Buy This, Not That: The Zero-Commission Pioneer vs. the Established Giant

Robinhood just earned its spot in the S&P 500. But does that make it a better buy than Charles Schwab? The numbers might shock you…

Monday Takeaways: Panic Sellers Just Gifted You AI’s Leader at Fire Sale Prices

This recent rollover has spooked the market, but at 8% of the S&P, any dip toward $150 is a gift. Here’s why the pullback sets up the next leg higher.

Dealmaker’s Diary: This $82 Billion Comeback Creates Rare Value Opportunity

This company died, got reborn, and emerged as an AI infrastructure giant. With $107 billion in revenue and trading 27% below fair value, this comeback story is just getting started.

Fed Cuts Without Recession: This Rare “Goldilocks” Scenario Could Trigger a 300%+ Crypto Rally

Jerome Powell just confirmed rate cuts are coming – without a recession. History shows this rare combination has triggered the biggest crypto surges on record. Here’s how to position yourself before the flood hits.

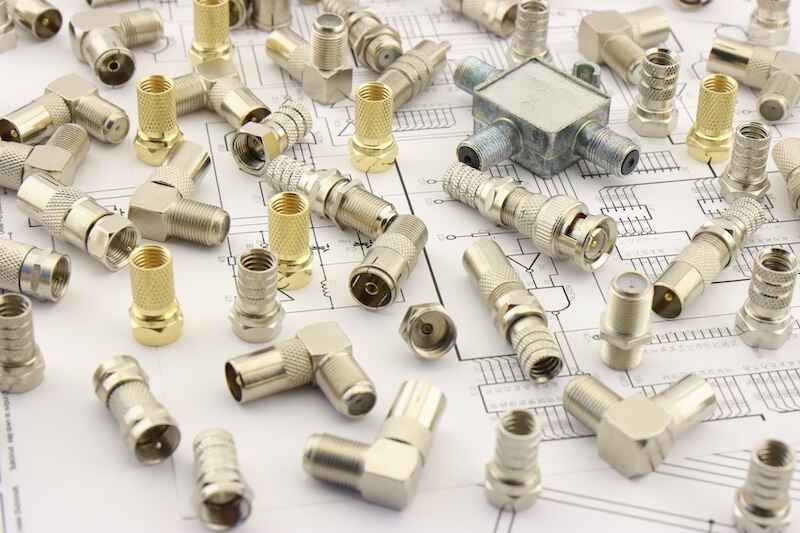

Dealmaker’s Diary: This Connector King Could Deliver 50% Returns With Low Volatility

While tech stocks swing wildly, this $135 billion infrastructure play proves that boring businesses can deliver exceptional returns with minimal drama.

Monday Takeaways: Jackson Hole’s Short Covering Frenzy Hides Inflation Reality

Powell’s dovish surprise triggered massive short covering Friday, but with Walmart and Target warning about tariff price impacts every week, this September rate cut narrative faces a harsh reality check.

Dealmaker’s Diary: How AI Turned This Cruise Company Into a Cash Cow

Seventeen billion dollars in revenue, AI optimization across every operation, and volatility below 15%. This isn’t your typical leisure stock – it’s a technology play disguised as a vacation company.

Buy This, Not That: Earnings Are In – Home Depot vs. Lowe’s?

Two of the biggest names in home improvement just reported earnings: Home Depot and Lowe’s. Both stocks jumped. But if you’re thinking about investing in one of these retailers right now… The choice is clear.

Monday Takeaways: Stocks at Record Highs – What’s Next?

The S&P 500, Nasdaq Composite, and Nasdaq 100 all notched fresh record highs last week… yet Wall Street is split. Are stocks “too good to be true”—or is the rally just getting started?

Dealmaker’s Diary: An Auto Parts Giant With an AI-Driven Moat

Predictive parts recommendations, dynamic pricing, and supply chain optimization aren’t just buzzwords – they’re competitive weapons. See how this $67B retailer is building a massive competitive moat.