Recession

Two COVID-Era Stocks Feeling the Fed’s Sting are Today’s Top Plays

As the Fed raises interest rates, easy access to cheap money is drying up, and companies that don’t make a profit, burn through cash, and rely on borrowing cheap money may be forced to default on interest payments without the possibility of refinancing. This week, I want to focus on two companies that could feel […]

Looking for an Investable Market Bottom? Check This Out

The bear market boundary has been breached. With the Nasdaq Composite, the Nasdaq 100, the Russell 2000, and the S&P 500 (based on its May 20, 2022 intraday lows) are all 20% off their most recent all-time highs, many of you came to me with questions. How low could we go? When will we reach […]

Don’t Buy Increasing Predictions of a Recession: Do This Instead

More analysts, economists, and former Federal Reserve officials are predicting a recession – one that will stagger the U.S. economy. That’s frightening investors into selling profitable positions and going to the sidelines.

I say they’re wrong, and getting out of the market now is a mistake, and I’m telling you why in today’s edition of Total Wealth.

Don’t Fall for Fake News About the Inverted Yield Curve

Claims that we’re 100% heading into a recession (because the never-wrong inverted yield curve says so) are fake news. This time the recession indicator is wrong.

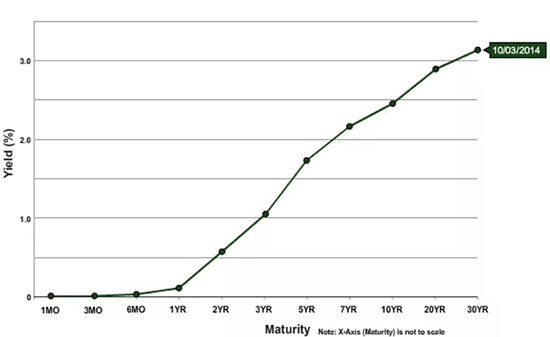

The yield curve is a simple concept. It shows graphically what different maturity bonds pay investors in terms of the yield (or interest rate) they pay.

Super short maturity instruments, like the fed funds rate (the interest rate banks charge each other when they lend money), yield very little because the loan is only overnight. The risk of default in a day is infinitesimally small. The yield on a 6-month T-Bill would be higher due to investors lending money to the government for 6-months also wanting more interest. The yield on a 2-year Treasury note would be higher because of the longer maturity of the loan. The 10-year yield would be higher still. And so on, out to 30-year bonds.

When graphed, these yields typically slope upwards like the Treasury yield curve shown below.

The yield curve is said to be inverted any time the yield on a shorter-dated maturity is higher than a longer-dated maturity instrument – in other words, a reversal of the chart above. What everyone’s panicking about was an inversion of the U.S. Treasury 2-year note and U.S Treasury 10-year bond (referred to as the 2s and 10s in Wall Street Parlance).

Over the past 30-days, the yield curve (as measured by 2s and 10s) has inverted a couple of times. At some points, this inversion was only by a few points or a few tenths of a percent, but an inversion nonetheless.

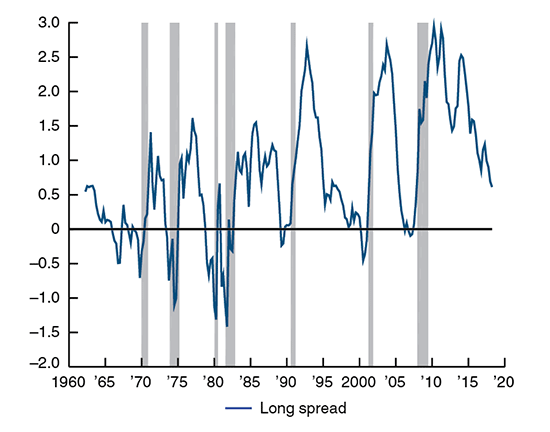

And this is concerning to some because, historically, whenever the curve inverts (even by a tiny amount), a recession follows. That’s what’s making headlines now.

The graph below shows the spread between 2s and 10s in the blue line. Whenever the spread goes negative, a recession (the gray longitudinal bars) occurs. So, it’s been a pretty good indicator so far.

But dare I say, “this time is different.”

Click here to learn why and how to position yourself to play what’s really happening.

Markets Are Telling Us They Want To Go Higher: Here’s What to Do

There’s a difference.

A rally won’t let you down. In fact, a rally will give you an opportunity to make money, hand over fist, four days a week… and it only takes one hour per day.

My friend and colleague, Andrew Keene, has devised a system that can make you four-figure windfalls, every day, four days a week.

And it only takes an hour, every day.

You don’t have to take my word for it. Just ask Steve Milton, who made $250,000 with Andrew’s system.

Or Carrie Saunders, who made $3,000… three days in a row.

Or Mark Befano, who made $706,000 in only one year.

Andrew’s system made it possible for these folks to grab mind-boggling windfalls, and he can do the same for you.

He’s willing to share his secrets, all you have to do is click here.

Now, here’s what the market’s trying to tell us.. and what to do about it right now…

Look Out Below: The Mortgage Market Is About to Revisit 2008 Crisis Woes

If you thought the worst of the financial crisis was way behind us, you’re about to get a rude awakening.

Mortgage Massacre 2.0 is right around the corner.