Search Results for: fed

The Fed Lights the World on Fire

We often talk about the compounding power of interest, but what about the compounding power of inflation?

How to Know When the Fed’s Free-Money Trade Is Over

The nation’s fate depends on truckloads of free money and loose policy. So if either of these key numbers begins to climb, it’s time to pay attention.

What Every Investor Needs to Know About the Fed

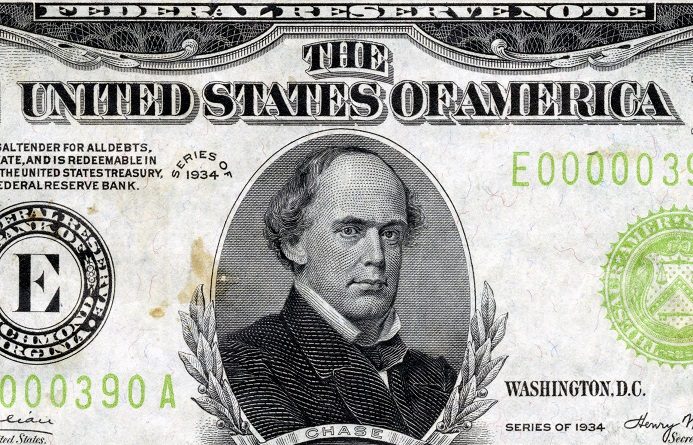

Have you ever wondered, “What is the Fed?” or, more importantly, “What does the Fed DO?” Here’s the controversial origin story…

Buried Treasure Doesn’t Stand a Chance Against the Fed

We dug up an old penny last night. Boy, the stories it could tell about the value of our money…

Here’s Why the Fed Pulling Another “Saturday Night Massacre” Would be the Best Thing for the Markets

The Federal Reserve’s not the problem, or maybe it is.

Economic growth, job creation, narrowing the wealth gap, equal opportunity in America, are the problems, but not the Fed’s problems.

Those problems should fall on the administration in power and Congress, but instead, the Fed has made these problems their concern, and if that doesn’t change, our economy could be headed for trouble, big trouble. We’re talking a meltdown that will put the Great Recession to shame.

On October 10, 2020, the Saturday before Columbus Day, the Fed should announce a new role for itself, one that will shake up markets, politics, and the country, but ultimately result in the problems the Fed can’t fix being addressed and fixed by presidents and Congress.

It’s been done before. On the Saturday prior to Columbus Day in 1979, then Fed chairman Paul Volcker, the last strong, independent Federal Reserve chairman, changed America’s future.

The Federal Reserve: Not the All-Powerful Oz You May Think It Is

The privately owned and controlled Federal Reserve System, America’s so-called central bank, is more powerful than the U.S. government. In fact, it controls our government by financing particularly Fed-friendly governments, as only it can. MEET DAVID He’s got a 95% success rate and $20 million net worth. He’s one of New York’s most successful angel […]

Everyone Has a Plan Until They Get Punched in the Mouth: What You Need to Do When the Fed Realizes It’s in Trouble

Just because the master manipulators at the Federal Reserve say they’re going to backstop U.S. bond markets, as well as debt on corporate balance sheets, doesn’t mean they can.

It’s true they’re managing easily enough in the early rounds of the fight to save debt markets, corporations, and the economy, but they’re going to have to do more, including the impossible, when their real opponent comes out swinging.

As Mike Tyson famously said of Evander Holyfield’s fight tactics to beat him in their first bout, “Everyone has a plan until they get punched in the mouth.”

This Chart Shows the Only Place the Fed’s Money Can Go

The more the Fed spends, the higher stocks will go. While the meddling in our economy is good for now… it will be hell down the road.

Gold Says We’ve Got Problems the Fed Can’t Fix

Gold’s having a great year… and it’s proof that another stimulus isn’t going to fix what ails us.

The Only Way to Protect Yourself From the Fed’s Money Crimes

With just days to save the nation from eating itself, all eyes are on Washington.