Three-Part Super Trader Research Starter Kit

Manward Financial Research

INSIDE…

Part 1: How to Open a Brokerage Account

Part 2: Four Investments to Build a Rock-Solid Foundation for Your Portfolio

Part 1: How to Open a Brokerage Account

What to Prepare, What to Expect… and the One Online Broker to Avoid

You can’t become a “Super Trader” unless you, well, trade.

Fortunately, opening a brokerage account has never been easier. It takes less than 15 minutes. And your options are more bountiful than ever.

So if you’ve never created a brokerage account, pay attention. We’ll walk you through the entire process, from beginning to end… starting with everything you need to get the ball rolling.

For this example, we’ll use Merrill Lynch. But the process and requirements are nearly identical at every popular broker – whether you sign up with E-Trade, Fidelity or Robinhood.

[Note: Manward Press has no ties with Merrill Lynch. This is not an endorsement of Merrill or its trading platform.]

What You Need to Get Started

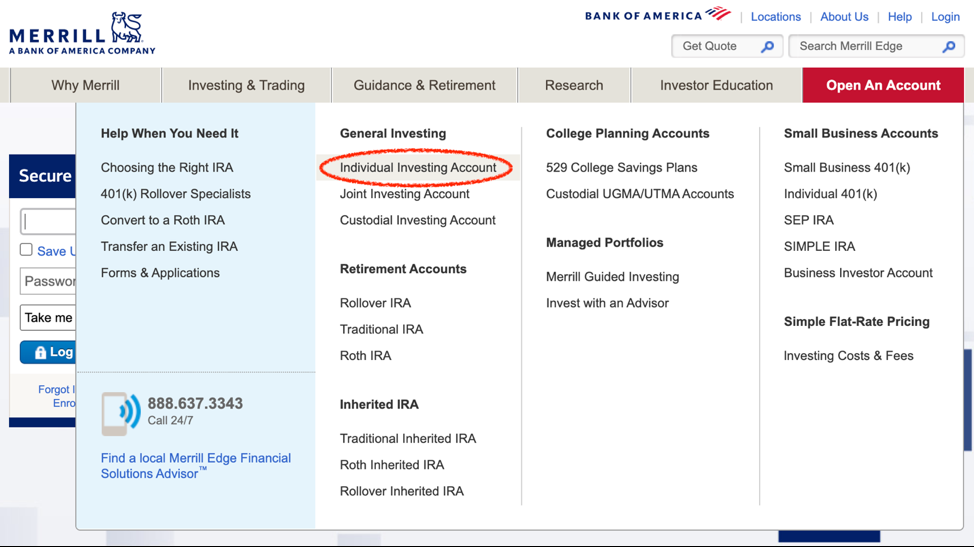

Opening a new brokerage account isn’t all that different from opening a new bank account. Simply head to the broker’s website and navigate to the page where you can open an individual investing account.

It shouldn’t be hard to find. (In Merrill’s case, there’s a big red button right on the homepage that says, “Open An Account.”)

If you already have a relationship with the bank, you may have the option to link to your existing account. Otherwise, you can proceed as a new client.

But before you begin filling out the online form, make sure you have the following handy:

- Social Security number

- Date of birth

- Mailing address

- Email address

- Employment information (if employed)

- General financial information (your annual income, net worth, etc.).

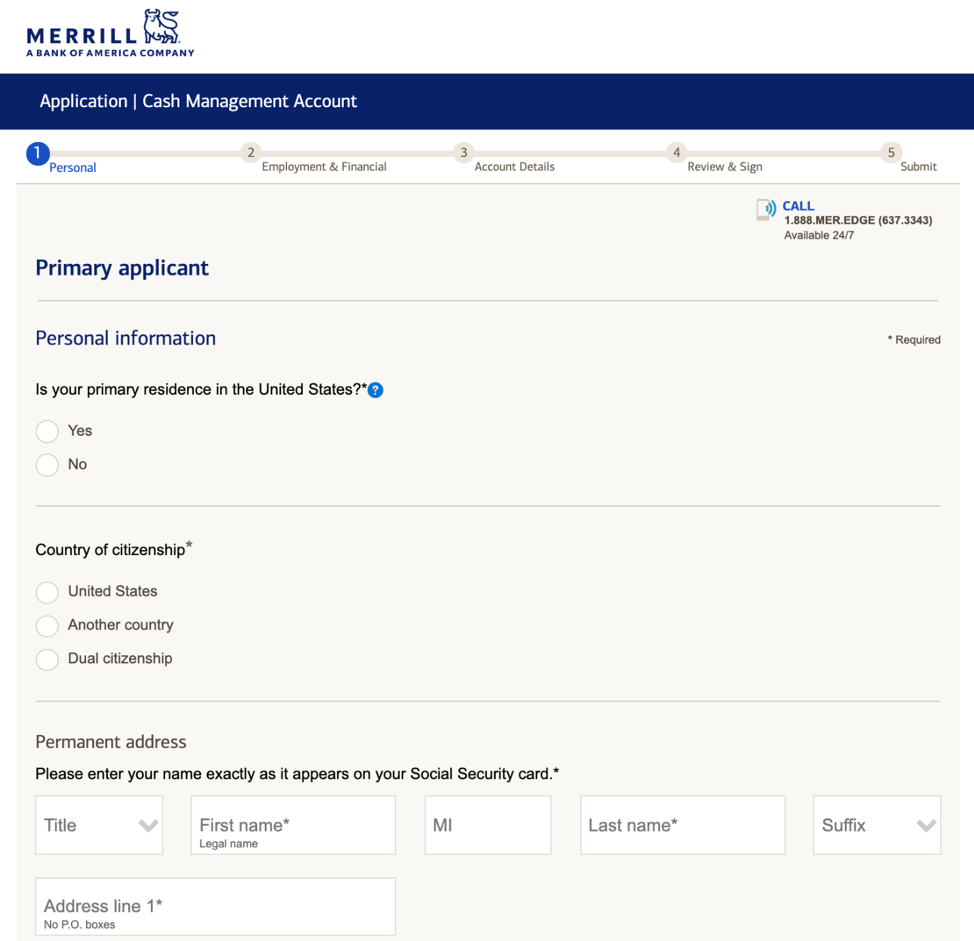

With this information at your disposal, you should be good to get started. Merrill’s application consists of just five steps, outlined at the top of the screenshot below.

Throughout the process, you will be asked about your trading experience. This may include questions like, “Have you invested before? If so, when did you start?” and “What have you invested in? Stocks? Bonds? Mutual Funds? Options?”

Answer honestly. If you’re a total newbie, say so. It will have no bearing on whether you’re approved for a basic account.

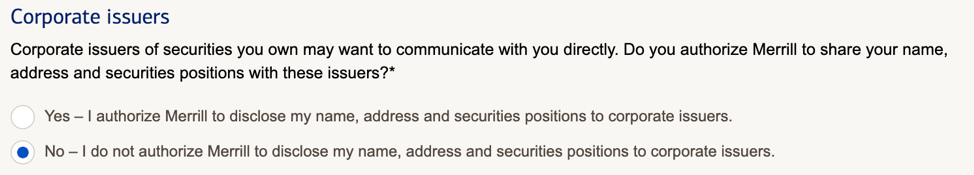

You may also be asked whether you’d like to share your information with corporate issuers of securities you hold. In other words… would you like to be contacted directly by the businesses you’re invested in?

The decision is up to you, but we personally prefer to keep our information to ourselves. And anyway, your broker is required to notify you of any key events involving your holdings – if a dividend’s been paid, earnings are coming up or a shareholder meeting is scheduled.

You may be offered additional services (like a shiny new debit card) and features (like the ability to trade on margin). But if you’re just getting started, we recommend sticking to the basics for now. You can always add features later, once you have a few trades under your belt.

With all of that information entered and reviewed, all that’s left is to click “Submit.” You should receive confirmation or approval of your new trading account shortly, if not immediately.

But… you’re not quite done yet.

Funding Your Account

Before you make your first trade, you need to fund your account.

Makes sense, right? You’ve got to pay for those shares somehow.

To do this, you’ll have to link your trading account to either a checking or savings account. These days, it’s as simple as selecting your bank from a drop-down menu and logging in with your username and password.

And if your bank isn’t listed, you might need to set things up the old-school way: Grab your checkbook and type in the account and routing numbers inside.

Either way, this crucial step shouldn’t take more than a minute or two to complete.

Once your accounts are linked, you can set up a one-time transfer… or you can set up recurring transfers as a smart way to continually add to your investment portfolio.

There’s no right or wrong choice. Go with whatever works for you and your needs. Just know that it usually takes a day or two – from when you first initiate the transfer – for funds to become available to invest.

But as soon as they are, you’ll be off to the races.

Again… all told, establishing a new brokerage account shouldn’t take more than 10 to 15 minutes of your time.

And that should be true no matter which platform you choose.

That reminds us…

Which platform should you choose? And perhaps more importantly… which shouldn’t you choose?

The Best Broker for YOU

We’ll address that first question simply…

It depends.

Are you planning to buy and hold? Do you intend to move in and out of trades frequently? Are you interested in trading options?

The answers to those questions will ultimately determine which platform is best for you.

For example, if you’ve placed a few trades and are looking for something a bit more robust, with ample options coverage and forex (foreign exchange) trading, TD Ameritrade might be your best bet. It’s a leader in options trading and research.

And if you’re brand new to investing, E-Trade might fit the bill better. E-Trade offers plenty of market research and educational resources built right into its platform… And like most brokerages these days, it does so without charging a trading commission on many investments. It’s ideal for new investors.

The good news is… you’re not married to whichever option you choose. Just do your due diligence, try one out and see how it works for you. If you need to make a switch – as you’ve seen – it won’t be hard to get started elsewhere.

Now… as for the No. 1 broker to stay away from…

The Broker New Investors Should Avoid

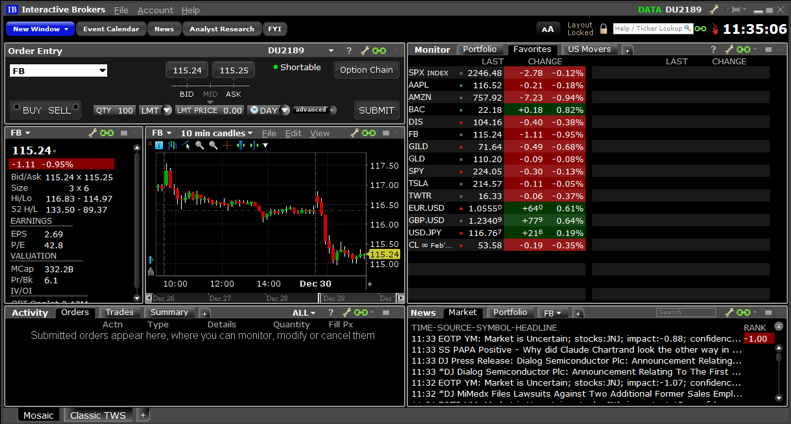

Allow us to preface this by saying that there is nothing wrong with Interactive Brokers. In fact, it’s the largest electronic trading platform in the U.S.

It’s a solid brokerage that offers cheap options trading, not to mention stocks, bonds, funds, futures, forex… you name it.

Interactive Brokers packs tons of value… for professional traders.

If you’re looking for extra guidance in the form of research for beginners or educational tools, you won’t find it here.

For the new or novice investor, the interface can be quite intimidating as well.

Want proof? Here’s a screenshot…

So unless you’re a pro or a seasoned trader, we’d recommend you avoid Interactive Brokers… at least for now.

Remember: Our goal here isn’t to leap headfirst into the most complicated types of investing…

It’s to get started and learn how to invest right.

So follow the steps above and open your first brokerage account.

Just this simple act will put you well on your way to becoming a Super Trader.

Part 2: Four Investments to Build a Rock-Solid Foundation for Your Portfolio

To be a “Super Trader” first requires a rock-solid foundation…

We’re talking about a base portfolio so strong that it enables us to swing for the fences with our shorter-term stocks and options plays.

But here’s the thing… just because we’re talking about bigger, long-term investments doesn’t mean we have to sacrifice growth.

Our rock-solid foundation isn’t composed of certificates of deposit (CDs) or fixed-rate annuities.

As you’ll see, the four tickers below offer plenty of protection… and upside. They’re the perfect complement to any active trading portfolio. And if you’re just getting started investing, these are the ideal stocks and funds to check out first.

We’ll start with a benchmark investment that 90% of professional traders can’t beat…

Rock-Solid Investment No. 1: Buying the Biggest and Best

Everyone knows the S&P 500. It’s the index that all other investments are compared with. And for good reason – the S&P comprises the biggest and best companies in America.

And those are exactly the kinds of companies you want to own if your goal is to generate reliable, long-term wealth.

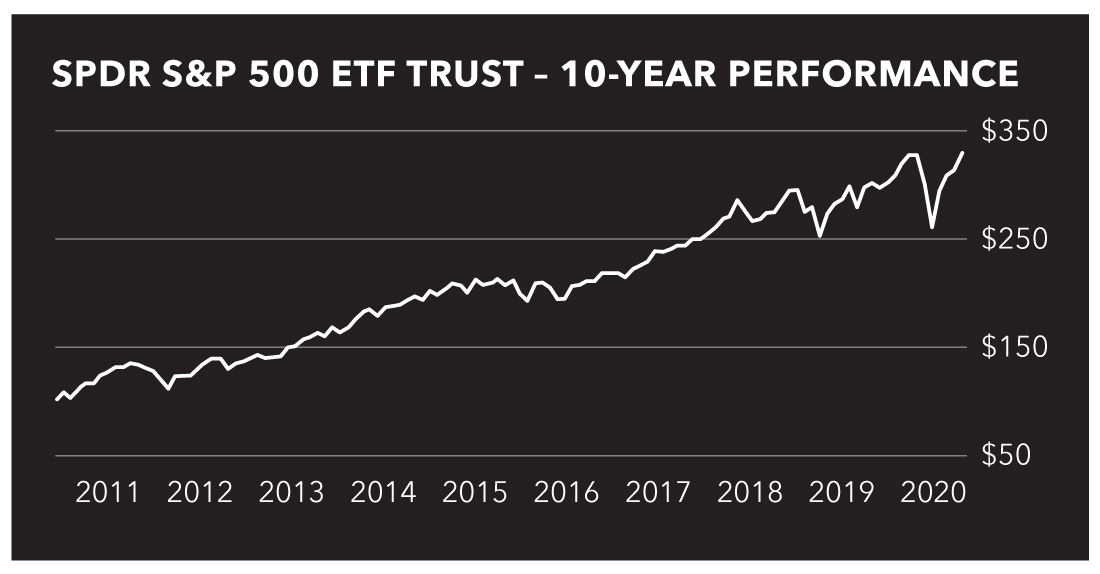

That’s why we’re allocating 50% of our base portfolio to the SPDR S&P 500 ETF Trust (NYSE: SPY).

Since 1993, this specialized fund – the largest exchange-traded fund (ETF) in the world – has closely tracked the performance of its namesake.

Over the past decade, shares of the SPDR S&P 500 ETF Trust have more than tripled as blue chip stocks enjoyed a massive bull run. And as an added bonus, the fund can be traded without commission on many online platforms, including E-Trade and TD Ameritrade.

So if you decide to pick up shares today, you’ll be out only the cost of the actual investment. An expensive commission won’t have you starting off in the red.

That said… the SPDR S&P 500 ETF Trust isn’t totally without its fees.

Like all of the funds we’ll cover in this report, it does carry some fees – measured by an expense ratio. That’s the total percentage of fund assets spent on things like advertising, administrative costs, management, etc.

With funds, the expense ratio is just a cost of doing business (literally). But the SPDR S&P 500 ETF Trust’s ratio of 0.09% is well within an acceptable range.

And the quick-and-easy exposure it offers to the top companies in America makes it well worth the nominal cost. Top holdings include powerhouse businesses like Visa, Berkshire Hathaway, Johnson & Johnson and more.

Next up we have another proven growth play… with even more explosive potential…

Rock-Solid Investment No. 2: Profiting From the Future of America

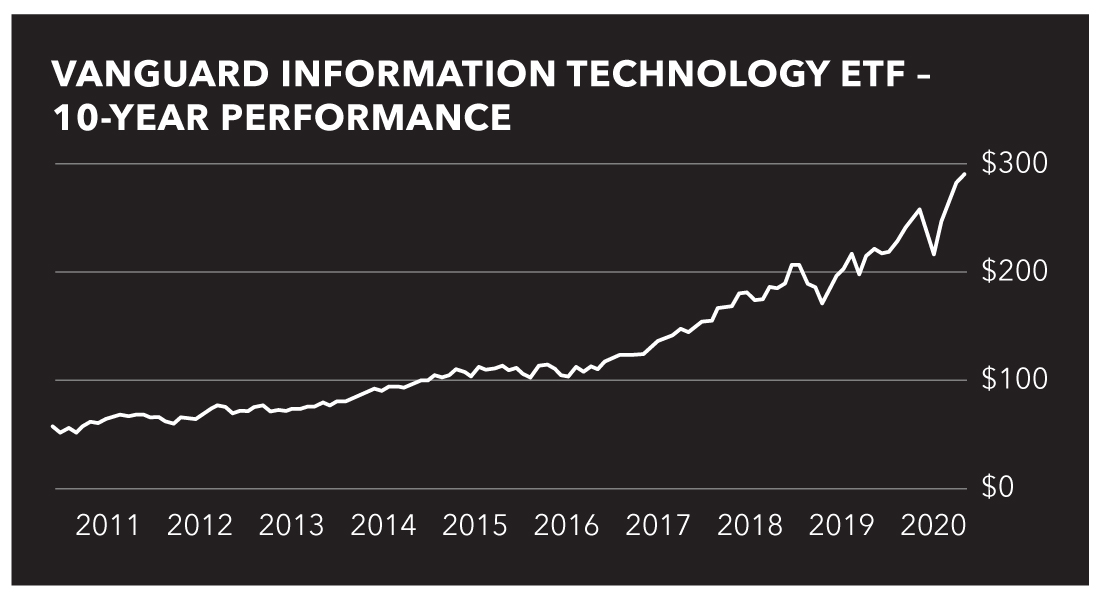

While the SPDR S&P 500 ETF Trust has steadily grown investors’ money over the past decade, the Vanguard Information Technology ETF (NYSE: VGT) has absolutely supercharged it.

Shares of the Vanguard Information Technology ETF – which, as its name suggests, comprises the biggest names in tech – have rocketed more than 440% since 2010.

That means every $10,000 invested 10 years ago would be worth $54,000 today.

That trend should come as no surprise. After all, technology is the future of America. The sector has led the charge over the past decade and exploded in 2020.

It’s also an ideal place to invest as the world accepts financial stimulus and quantitative easing as the norm. Since these companies have relatively few tangible assets, they can absorb higher valuations without investors stopping to ask why (see Tesla).

In short, the Vanguard Information Technology ETF is an ideal play for today… and an even better play for tomorrow. Through this fund, you’ll get exposure to big-name tech giants like Intel, Nvidia, Apple, Cisco Systems, PayPal and many more.

And with an expense ratio of 0.1%, like the SPDR S&P 500 ETF, its cost is cheap compared with other large cap funds.

That’s why it makes up 25% of our base portfolio.

Now let’s turn our attention toward another key trend for growth investors…

Rock-Solid Investment No. 3: A Key Play on One of History’s Greatest Growth Stories

If you’ve been paying attention to the news in recent years, you understand that China has emerged as a top global superpower. Business is booming in the Far East… and we’ve got the perfect way to play the trend…

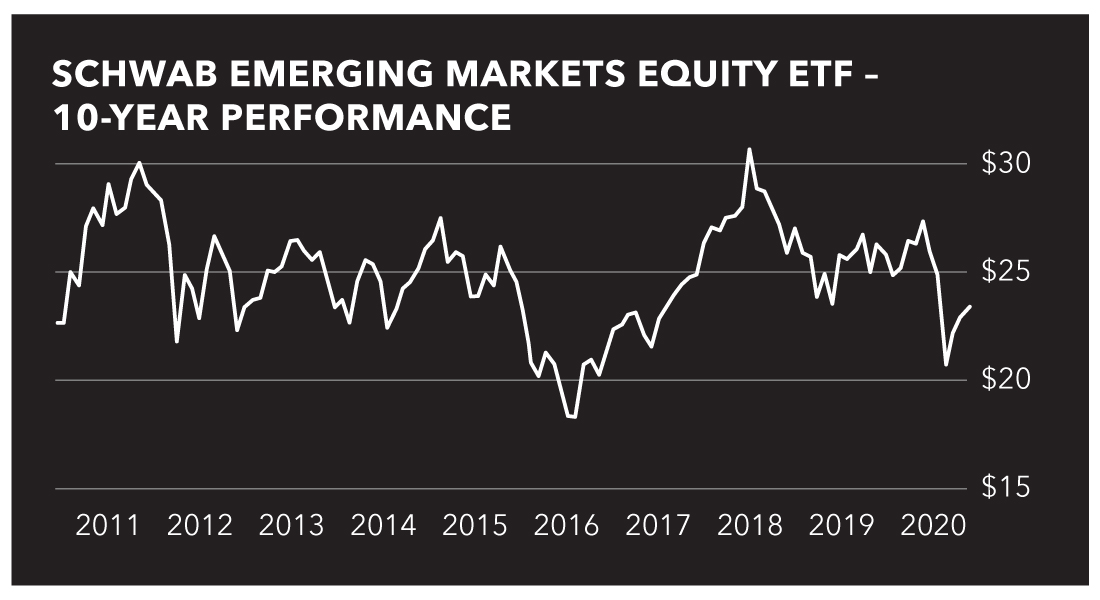

The Schwab Emerging Markets Equity ETF (NYSE: SCHE) tracks the FTSE Emerging Index, which provides exposure to the most liquid companies in emerging markets.

As you can see, the 10-year chart for the Schwab Emerging Markets Equity ETF doesn’t appear as rosy as the last two charts we examined. But we urge you to look closer.

Recent years have seen the rise of megacorps like Alibaba and Tencent. With the help of these and other Chinese success stories, shares of the Schwab Emerging Markets Equity ETF have flown as high as 59% since 2016.

They took a significant hit this year, along with virtually every other market, due to COVID-19. But that doesn’t change the long-term story. If anything, it makes this an ideal time to get in on this fund while prices are down.

Just one final thing to note… there are other emerging market ETFs with lower expense ratios (the Schwab Emerging Markets Equity ETF’s comes in at 0.11%). But we expect that this fund’s focus on bigger companies in healthier countries will more than make up for the slightly higher expense.

Having exposure to emerging markets is key to proper diversification, which is why the Schwab Emerging Markets Equity ETF makes up 15% of our base portfolio.

Its top 10 holdings include…

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Reliance Industries Ltd.

- Meituan-Dianping

- Naspers Ltd.

- China Construction Bank Corp.

- Ping An Insurance (Group) Company of China Ltd.

- com Inc.

- Industrial and Commercial Bank of China.

And lastly… we wrap things up with an old standard that’s in the middle of its own bull run…

Rock-Solid Investment(s) No. 4: This “Old-School” Safety Net Is Headed to New Heights

You can’t talk about rock-solid investments without mentioning the original rock-solid investment… gold.

For literally thousands of years, gold has been a store of value for countless civilizations. It’s the ultimate insurance policy… and, even today, it should be a cornerstone of your base portfolio, making up 10% of your overall holdings.

But before you go thinking that gold is just some old-school anchor that will weigh down your portfolio, take a look at the recent price action…

Gold is in the middle of a heck of a rally. And there are plenty of reasons to believe that rally will continue.

Here are just a few of the underlying “big picture” fundamentals that explain why we’re so bullish…

- Government spending policies across the world are expansionary and inflationary, which tend to help gold prices.

- Several key global players – with China and Russia leading the pack – seek an alternative to the dollar and/or petrodollar. Gold is clearly part of that scenario.

- Geopolitics are flaring up – hyperinflation and chaos in Venezuela, tensions with North Korea and Russia, and the U.S.-China trade war, to name a few. This kind of risk favors gold.

- Gold discoveries in the past 20 years are fewer and fewer. Supply is tightening.

- Gold demand is growing from China, Russia, India, individual investors and more.

Overall, it’s all positive for gold and, by extension, for gold miners.

Our preference would be to invest in physical gold, but you could also pick up shares of the SPDR Gold Shares (NYSE: GLD). This specialty fund tracks gold’s spot price, and it has less expenses and liabilities (its expense ratio is fairly high at 0.4%).

Whichever option you choose, just be sure to fortify your base portfolio with gold.

You’ll be glad you did.

Part 3: Target the Market’s Top Growth, Value and Income Plays With These Three Easy-to-Use Stock Screens

Imagine if you could press a button and instantly generate a list of the market’s highest-yielding income stocks.

Or find out which tiny tech company – out of hundreds of tiny tech companies – is on its way to becoming the next Netflix (Nasdaq: NFLX).

What if you could access a current list of Wall Street’s best value plays… on demand… at any time of day?

You can.

And best of all… it won’t cost you a dime.

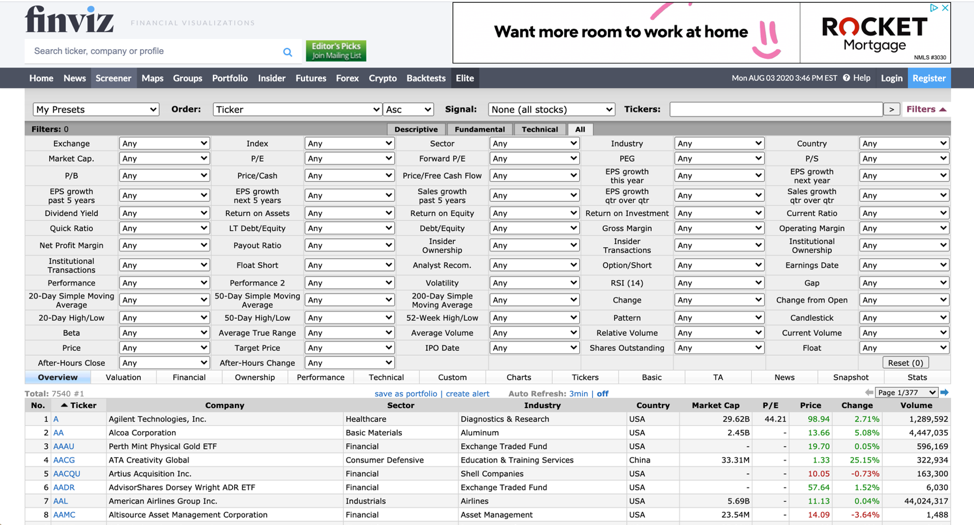

Thanks to modern technology – and easy-to-use sites like Finviz and TradingView – you can build custom screens that allow you to do everything we mentioned above.

You can select and sort stocks based on a wide variety of metrics, such as…

- Industry

- Market cap

- Sales and revenue trends

- Price-to-earnings (P/E) ratio

- Dividend yield

- Cash flow

- And more.

When you combine metrics in different ways, it allows you to get a sense of where a stock – or group of stocks – is heading.

That information can be incredibly useful… and profitable.

Let us show you how to get started.

Picking the Right Tool for the Job

To kick things off, you need to first settle on a screening tool.

Finviz is good for beginners. It’s free and simple to operate. But there are plenty of other options – both free and paid, with varying degrees of complexity – you can choose from.

Screenshot of Finviz screener tool

TradingView, which we previously mentioned, allows you to build custom screens for free. But you can’t export your data, and certain chart types are restricted unless you upgrade.

However, if you’re a TD Ameritrade account holder, you can access its premium screening tools without paying any additional fees.

A quick online search will pull up services by Zacks, ChartMill, Stock Rover and countless others. So to sum up… there’s no shortage of screeners for you to choose from.

A word of advice: If you’re new to these types of platforms, test out one of the freebies – like Finviz – first. You can always pony up for a premium account later, once you’ve got a good grip on how everything works.

And as soon as you’ve settled on a screening tool, the real fun can begin.

It’s time to create your first screen.

Screener No. 1: Gunning for Growth… in Wall Street’s Hottest Sector

Ask the average investor what they’re looking for in a stock and they’ll say one word: growth.

Companies that consistently expand their business and sales each quarter are some of the best stocks to own. See: Apple (Nasdaq: AAPL).

And if you’re looking for growth, you’d better be looking at tech.

Not only is it a red-hot sector… but it’s also a breeding ground for some of the most reliable growth stocks on the market right now.

Here’s what our tech growth screen looks like:

- Sector: Technology

- Year-Over-Year Quarterly Revenue Growth: > 25%

- Year-Over-Year Growth in Earnings per Share (EPS): > 20%

- Market Cap: > $20 billion

As you can see, we’re focusing on high year-over-year quarterly revenue growth to ensure that we’re not investing in some flash-in-the-pan play. We want to filter out companies that had a one-time profit surge because of an accounting anomaly.

EPS growth ensures that a decent portion of the sales boom is flowing to the companies’ bottom lines.

And lastly, we go with a minimum market cap of $20 billion to weed out small, risky players.

Plug these metrics into your screener and it’ll let you know who the top players in Wall Street’s most explosive sector are.

Screener No. 2: Uncover the Market’s Greatest Value Plays

Buy-and-hold investors love a good value play. These plays are a cornerstone of any solid, long-term portfolio.

And who doesn’t love a good deal?

Essentially, what we’re looking for with our value screener are companies that are fundamentally sound and trading at a discount compared with their peers.

The recipe is simple. Here’s what you’ll enter into your screening tool:

- Trailing P/E Ratio:< 20

- Price-to-Earnings to Growth (PEG) Ratio:< 1

- Return on Equity: > 15%

- Market Cap: > $10 billion

A trailing price-to-earnings ratio below 20 will give us stocks below the S&P’s current valuation of 22.

The PEG ratio ensures the companies we find aren’t cheap merely because growth is stalling and Wall Street expects smaller earnings.

A return on equity above 15% gives us stocks that are doing good, fundamental business and using their assets efficiently.

And the $10 billion market cap weeds out any volatile small companies.

Easy enough, right? This is the screener to fire up when you’re looking for high-quality bargain buys.

Screener No. 3: Want to Stay Paid? Give This a Try

Our final stock screen is sure to please anyone searching for rock-solid income yields.

It can be tough to find stocks that pay solid – and rising – dividends. And even if you do find a good candidate, there’s no guarantee that share prices will see the same healthy growth…

Or that the company will remain strong enough to support that dividend in the future.

That’s where this handy screen comes in:

- Dividend Yield: > 3%

- Year-Over-Year Change in Cash Flow Growth: > 10%

- Year-Over-Year Growth in EPS: > 20%

- Market Cap: > $50 billion

Obviously, we want to target dividend-paying stocks with a yield of at least 3%. It’s a solid base figure… and realistic.

Beyond that, as you can see, we’re focusing tightly on cash flow and earnings.

Cash flow growth helps to ensure the dividend can be paid out again next year and has a chance of growing.

EPS growth does the same thing, but also helps get us into growth companies that have a strong shot of share price appreciation.

And once again, we’re keeping our desired market cap at a respectable amount. Remember, we’re looking for solid, proven companies that can keep us profiting for a long, long time.

Try plugging this screen – and the others above – into a screening tool today. And when you start to feel confident, start adding in your own qualifiers.

Knowing how to comb the markets for the hottest growth, value and income plays is a skill every “Super Trader” should have.