This “Smart Risk” Trade Keeps Winning Big

Robert Ross|December 5, 2023

Back in September, I told you about three high-upside opportunities I had on my radar.

I hope you were paying attention…

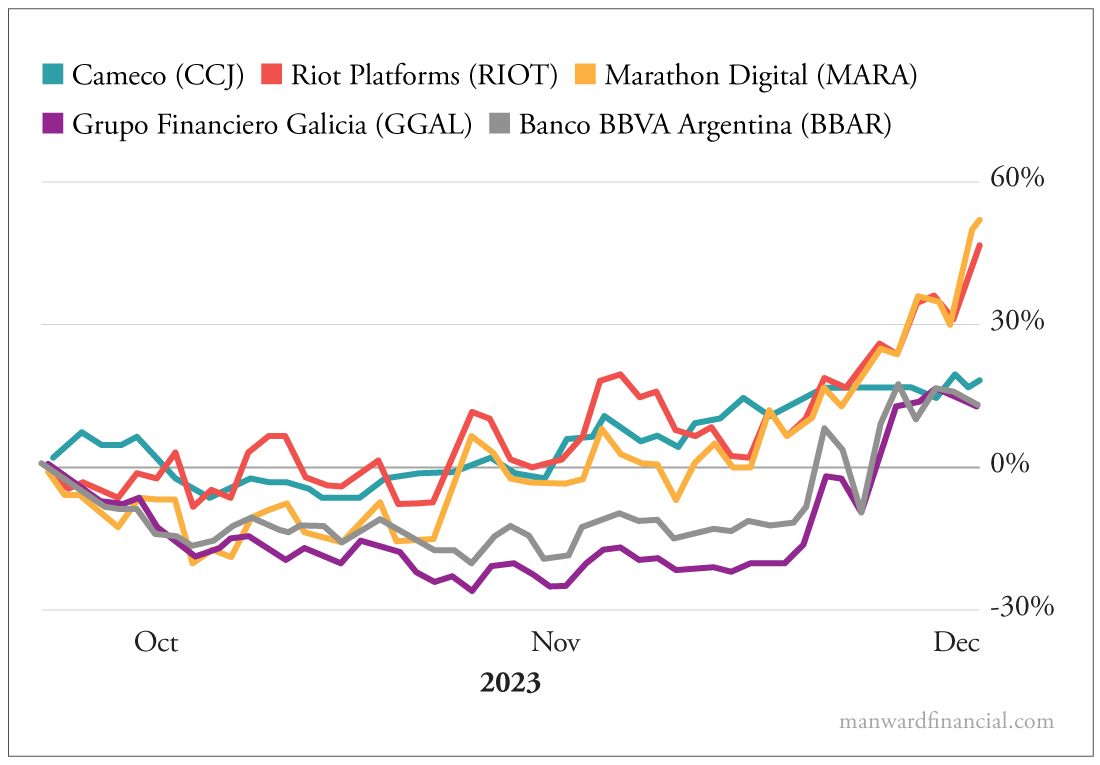

Because the five stocks I mentioned in that piece have gone up an average of 21% since my essay hit your inbox…

That’s about four times the 5.4% return the S&P 500 has produced over the same period. But there’s one trade I’d like to dig into even deeper today.

Another Casualty of Unbridled Socialism

I’ve traveled to more than 35 countries.

On one trip, I spent over a month working in Argentina. While the nation is often celebrated for its culinary delights like steaks and mate tea, it is home to one of the world’s most mismanaged economies.

The main culprit behind this economic trouble is Peronism, a populist movement that sought to assert state dominance in economic affairs. It promoted nationalist ideals and emphasized the state’s role in various industries.

The nationalization of key industries, protectionist measures and an intrusive state presence in economic activities may have had short-term populist appeal. But they led to long-term consequences such as economic mismanagement, currency devaluation and a volatile business environment…

Not to mention an inflation rate over 100% and two sovereign debt defaults.

But it looks like that all may be coming to an end thanks to newly elected President Javier Milei.

“Shock Therapy” for Argentina

Argentina’s colorful new president has an interesting agenda.

While he has only two years of experience as a national legislator, he has a bold plan.

For instance, he claimed during his campaign that he wants to “dollarize” the Argentine economy.

This means the U.S. dollar would become the de facto currency of Argentina. It also means the country would disband its central bank – another campaign rallying point for Milei and his followers.

Dollarization has its issues, the most pressing of which is that it forces countries to relinquish control of their monetary policy to the Federal Reserve.

But considering how well it’s worked in other Latin American countries – like Ecuador and El Salvador – Milei and the Argentine people are happy to give it a try.

The U.S. Dollar to the Rescue

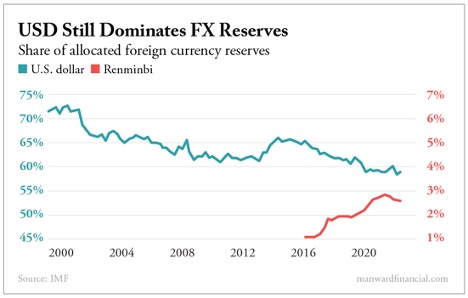

I know “de-dollarization” is a sexy theory in finance these days.

It’s the idea that the rest of the world is moving away from the dollar because the U.S. weaponized it after Russia invaded Ukraine… because our debt is unsustainable… and because the currency is on its way to becoming the next Roman aureus.

But as I’ve shown you, I don’t think this argument is sound. International transactions in U.S. dollars hit an all-time high this year…

And the dollar is by far the most common currency in global reserves…

This is a key reason struggling countries like Ecuador and El Salvador have turned to the dollar.

Ecuador adopted the U.S. dollar as its official currency in 2000, following a severe economic crisis. Dollarization helped stabilize the economy, control inflation and attract foreign investment.

In 2001, El Salvador officially adopted the U.S. dollar as its legal tender. Dollarization was intended to address hyperinflation and economic instability. It brought about a period of relative economic stability.

Argentina will likely be the next country to try it. And that’s good news for Argentine banks.

The Best Way to Play Argentina’s Dollarization

Argentina getting its fiscal house in order will benefit the country’s banks for a few reasons.

First is currency stability. A stable U.S. dollar fosters a more secure environment for financial transactions and encourages both domestic and foreign investors to engage with the banking sector.

Second, dollarization has the potential to alleviate inflationary pressures (as it did in Ecuador and El Salvador). Reduced inflation allows banks to plan and execute lending strategies more effectively, creating a conducive environment for economic growth.

Lastly, a “dollarized” Argentina will attract foreign investment by creating a more predictable economic landscape. A stable currency and reduced inflation risks would make Argentine banks more appealing to international investors. An increase in foreign investment would infuse capital into the banking sector, enabling banks to expand their operations and support economic development.

As Argentina considers the bold move toward dollarization under President Javier Milei, the potential positive outcomes for the banking sector are clear. This should benefit Argentine banks like Grupo Financiero Galicia (GGAL) and Banco BBVA Argentina (BBAR)… which I told you about in the September essay I mentioned above.

Both banks have gone up by double digits since then.

While challenges and risks remain, the proposed measures aim to address long-standing economic issues and create an environment where financial institutions can thrive.

While much of the optimism has already been priced into Argentine banks, it’s a trend I’m keeping on my radar for now.

Robert Ross

Robert Ross’s unique style of clear and direct stock research helped him build a massive following in the investment research industry, starting his career at investment research company Mauldin Economics and quickly rising through the ranks to become one of the youngest chief analysts in the industry. Today, over a million investors turn to Ross every month for his take on investing, economics, and personal finance. He now shares his unique insights in Total Wealth and Manward Money Report.