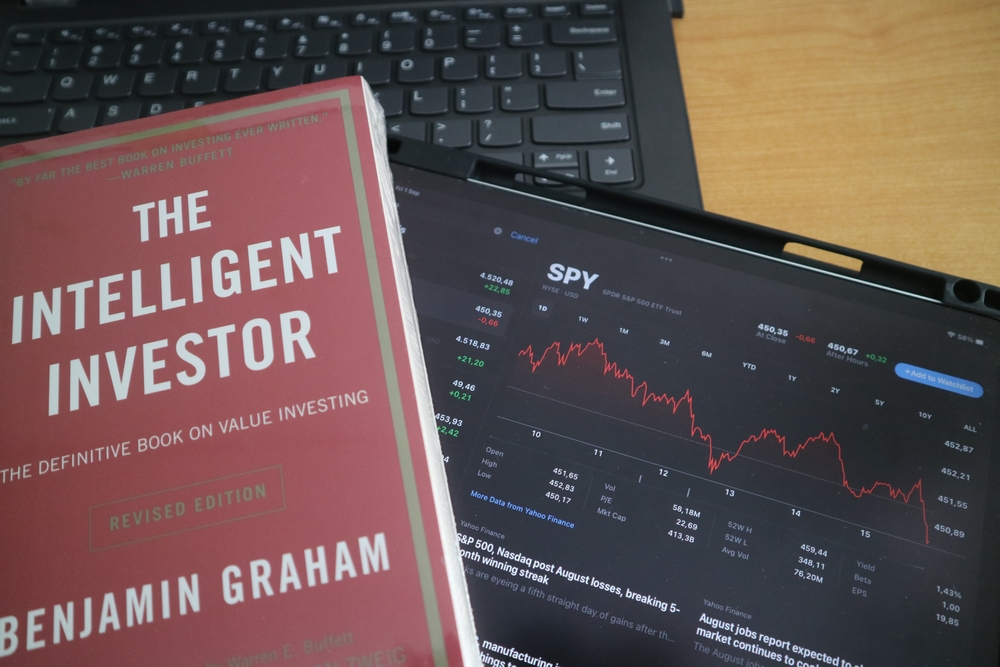

The Controversial Investing Strategy Billionaires Swear By

It flies in the face of two long-held investing beliefs… but if it’s good enough for Benjamin Graham, then it’s good enough for everyone.

How to Play the Oversold Utilities Sector for Profit and Avoid the Losers

One of the places where investors like to go looking for opportunities when markets are sideways (like they are now) is sectors that are extremely oversold. The logic is that oversold stocks, especially in business sectors that are evergreen, are ripe for a bounce as the stock price rebounds. So I’m not surprised that utility […]

A Misfit’s Investing Guide to Actually Getting Ahead

Anyone who has money in the market should check this out. It’s flies in the face of the mainstream way of doing things.

Now’s the Time for Contrarian Investing

People are very bearish right now. And there are some good reasons for that. But when you dig deeper… you see things aren’t as bad as the media makes them out to be.

What to Watch for This Week as Markets Continue to Struggle

Early on in my career as a trader, I learned something crucial, and it goes something like this: when there’s nothing to do, do nothing. The bottom line is, markets are shaky right now because investors are indecisive. There isn’t anything in the news or other emerging narrative that conveys a sense of enthusiasm about […]

Stock of the Week: A “Low-Tech” Contrarian Bet

Alpesh has his eye on a contrarian “low-tech” play… a surprising bet on the back-to-office trend.

China Is Headed for a “Lehman Moment” – Here’s What to Do

It’s Friday, so we’re going to have some fun. We’ll combine the premise of a popular 1970s movie with a tried and so-far successful policy prescription for averting financial disaster. All of this relates to what triggers an actual capital markets and global economic meltdown, because it all pertains to China’s imploding property market. The […]

The Biggest Threat to Your Wealth

A reader asked why we don’t keep politics out of our newsletter. The reason is simple…

Watch Out for This New Green Energy Darling

This is like creating a program to help bank robbers spend the money they stole. It’s idiotic.

The Smart Way to Play Consumer Discretionary Stocks Right Now

Markets remain in the doldrums thanks to a slew of narrative headwinds dampening investor confidence, whether it’s the Fed’s “higher for longer” stance on interest rates, pending concerns over a government shutdown, or continuing woes for an overextended banking system. There is a chance that we could get a short-term pop just on a mechanical […]