How to Buy Gold: Two Ways to Profit From Gold’s Rise

Manward Financial Research

Nearly since the days of Adam and Eve, gold has been seen as a reliable store of value.

Even today, gold is viewed as the ultimate insurance policy against inflation, deflation and the erosion of major currencies. For investors, it can also help protect long-term portfolios. It’s one of the best investments to offset losses during economic and market downturns.

One reason is due to gold’s limited supply.

While central banks worldwide print money at will, the supply of gold cannot be increased except through active mining efforts. Therefore, its value rises when demand for gold outstrips available supply.

Sometimes gold prices may seem to swing wildly over short periods. But when you look at prices over the longer term, you’ll see that gold maintains its value. That’s what makes it a safe and efficient way to preserve purchasing power.

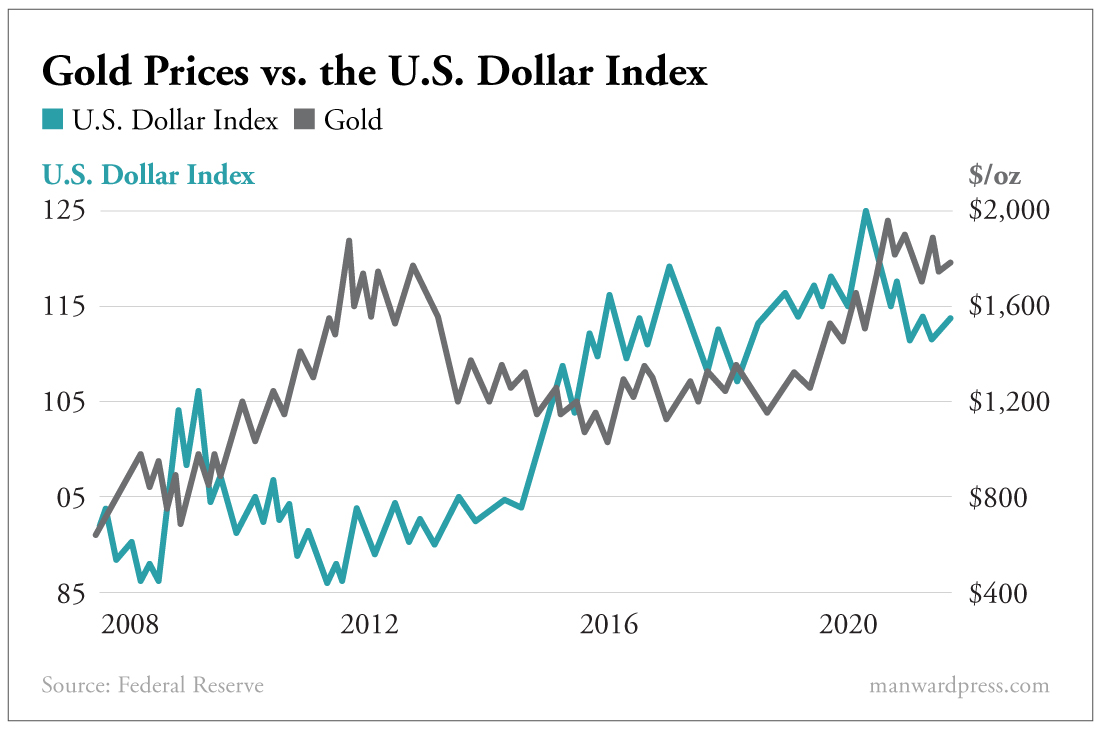

Speaking of purchasing power, check out this chart…

It displays the negative relationship between Gold Prices ($/oz) and the U.S. Dollar index.

While gold prices tend to move inversely to the U.S. dollar, something interesting happens during times of crisis (as shown by the shaded areas representing the housing market crash in 2008 and the pandemic crash in 2020.)

Look closely, and you’ll notice that they both rise and fall together as investors seek safe assets in both cash and gold. When markets crash, the price of gold tends to rise.

That’s when gold investors see significant returns on their gold investment.

The lesson here? Buying gold can help mitigate risk during some of the worst times in the market.

The Ultimate “Hedge” Investment

Gold prices are also boosted by monetary policy.

Take the recent response to the COVID pandemic…

The Fed implemented policies that caused a sharp rise in inflationary pressures:

- Increased money supply

- Increased velocity of money as consumers spend stimulus money

- And extremely low interest rates

Markets don’t like inflation or uncertainty. But these conditions set the stage for a bull market run in gold prices.

At a recent meeting, the Fed revealed that it isn’t in a hurry to taper off bond purchases. That means that near-record low interest rates will continue. The value of the U.S. dollar will also remain depressed.

The main goal at the Fed is to ensure and restore confidence in the U.S. economy. The Fed isn’t concerned about the strength of the U.S. dollar.

Gold also has momentum thanks to geopolitical tensions.

The emerging trade war between the U.S. and China, the rising threat of global terrorism, new variants of COVID-19… all of these concerns are putting downward pressure on stock prices.

Then there’s inflation. Oil and gas prices are surging. They’ve risen over 90% so far this year alone.

It’s All About Supply and Demand

The chart above shows the demand for gold by quarter. It also shows demand by the type of gold buyer: Jewelry, Technology, Investment, Central Banks.

In the last three quarters, investment demand for gold has increased by more than 100%. Central bank demand has risen by more than 225%.

Global supply chain shortages are also driving prices higher. These shortages will likely carry into 2022.

While demand is on the rise, gold discoveries over the last 20 years are fewer and fewer. Supply is declining.

The high demand, low supply environment in the market for gold will drive up prices and warrant even further demand.

In short, there’s a perfect storm ready to push gold prices higher. There are plenty of market indicators that bode well for gold at this moment. It’s the perfect time to diversify your portfolio by buying gold.

Two Perfect Plays for Gold’s Rise

Owning physical gold is the purest play on the precious metal. But it may not be possible for all investors. That’s why we have two perfect plays for you today to take advantage of gold’s rise.

Picking up a gold ETF is the most efficient, low maintenance method for the average investor to increase their exposure to gold without purchasing the physical metal.

If you’re not familiar, exchange-traded funds – or ETFs – are a great choice for investors looking to diversify their portfolios. They offer exposure to a wide range of assets through a single security.

Lower costs are a great advantage of ETFs over mutual funds, which offer similar products but with much higher fees.

Plus, ETFs offer easier, more flexible trading since transactions can take place throughout the trading day.

And the SPDR Gold MiniShares Trust (NYSE: GLDM) is the best option for investors who want to own gold without the hassle of storage, insurance costs and transaction fees that come with the physical metal.

It closely tracks the performance of gold through its holdings of 2.5 million ounces, or 78.31 tonnes of gold, amounting to $4.38 billion.

And this ETF comes with a far cheaper expense ratio of 0.18% compared to the average gold ETF’s at 0.65%.

Even better, the expense ratio of SPDR Gold MiniShares Trust is much less than the costs associated with the physical metal (like commissions, storage and insurance), presenting both a cheaper and more practical option.

With more than 2 million shares traded daily, the ETF offers a much higher degree of liquidity compared to owning physical gold.

Owing shares of the SPDR Gold MiniShares Trust is a convenient way investors can gain exposure to gold with lower ownership costs and more liquidity over the short and long term.

Our second play offers more risk, but has the potential for more reward. I’m talking about picking up shares of a gold miner.

And the best one to own is Agnico Eagle Mines Limited (NYSE: AEM).

Agnico is an ideal gold miner for times like this. It operates 10 mines across Canada, Mexico and Finland and are on pace to produce 2.05 million ounces of gold in 2021, an 18% increase from 2020.

Recently, it entered into an agreement to merge with Kirkland Lake Gold. This business combination will establish Agnico Eagle as one of the highest-quality producers in the gold industry.

This will lower unit costs, improve margins, and increase gold production.

The deal has been unanimously approved and is expected to close by the first quarter of 2022.

Agnico has reported healthy financials lately, increasing earnings per share by 63% last year and an estimated 56% this year. This improvement is thanks to revenue growth of more than 40% since June 2020.

An important metric for gold miners is operating margin. Agnico has a strong 31.74% operating margin, and this will likely grow wider from the merge with Kirkland Lake.

With growing fears of inflation and market volatility comes growing demand for gold. Agnico Eagle is a ideal choice for an investor who seeks diversification and moderate downside protection with significant upside potential.

Plus, Agnico Eagle pays a quarterly dividend with a 2.74% yield.

In light of the recent economic and geopolitical uncertainty, gold should be incorporated into your portfolio as an insurance policy. Properly diversified investors combine gold with stocks and bonds in their portfolio to reduce overall risk.

Consider the SPDR Gold MiniShares Trust as an efficient alternative to holding physical gold and Agnico Eagle as a mining play that will produce great returns when gold prices rise, plus a quarterly dividend, and.

With the upcoming Fed efforts to combat inflation with interest rate hikes, and the controversy over the U.S. debt ceiling, market volatility is likely to remain.

Whether you want to preserve purchasing power for a future investment or diversify your portfolio to hedge against risk and uncertainty, gold will maintain its value for years to come.