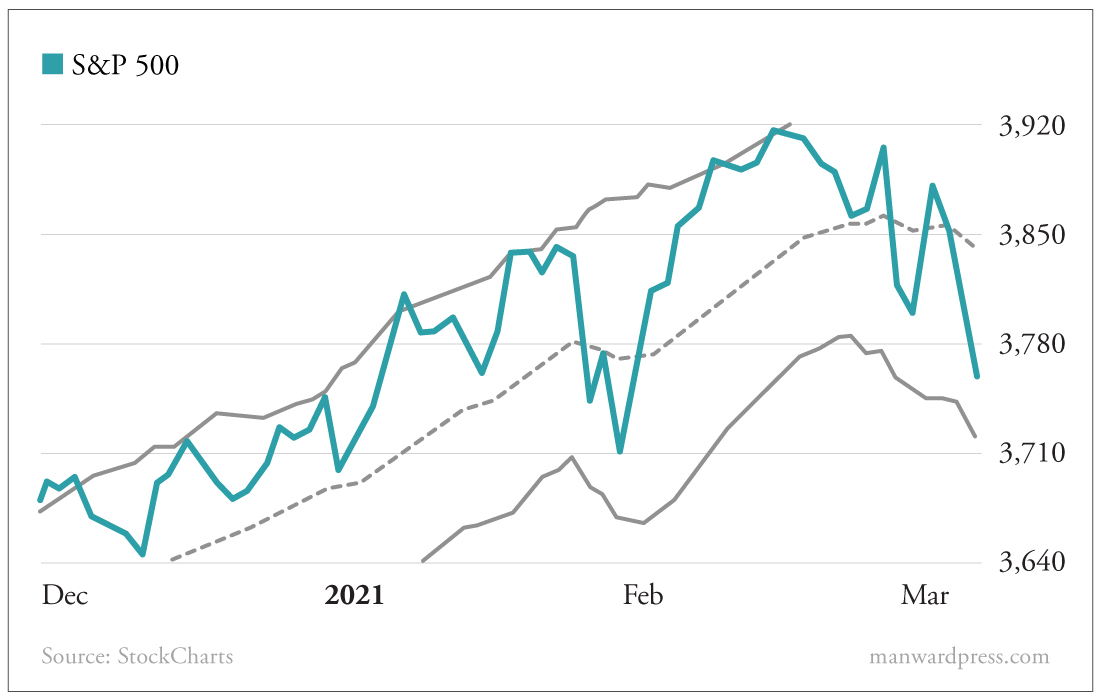

On Friday, I talked to you about the history of stock market crashes to show you that we have gone through hard times before, and the market has always been able to recover.

Today, I want to tell you what I’m doing to safeguard my wealth.

I’ve written about the stock market at least a dozen times over the past 10 years. And in each of those essays I’ve reminded readers that I don’t have a crystal ball, and that my guess about the market’s future is as valid as your next Uber driver’s.

In my lifetime as an investor, I’ve seen several serious bear markets. Had I been able to predict their tops and bottoms, I would have cashed out my stocks early, moved into cash and gold during the descent, and put back that and some more at the bottom.

But since I’ve never had a crystal ball, I’ve never tried to time the market. I’ve always taken the view that, while I can’t know how steeply the market may drop or how long the recession might last, sooner or later prices will return to their pre-crash peaks, and then continue to move up from there.

I should say, though, that this strategy makes sense only when the stocks you own are in large, profitable businesses that are antifragile, that have the resources a business needs to survive a crash and even an extended recession.

And, as long-time readers know, my Legacy Portfolio is populated exclusively with companies like that.

What Is the Legacy Portfolio?

It’s the easiest, safest, most consistently successful strategy for building wealth in the stock market.

The goal of the Legacy Portfolio is to accumulate shares of no more than 10-25 of the world’s best companies when they’re “on sale,” holding well into retirement. We adopt a long-term mentality, whereas most investors are reckless and trade in and out of stocks, chasing invisible returns. We plan to never sell. By doing this, we take advantage of the power of compounding, through price appreciation and growing dividends.

What About Buying Gold?

I bought a fair amount of gold back in 2004, when it was selling for $400 an ounce.

I didn’t buy it as a hedge against the dollar or the stock market. I bought bullion coins (mostly) as a “chaos” hedge. A stockpile of tradable hard assets that might come in handy if the world economy moved into another depression, like we had in the 1930s.

If we do see that economic era repeated, the value of my gold will almost surely continue to increase. But I’m not counting on that. Its purpose isn’t to compensate for the paper wealth I’d lose in stocks, but to be a form of insurance – “just in case” currency that I could use to buy necessities for family and friends.

Which raises the question: When and how do you buy gold? And the answer is, you buy it just like you buy any sort of insurance. Figure out the likelihood of the risk. Determine how much coverage you would need. And then decide if the premium you have to pay is worth it.

When I decided to buy gold coins, I bought enough of them (at an average price of $450) to sustain my family and my core business for a good length of time. I didn’t buy enough to cover historical expenses for many years. I bought enough to pay for the basics. And that helped me feel more secure.

But that was hardly all that I did to protect my family’s wealth against a stock market crash and a recession. It was just one piece of a financial structure I began setting up 40 years ago and began writing about when I started writing about wealth nearly 30 years ago.

What About Stockpiling Cash?

I like having a portion of my net investible assets in cash for all the obvious reasons – doing my own banking, using it for fast moving investment opportunities, and as part of my insurance program against crises like this one.

But that feeling is counterbalanced by the recognition that cash is generally a low- or no-return asset class and therefore having a lot of it means that I won’t be taking advantage of the historically high returns of the stock market, the real estate market, private equity, and private lending.

I don’t have a fixed number in my head about how much cash I should have at any one time. I let the markets make those decisions for me.

I don’t, for example, invest in rental real estate properties when I can’t find properties I can buy for less than eight times gross rent. Likewise I don’t buy any additional shares of Legacy Stocks when their P/E ratios are expensive by historical standards.

By adhering strictly to these sorts of value-based investing strategies I am effectively prevented from putting my new earnings into any one of them. And that means I end up accumulating lots of cash while these markets are expensive.

In the past half-dozen years, most stocks – including most of my Legacy Stocks – have been so expensive (relative to earnings) that I have not allowed myself to buy them. This means that the dividends I’ve been receiving for the stocks in my Legacy Portfolio have been going into my cash account. And that is okay with me.

I normally put a good chunk of my earnings every year into real estate. About 10 years ago I began selling off my individual units and moving into apartments, where I could get better yields with less hassle. But the number of such deals I could find has diminished to a trickle in the last three or four years. Again, by sticking to my valuation standards, I’ve been effectively locked out of these markets, too.

I have put some money into private debt and private equity. But only when I knew the borrowers and the businesses very well and felt sure my lending was secure.

In past essays on the stock market I’ve said that to make my wealth as antifragile as possible, I did my projections based on a stock market crash of 50%. When I first picked that number nearly 15 years ago, it seemed like quite a long shot. Today it doesn’t feel so crazy.

Now What?

As I’ve alluded to, my core investment philosophy mimics Nassim Taleb’s concept of “antifragility.”

In his bestselling book Antifragile, Taleb defined antifragility as the ability to not only survive, but also to benefit from random events, errors, and volatility.

My version of that is very simple…

I invest primarily for income, not for growth. That means rental real estate, bonds, private debt, income-producing equity and dividend yielding stocks. Depending on the economy, not less than 80% and sometimes as much as 90% of my net investible wealth is in income-producing assets.

I invest in what is proven today, not what might happen tomorrow. Investing in income-producing assets means investing in current facts, not future possibilities. This is, admittedly, a conservative approach to wealth building. I am willing to give up the potential for cashing in big on the upside for a smaller but virtually guaranteed return.

I don’t gamble. I am as tempted to invest in attractive speculations as the next person. But I’ve learned from experience that is a bad idea. My historical ROI for the speculation I’ve made is nearly perfect. I’ve lost almost all my money every single time. I will occasionally invest in a friend’s business. But when I do that I consider it a gift. I expect no return and usually get no return. So I limit those “investments” to how much I’m willing to lose.

I pay attention to value. I invest exclusively in income-producing assets, but that doesn’t mean I don’t pay attention to how much they are worth. As I said above, I invest in stocks when they are well-priced relative to their P/E ratios (among other metrics). I invest in real estate when I can buy properties that are inexpensive relative to their rental income. I buy debt when I can get a yield that is at least better than inflation, etc.

I hope for the best but plan for the worst. In terms of antifragility, nothing is more important than planning for the worst. Planning for the worst in good times allows you to survive and even thrive during the bad times. My worst-case planning began by imagining almost everything going wrong at one time. The market collapses. The economy moves into a deep recession. My businesses fail. The whole nine yards.

When you think that way, you have no choice but to include all the fundamental asset-protection strategies in your financial planning, as well as a few more.

Diversification. I won’t waste our time talking about the importance of diversifying financial assets. I don’t look at it as a theory. I see it as a fact. To achieve maximum antifragility, dividing one’s financial assets into different classes is rule number one.

Position sizing. In my humble opinion, position sizing (limiting how much money you put into any particular investment) is almost as important as diversification itself. When your investible net worth is relatively small you might have to limit individual investments to 10% of your portfolio. The goal, as you acquire wealth, is to reduce that percentage as you go along. These days I rarely put more than 1% of my net investible wealth in any investment.

Here’s a Look at My Portfolio

Stocks: I came into the stock investing game late. And cautiously. When I set up the Legacy Portfolio about 14 years ago, I invested what was at that time 10% of my net investible wealth in those stocks.

Thanks to the bull market that followed, my stock account doubled and stood, at the beginning of the corona crisis, at about 20% of the portfolio. That’s a good deal. But it’s still only 20%. So when the market is down 30% like it is today, that means my net investible wealth is down by 6%. If the market continues to fall to 50% – my worst-case scenario – then I’ll be down 10% overall. Not good, but not bad either.

My strategy for stocks is to hold on and wait for the market to recover. It might happen in six months (unlikely). It might happen in a year (possible). Or it might happen in 10 years (safe bet.) I’m hoping the return will be sooner rather than later, but I’ve planned for later so I’m not going to fret about it.

Debt: About 10% of my net investible worth is in debt instruments. My debt portfolio is diversified among bonds and private lending. Because of the private debt I’m getting decent returns – from 4% to 12% on most of my deals. For a while I’ve not been able to buy good debt at good prices. But that may change. If so, that’s where some of the cash will go.

Ongoing Enterprises: About 20% of my net investible wealth is invested in about a half-dozen private companies, ranging from $10 million to $1 billion. This is where I get the lion’s share of my current income. I’m very concerned that income may slow or dry up completely in the next year. If it does, I will have to turn to other income sources. In the meantime, I’m working hard to keep those businesses afloat.

Real Estate: About 40% of my net investible wealth is invested in real estate, and 80% of that is in income-producing properties in various locations. If all of these properties were leveraged, I’d be worried. But my debt on them is less than 5%. I may see diminished income, but in the worst-case scenario it will be a 25% drop, which would still be acceptable.

Hard Assets and Cash: About 5% of my net investible wealth is in hard assets like bullion coins, rare coins, and investment-grade art. These are last-refuge resources. For the time being I have not thought of tapping into them. That could change.

Cash: As I explained above, my cash position has grown in the past several years because my preferred income-producing assets have gotten pricey. I’m expecting that some time before this crisis is over, cash will be king again. I’m waiting for that.

So What Am I Doing?

I’m doing just about nothing right now. I’m not selling stocks. I’m not selling real estate. I’m not selling my businesses, my private equity. I’m not even selling my debt.

For the moment I don’t feel that I need to make any changes, because many years ago I put in these safeguards in order to protect my family’s wealth.

We are going to get poorer. That’s for sure. But I’m not making any changes because the way I diversified my assets 20 years ago seems to be giving me the protection I had hoped it would today.

What About You?

If you have been reading my writing these past 20 years and even loosely following my strategy, you should be in more or less the same position I am. If you feel good about that, as I do, then you will probably want to do exactly what I’m doing: mostly nothing.

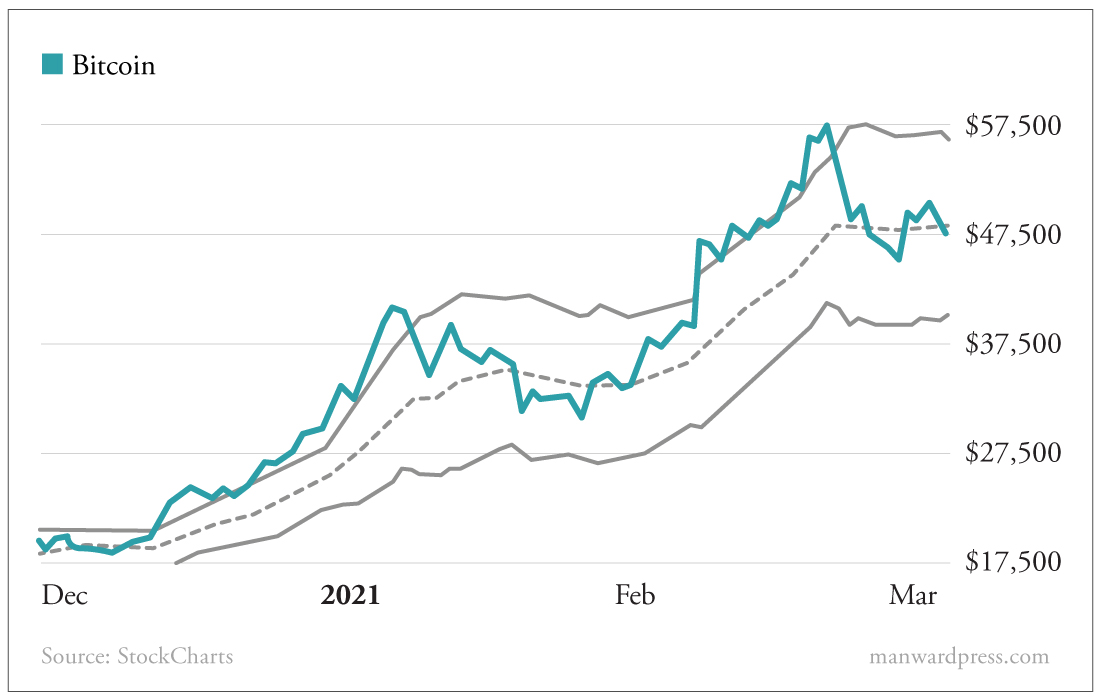

But if you aren’t diversified, and have the lion’s share of your money in cryptos or growth stocks – well then, you are going to have to listen to the advice of the people that persuaded you to put so much of your money in those deals.

And while you are doing that, don’t despair. And double down on your day job. Things will get better eventually and if you are getting better (investing smarter) in the meantime, you’ll be fine after it all shakes out.

Editor’s Note: Mark’s “chaos hedge” – gold – is entering a new and powerful bull market. So if you want to both protect and, more importantly, GROW your wealth in the coming years, then you need to check out what we’re calling the PERFECT gold investment for 2020. Click here to discover the BEST possible way to grow your money… with legally guaranteed returns of up to 109%!

Like what you’re reading? Let us know your thoughts at mailbag@manwardpress.com.