Uncategorized

Your Latest Buy, Sell, or Hold Now Available (Transcript Inside)

This week, Twitter, Delta, and JP Morgan Chase have all been in the spotlight – and many of you are asking: What should we do with these stocks? Buy? Sell? Or hold on to our shares? Well, in today’s BS.H, I answer just that. Click the video below to watch my full analysis of each […]

The Latest in Fake News: Inflation Has Peaked

On Tuesday, when the March reading of the headline Consumer Price Index (CPI) came out hot, but a tad less than jacked up expectations, stocks rallied. On Wednesday, when the Producer Price Index (PPI) came out hotter than hot, stocks jumped higher. Why? Well, the crazy reason is traders and investors are following a ridiculous […]

Plant Your Love and Let It Grow with this Fertilizer Stock

Fertilizer prices are through the roof.

According to the USDA, over the past year, urea, liquid nitrogen, and anhydrous ammonia (three kinds of commonly fertilizers) grew 149%, 192%, and 235%, respectively. For farmers worldwide, this unexpected consequence of the Russia-Ukraine War has a steep cost – but they will pay it.

Why? Because they have no other choice. They need it and, as a result, fertilizer companies are hitting it out of the park, especially the one I am recommending in today’s video.

Click the video below to learn how to play CF Industries, or click here to read the transcript.

Russian Threat to U.S. Cyber Security Will Send This Company into Hyperdrive

With sanctions on Russia ramping up, security experts warn that a retaliatory cyber-fight could be coming to the West. Whether or not a full-blown cyberwar with Russia ever materializes doesn’t matter from a short-term trading perspective. All that matters is the cyber threat narrative driving stocks higher. Case in point, the iShares Cybersecurity and Tech […]

Don’t Fall for Fake News About the Inverted Yield Curve

Claims that we’re 100% heading into a recession (because the never-wrong inverted yield curve says so) are fake news. This time the recession indicator is wrong.

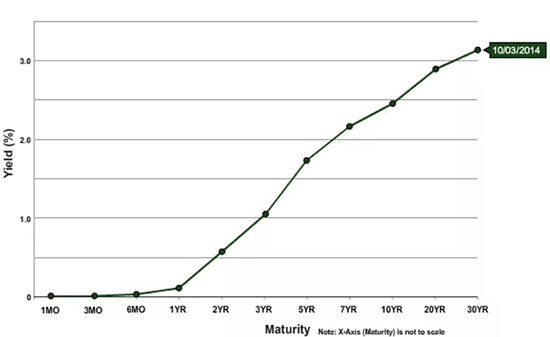

The yield curve is a simple concept. It shows graphically what different maturity bonds pay investors in terms of the yield (or interest rate) they pay.

Super short maturity instruments, like the fed funds rate (the interest rate banks charge each other when they lend money), yield very little because the loan is only overnight. The risk of default in a day is infinitesimally small. The yield on a 6-month T-Bill would be higher due to investors lending money to the government for 6-months also wanting more interest. The yield on a 2-year Treasury note would be higher because of the longer maturity of the loan. The 10-year yield would be higher still. And so on, out to 30-year bonds.

When graphed, these yields typically slope upwards like the Treasury yield curve shown below.

The yield curve is said to be inverted any time the yield on a shorter-dated maturity is higher than a longer-dated maturity instrument – in other words, a reversal of the chart above. What everyone’s panicking about was an inversion of the U.S. Treasury 2-year note and U.S Treasury 10-year bond (referred to as the 2s and 10s in Wall Street Parlance).

Over the past 30-days, the yield curve (as measured by 2s and 10s) has inverted a couple of times. At some points, this inversion was only by a few points or a few tenths of a percent, but an inversion nonetheless.

And this is concerning to some because, historically, whenever the curve inverts (even by a tiny amount), a recession follows. That’s what’s making headlines now.

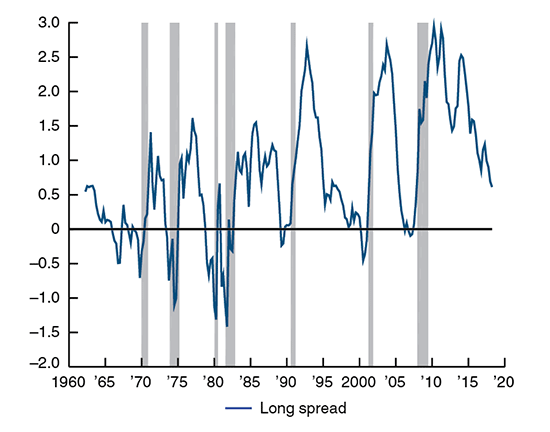

The graph below shows the spread between 2s and 10s in the blue line. Whenever the spread goes negative, a recession (the gray longitudinal bars) occurs. So, it’s been a pretty good indicator so far.

But dare I say, “this time is different.”

Click here to learn why and how to position yourself to play what’s really happening.

China is ‘Uninvestable’? Not When This Tech Stock Has a 100% Profit Potential

Last year, some analysts condemned Chinese stocks listed on U.S. exchanges as ‘uninvestible.’ But I didn’t buy that claim. Yes, Chinese regulators had sent a clear message to those companies: You can’t do anything we don’t want you to do. You can’t share data with anyone we don’t want you to. And if you do, […]

Ride High on These Three Chinese Stocks As Retail Drives Them Higher

It has been two years since then-U.S. President Donald Trump vowed to hold foreign companies accountable, demanding audited financials from all companies listed on U.S. exchanges – including the Chinese ones which, until then, didn’t have to submit audited financial and never did.

The response to this policy became a “cold war” fought on the front-lines of securities trading. High-quality stocks like BABA, DIDI, and NIO, some of my favorites to come out of China, were beaten down. IPOs were postponed. But, regardless of Chinese Central Government’s retaliation, the deadline was set.

All non-compliant businesses would be removed from the New York Stock Exchange and Nasdaq by 2024 – and it seems that Chinese authorities have started to give in.

On Friday, investors learned that they are preparing to give U.S. regulators full access to auditing reports of the majority of the 200-plus companies listed in New York, as soon as this Summer.

There’s no way of knowing how serious Chinese authorities are, regarding the matter, but that didn’t stopped traders from driving shares of Chinese stocks higher in Friday’s session.

Given the fact that Chinese stocks have been significantly beaten down over the last 18 months, I think we have a pretty good short-term trading opportunity to catch a ride as retail traders look for new trades.

Close the Books on Deutsche Bank, Put Your Money Where It Really Counts

Russia’s unprovoked invasion of Ukraine has made waves throughout the world, politically and financially – and they are taking their toll.

It is looking grim for European economies and a recession may be on its way.

In the last week, German economists have urged business and households to dramatically cut back their energy use. Christine Lagarde, president of the European Central Bank, went so far as to tell European households to become more pessimistic and cut back on spending.

To those of you asking me about the European finance sector, here’s your answer: don’t touch it with the ten-foot pole. There is a better option that could bolster your portfolio.

Watch the video below to learn more or…

Capital Moves Markets, Psychology Moves Capital, and You Take it to the Bank (Two New Plays Inside)

As complicated as the world and markets are now, there are ways to make money on what’s happening, ways to play volatility, ways to trade that will make you a successful investor for the rest of your life. I know because I’ve been doing it for 40 years, and I’m raking in big gains in […]

Money Morning Monday 03/28/2022 Transcript

Good morning, everybody. Shah Gilani here. Hope you all had a good weekend. Hope it’s going to be a good week. It’s going to be an interesting one because every week, so far, this year has been interesting. And certainly, I expect the volatility in the market will continue. So today I just want to touch base with you guys on a bunch of your questions. I’ve got a few of them that certainly are great questions. Most of them are really good questions. And there’s a lot of questions you guys have about particular stocks. I’m going to save my, I want to call a sort of a lightning round towards the end. It’s going to be 20 minutes, half an hour, call here, and I’m going to go over all of the stocks that I have, or most of the stocks that you guys have submitted.

So, there’s a bunch of them. And I know if you go into your Q and A box here in Zoom, you can post questions and I’ll try and get to those. Also, if you have some stock questions there, again, I’ll try and get to those towards the end of this call.

So, with that, let’s get started. Here are some of the questions that were submitted and I’m going to touch base on the market. And some of these in these questions, as I address them, I will talk generally about probably the things everyone’s most interested in as far as where the market is now, where it’s likely to go and why it might do what I think it’s going to do.