How to Play Inflation’s Next Move

Andy Snyder|June 21, 2023

Mother Nature is about to hand savvy investors a big gift.

Those who pay attention could profit handsomely. Those who don’t… well, it will cost them.

It’s dry throughout most of the country. Around our farm, the dog leaves a dust trail as he walks.

The situation is starting to get severe. For most of the country, 2012 was the last time there were severe drought worries. Most stats show the situation today is already worse than the price-hiking mess we saw back then.

The latest comparisons are to 1988… the agricultural world’s equivalent of the 2008 financial meltdown.

It’s the benchmark of benchmarks.

For opportunity-seeking investors, this spells a shot at profits – a shot that comes with quite a kicker.

Price Surge Ahead

In 2012, corn prices soared to more than 125% above their historical average as a drought slammed yields in the nation’s heartland. Soybean prices spiked to highs above $17 per bushel – figures we didn’t see even during last year’s war-induced price hikes.

Unless much of the nation gets consistent rain over the next few weeks (which isn’t looking likely), prices are likely to surge higher once again.

A quick jump of 25% to 50% is certainly possible.

It would push the Fed’s calculus off the rails and bring inflation back into the headlines – which would be bad news for stocks.

And there’s a kicker here… an idea that could push prices into unheard-of territory. It’s just now starting to make the news, but Vladimir Putin is once again threatening to shut off grain exports.

The Russian warmonger accuses his enemies of cheating on the deal they brokered last year. The pact has kept global trade flowing and pushed soaring grain prices back down. But that could change… quickly.

Even hints of the deal faltering over the next two weeks (the current agreement ends in July) would send prices surging.

It’d be a double whammy for anybody who eats.

Profits Raining Down

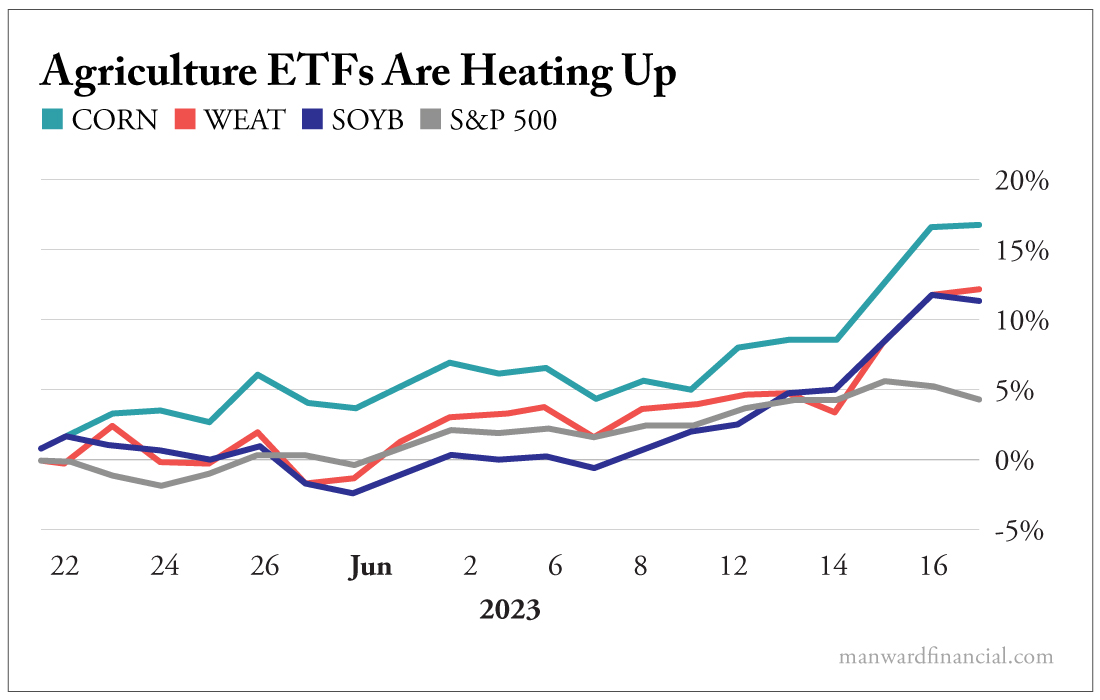

That means it’s time to go long on our nation’s biggest crops – corn, soybeans and wheat.

We’ve written about them before. Aside from bulky futures contracts, the easiest way to play rising prices in the ag sector is through a handful of ETFs from Teucrium.

The commodity trust offers a corn fund with the ticker CORN.

It has a soybean fund with the ticker SOYB.

And it has a wheat-focused fund with the ticker WEAT.

All three have had a strong couple of weeks. But unless we get some rain soon and Putin backs down, the action is just getting started.

This trio of funds offers a strong trading opportunity and a measure of protection from rising food prices and the many issues that will follow them.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.