Bitcoin vs. Stocks: What the Charts Say

Andy Snyder|March 8, 2021

Something is stirring in the markets.

Interest rates are surging. The repo market – which serves as the backbone of the banking industry – is getting shaky. And in Japan, the publicly traded shares of its central bank mysteriously soared higher last week… before crashing.

In Japan, investors are thinking the odd action is in anticipation of news out of a big policy meeting on March 19.

In the United States, investors are praying the Fed does something bold during its own meeting on March 17.

Clearly the world of money is getting anxious. It needs its addiction fed.

The Doge Joke

Meanwhile, billionaires are having a bit of fun with it all.

“It’s just money,” they say. “They’re printing more of it all the time.”

Mark Cuban – the outspoken owner of the Dallas Mavericks and future presidential candidate – announced last week that his team will now accept Dogecoin (DOGE) as form of payment for game tickets and merchandise.

The same fella who told GameStop (NYSE: GME) gamblers to hold “if you can afford to” is opening the doors to a joke cryptocurrency largely because, well, it’s all fake anyway.

“Sometimes in business you have to do things that are fun,” Cuban said. “Because we can, we have chosen to do so.”

That says something about all of this.

It says a lot about all the monetary manipulation and its effect on the markets, your retirement and your way of living.

“Keep holding if you can afford to,” the folks at the top say. “If not, well, thanks for the chuckle.”

Warren Buffett shared his thoughts on the situation in his latest letter to shareholders.

That’s where he wrote, “Retirees face a bleak future.”

He blamed, of course, the same thing we blame. He says it’s record-low interest rates – particularly the fact that bond yields are negative when we dare to factor in inflation – that make it nearly impossible for folks to build up a retirement that doesn’t rely on government handouts.

Take risk… is the message from the puppeteers. Or else go broke.

Painting the Picture

But when we look at the latest charts, we can’t help but wonder whether the risks we think are risky… are risky enough.

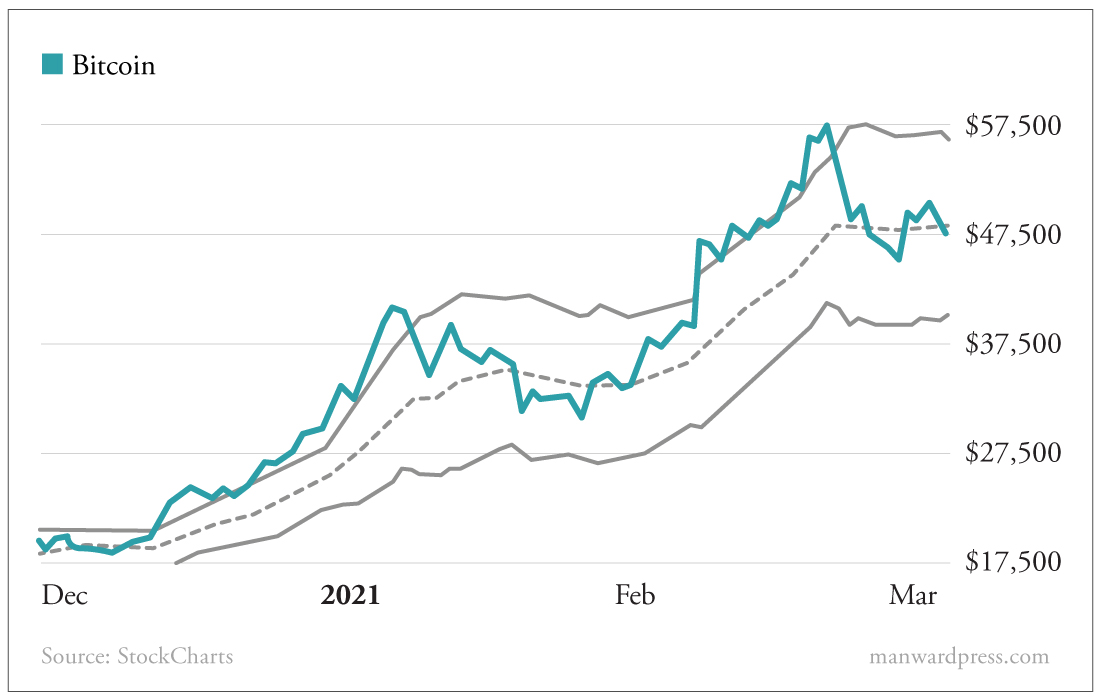

Right now, for example, Bitcoin’s chart looks a whole lot more appealing than what we’re seeing from the oh-so-mighty S&P 500.

The former is staying between the lines…

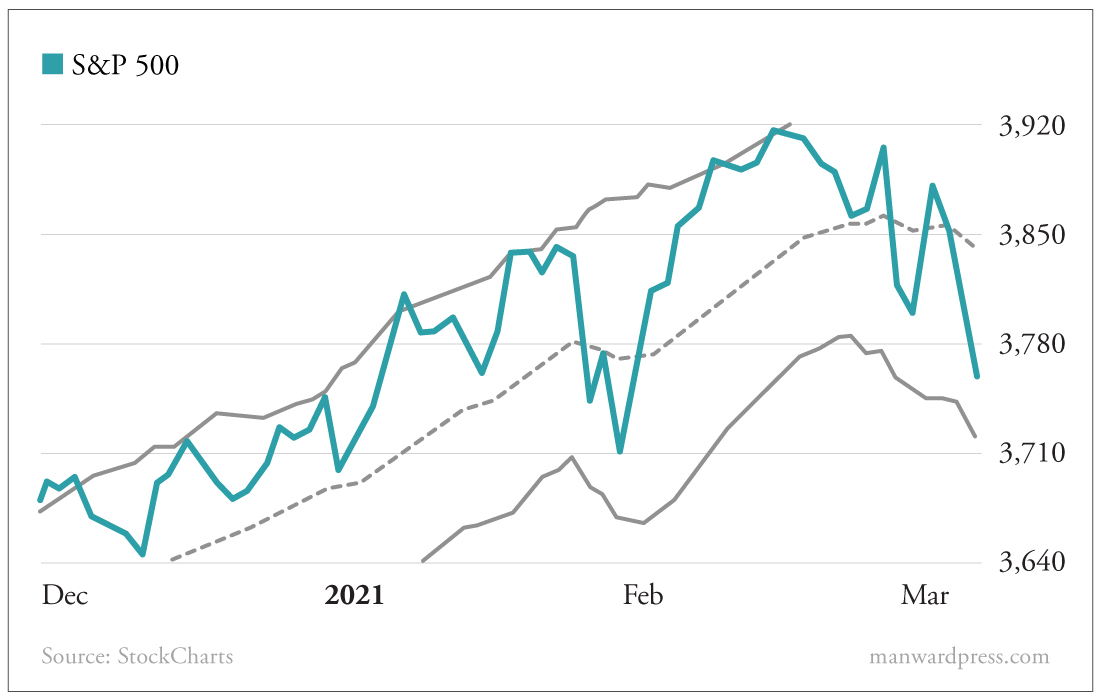

The latter is not…

Using the charting criteria we use in our popular Codebreaker Profits research service, high-risk Bitcoin is clearly the stronger asset.

Through the end of last week, it has steadily maintained its status as a bullish momentum play. The line on the chart that represents its mid-channel average has proven to be a long-term level of support.

That’s not the case for the broad stock market, though.

It performed beautifully through much of the winter… while interest rates hardly budged. But now that rates are rising, its mid-channel support appears to have turned to resistance.

It’s not a good sign.

The week ahead will tell the tale. If the S&P can climb back above that dotted line, our risks in the stock market will continue to reward us.

If not – if rising rates continue to sink stocks – Mr. Buffett will be proven right. And Mr. Cuban will be laughing all the way to the bank.

Create a Different Future

The facts these days are clear.

Bonds will cost you money.

Stocks won’t climb without more intervention.

And digital gold is screaming, “Look at me!”

We say the best solution is to change the way you allocate your wealth. The old way of doing things clearly won’t work. It’s why we created our Modern Asset Portfolio – the model portfolio at the center of Manward Letter. It tosses away the worn-out rules of yesterday and focuses squarely on what’s really moving markets.

Right now, it’s begging us to buy assets that outperform when inflation is high and interest rates are low – that’s buyback stocks, tech disruptors and, of course, crypto.

Buffett is right. Retirement looks bleak for many.

But it doesn’t have to be.

Think and invest differently.

P.S. Late last year we released an in-depth presentation about the Federal Reserve’s big meeting on March 17. It’s now just days away. Which means it’s now or never if you want to get ahead of this news. Get all the details here.

Have you been loading up on the types of stocks Andy has been recommending? Tell us about it at mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.