Watch Out for China’s Value Trap

Robert Ross|August 24, 2023

I keep close tabs on market sentiment.

It’s a technique one of my investing mentors, Jared Dillian, taught me. And it’s made me lots of money, particularly during the COVID crash in 2020 and the FTX collapse in 2022 (more on that on a bit).

Market sentiment refers to the overall feeling that investors have about a particular stock, market or investment.

When the sentiment on an asset is low, that’s usually the best time to buy that asset (and vice versa).

And when I see headlines like the one below, my sentiment “Spidey sense” starts to tingle.

But as with any investment that looks cheap, we need to decide whether it’s a bargain… or a “value trap.”

The Worst of Times

More than 500,000 people follow me on social media.

So when the The Wall Street Journal runs a headline like the one above, I get a flurry of DMs like this:

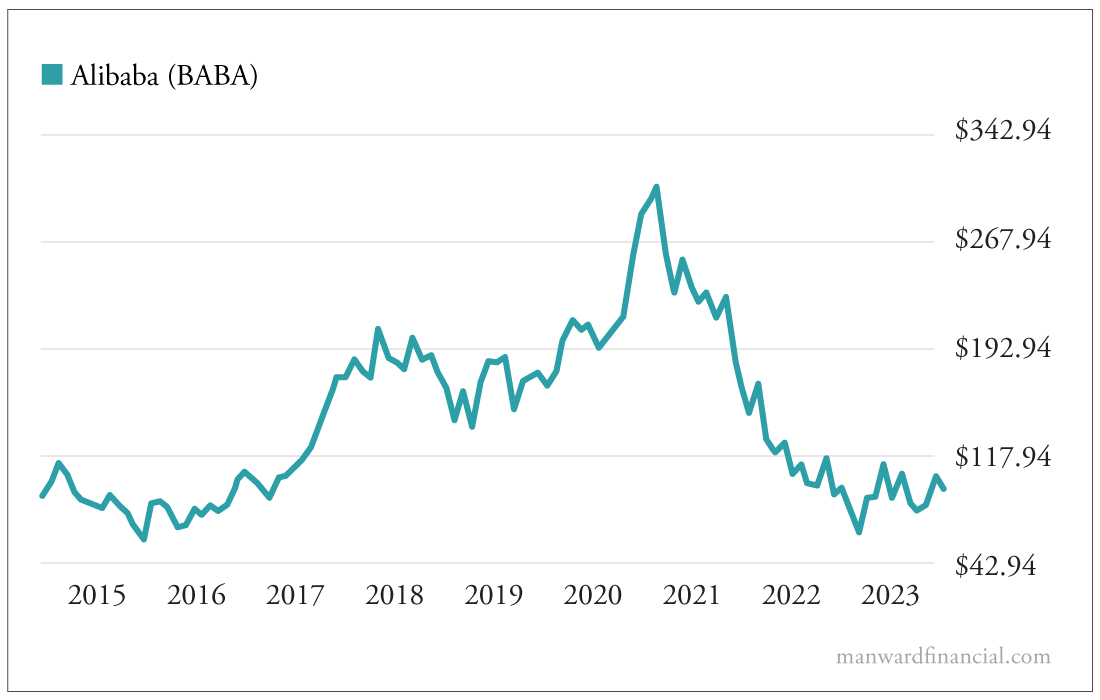

The reader who sent me this message isn’t wrong. Chinese stocks have been one of the worst-performing sectors over the last decade. Even Alibaba (BABA) – the “Amazon of China” – has delivered a mere 2% return since going public nearly a decade ago…

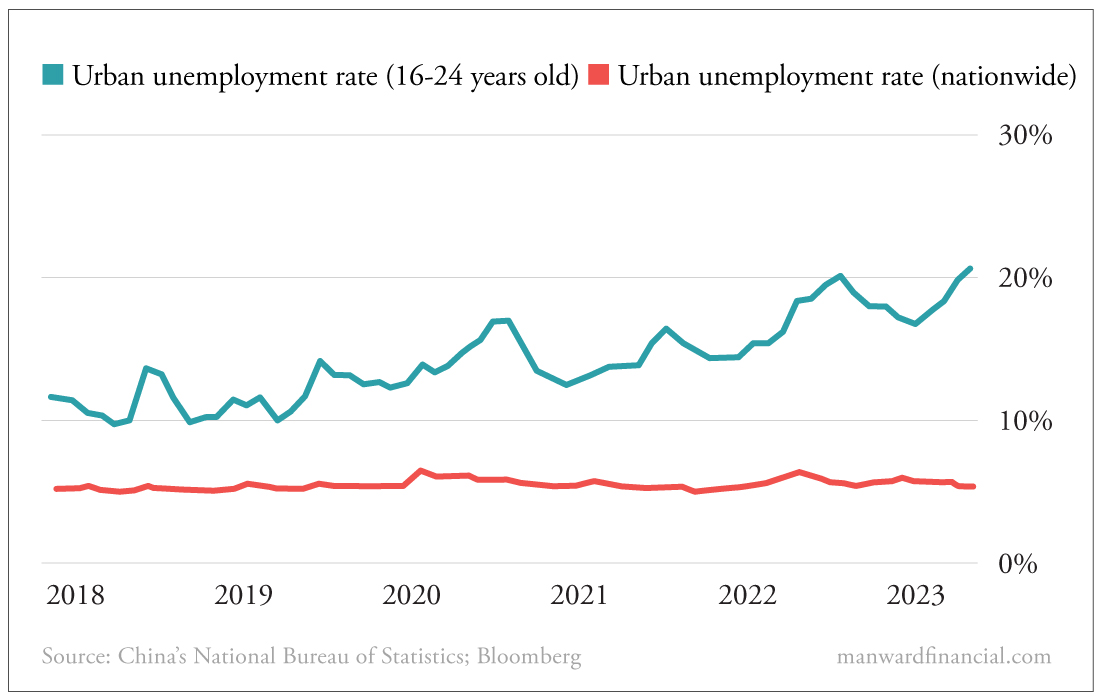

And my reader is right that the Chinese economy is in horrible shape. One of the country’s largest property developers – Evergrande – filed for bankruptcy last week. That sparked fears of financial contagion. And with retail sales cratering due to 1 in 5 Chinese youth being unemployed, the economy was already on edge.

Clearly, things are bad in China. And that’s been reflected in stock prices.

But that brings us back to our original question…

Is it time to buy?

Investing in the “Uninvestable”

Billionaire hedge fund manager Howard Marks says that whenever something is called “uninvestable,” it’s typically the best time to buy that asset.

When nobody wants to buy something, you get the best deals.

My favorite example of this idea is Bitcoin in late 2022. The crypto bear market bottomed with the collapse of FTX in November. At the time, nobody wanted to invest in crypto.

But in hindsight, it was the “sentiment low” – and the best time to buy.

.jpg)

The big question is whether that same logic applies to Chinese stocks right now.

Sure, they may be tempting because they look cheap and market sentiment is low.

But investors should stay away… for many reasons.

There’s Too Much Risk in China

The Communist Party of China (CCP) has grown increasingly hostile – both domestically and internationally – over the last five years.

Domestically, China’s dictator “president for life” Xi Jinping has unilaterally cracked down on Chinese tech companies. It started back in November 2020, when Alibaba founder Jack Ma criticized the Chinese government at an event in Shanghai.

Here’s what the Chinese government did to Jack Ma afterward…

- Canceled the Ant Group IPO (which would’ve been the world’s largest)

- Levied a multibillion-dollar fine against Alibaba

- Removed Alibaba’s app from the country’s app store.

But it didn’t end there.

The Chinese government soon went after the “Uber of China,” DiDi Global (DIDIY), days after the stock was listed on U.S. exchanges. The CCP then set its sights on Tencent Holdings (TCEHY), the country’s largest social media platform. Fines against Baidu (BIDU) and other consumer tech companies came soon after.

Even Chinese education companies were hit. Shares tanked as much as 80% overnight.

Conveniently, these were all U.S.-listed securities. Many non-Chinese investors were burned.

And it may happen again.

A Dangerous Game

It’s clear that the Chinese are going after only certain types of companies.

China has never cracked down on any “hard tech” sectors. These include industries like telecommunications, semiconductors and AI. Instead, it’s consumer-facing tech – like social media, e-commerce and gaming – that has been intentionally destroyed by the Chinese government.

It’s clear the Chinese government believes these “soft tech” companies are unnecessary… and even a net negative for society.

Xi Jinping said as much in a speech in 2021…

“We must recognize the fundamental importance of the real economy… and never deindustrialize.”

He’s made his agenda clear.

And finally… Americans who buy Chinese stocks typically don’t actually buy Chinese securities. Instead, they buy American depositary receipts (ADRs). While an ADR represents a share of a Chinese company, most ADRs are housed in the Cayman Islands and don’t give Western investors rights to the earnings these companies generate.

Unlike other downtrodden assets (like Bitcoin), Chinese stocks have unique factors that make them truly “uninvestable.”

While they may look cheap and be near a sentiment low, there are many risks hidden under the surface.

Knowing that, I wouldn’t touch Chinese stocks with a 10-foot pole.

Robert Ross

Robert Ross’s unique style of clear and direct stock research helped him build a massive following in the investment research industry, starting his career at investment research company Mauldin Economics and quickly rising through the ranks to become one of the youngest chief analysts in the industry. Today, over a million investors turn to Ross every month for his take on investing, economics, and personal finance. He now shares his unique insights in Total Wealth and Manward Money Report.